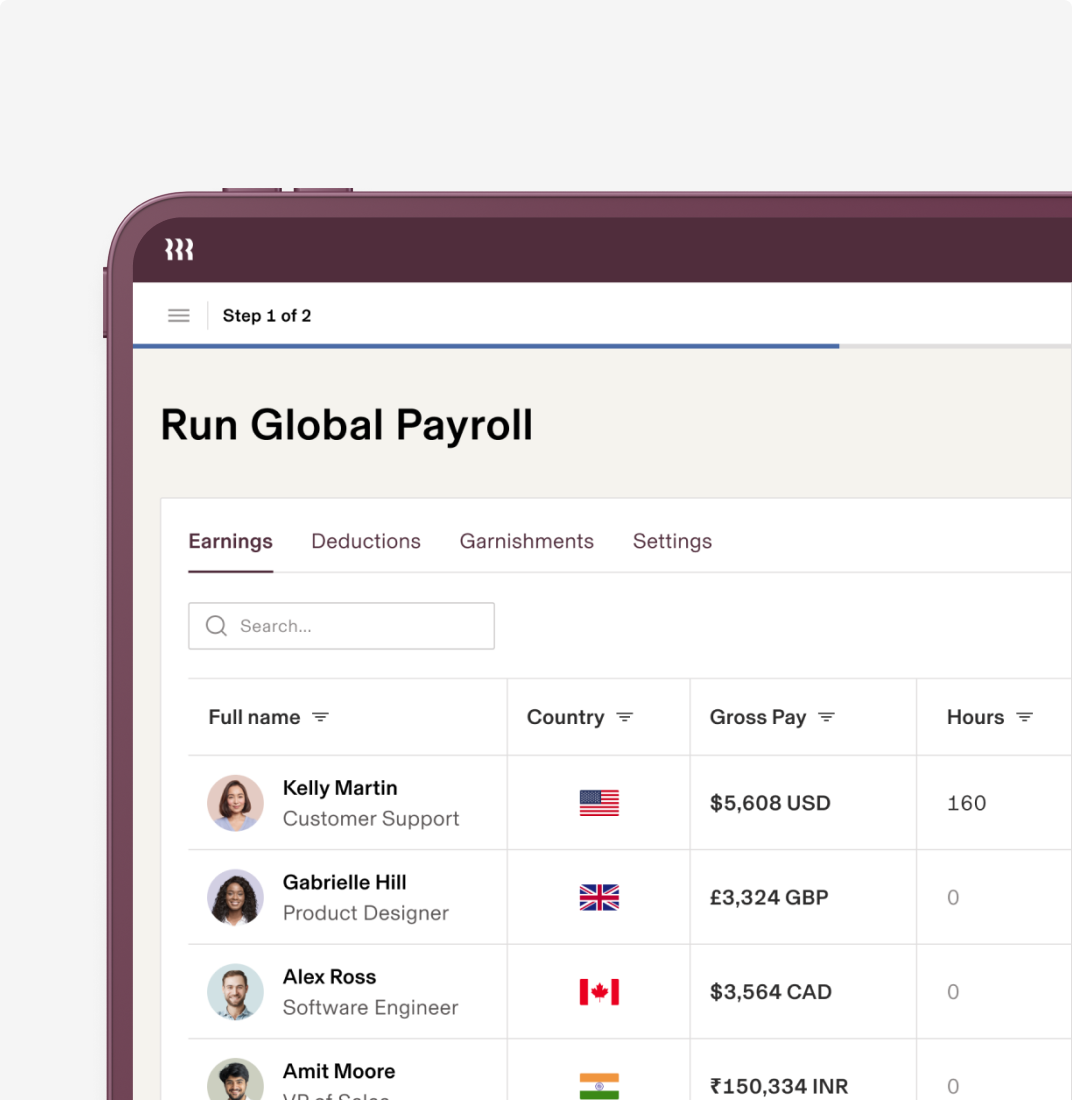

Everything you need to run and pay a global team

Rippling can help you address every step of your international growth while allowing you to transition easily between stages.

Hiring in the US? Rippling handles local complexity and compliance so you can focus on growing your business.

Currency: US dollar (USD)

Capital: Washington, D.C. (GMT-4)

Payroll cycle: Biweekly

Official language: English

By clicking “Get started,” you agree to the use of your data in accordance with Rippling's Privacy Notice, including for marketing purposes.

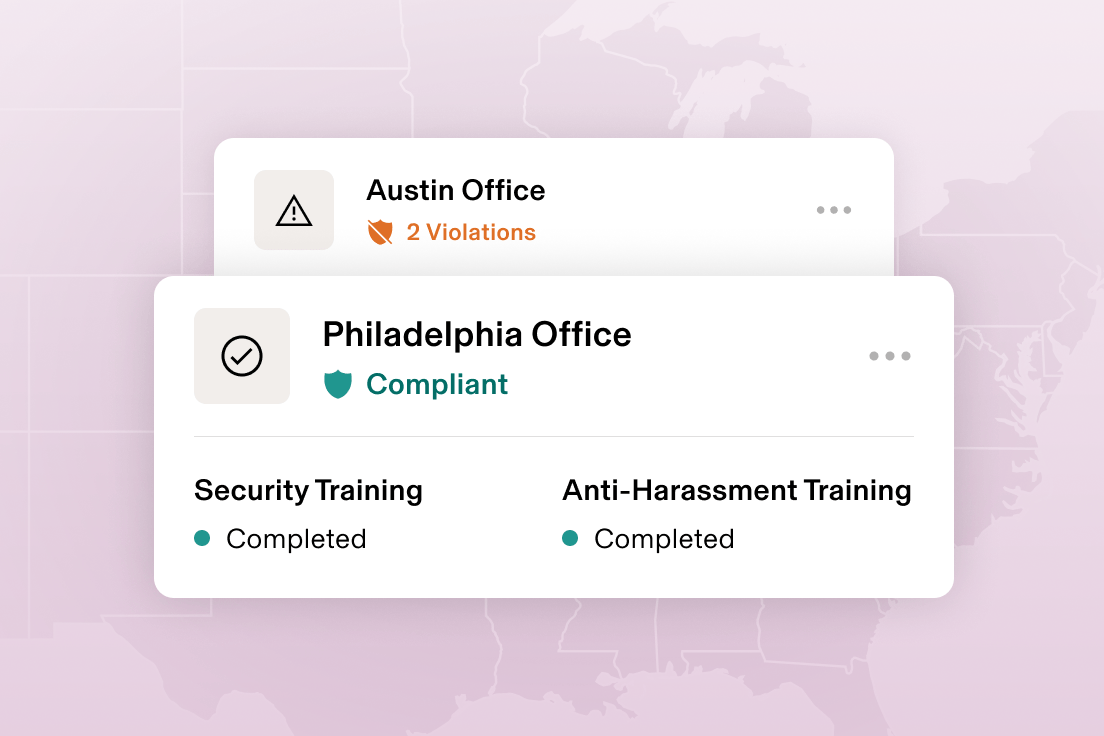

Set up new hires in the US with everything they need, from country-specific trainings to apps like Slack.

Pay all of your employees in the US without waiting on transfers or conversion.

Understanding and complying with US laws is hard work. Rippling does it for you.

Juggling multiple systems for your team? That creates silos and busy work. Rippling does it all — in a single system.

Rippling can help you address every step of your international growth while allowing you to transition easily between stages.

“Our CEO describes Rippling’s ability to scale globally as 'priceless.'”

Annabel Tomlin

VP of Operations

“Before Rippling, I would have had to coordinate with seven different people in different time zones. But I was able to do it for myself in 15 minutes — it was surprising and delightful, and inspirational.”

Varun Sharma

CEO

“I feel safe with Rippling—much more safe compared to Deel.”

Jisselle Baldwin-Todd

Head of HR

“We were originally working with Remote, as Deel was too expensive — but we knew we needed an all-in-one platform for future growth, and that was the key differentiator with Rippling.”

Christoper Welz

General Manager of Operations

“Rippling has eliminated tedious manual work, improved accuracy, and enabled faster, more efficient people operations, making HR and IT processes far more scalable and strategic.”

Selina Purdie

Head of People

In the US, payroll and taxes can be complex — state and local tax rates vary, and employers must register with the right agencies for each hire. Rippling simplifies the entire process by automatically calculating, withholding, and remitting taxes to the correct authorities, so you stay compliant without the manual admin. Here are a few important costs to take note:

10% to 37%, depending on the employee’s income and marital status.

It varies across different states. For more information on state and local taxes, read more here.

Before onboarding or running payroll, it’s critical to classify your US workers correctly — as employees or independent contractors. Misclassification can lead to steep penalties, including unpaid wages, back taxes, and fines from the IRS, Department of Labor, and state agencies. Rippling’s Worker Classification Analyzer helps you review and validate worker status to reduce risk and ensure compliance from day one.

Employees are more integrated into the company, follow employer direction, receive benefits like insurance and paid leave, and are generally engaged for ongoing indefinite roles, with the employer responsible for workplace protections.

Contractors have greater control over how they work, use their own tools, aren’t entitled to employee benefits, and typically work on short-term projects while managing their own taxes and liabilities.

The US has fewer mandatory benefits requirements for employers than most other developed countries around the world. Here’s what you need to know.

Under the Affordable Care Act, applicable large employers or ALEs (those with 50 or more full-time or full-time equivalent employees) must provide affordable healthcare coverage to at least 95% of their full-time employees and their dependent children. To meet the federal mandate, policies must cover at least 60% of employees’ healthcare costs, and employees can’t pay more than 9.86% of their household income for care.

Small businesses with fewer than 50 full-time or full-time equivalent employees aren’t required to offer coverage.

Both employers and employees contribute taxes to Social Security, a nation-backed retirement fund, and Medicare, a public health insurance program for Americans over the age of 65.

Social Security also funds programs that provide income for people who can’t work due to disability and survivor benefits for dependents of people who have died.

Unemployment insurance provides supplemental income for people who have lost their jobs. Employers must contribute to the federal fund but may be exempt from most of their contributions if they pay into state unemployment insurance funds instead.

The Family and Medical Leave Act (FMLA) guarantees qualifying employees up to 12 weeks of job-protected, unpaid leave each year for certain family and medical reasons, such as:

There is no federal law that mandates paid time off for US employees, but several states, including California, New York, and Washington, have implemented their own leave laws with varying requirements.

While few benefits are required for US employees, many are standard for employers to offer to help them attract the best talent. These are some common parts of a benefits package for a full-time employee in the US:

Labor and employment law compliance in the US can be tricky. In addition to federal laws, each state can have varying laws that employers need to follow based on where their employees live and work. Here are a few key regulations to know:

Under the federal Fair Labor Standards Act, qualifying employees are entitled to the federal minimum wage of $7.25 per hour plus overtime of 1.5 times their regular pay rate if they work more than 40 hours in a workweek. While states, counties, and cities cannot enact laws with minimum wages lower than the federal rate, they can enact minimum wages that are higher — and many have done so.

The Occupational Safety and Health (OSH) Act is administered by the Occupational Safety and Health Administration (OSHA) and a number of OSHA-approved state programs. It requires employers to follow standards for keeping their workers safe and healthy, including protecting them from recognized, serious hazards.

Workers’ compensation insurance provides income support and covers medical expenses for people who can’t work due to a job-related illness or injury. Federal workers’ compensation programs exist for federal employees and employees in the longshore, energy, and mining sectors. For other employees, businesses typically pay workers’ compensation taxes to the state where the employee lives; rates and requirements vary by state.

The National Labor Relations Act gives all employees the right to unionize, bargain collectively with their employer, strike or picket, or choose not to participate in any of these activities. The Act also makes it illegal for a union or an employer to threaten or harass an employee for choosing to participate or not.

No. With an Employer of Record (EOR) like Rippling, you can legally hire and pay US employees without setting up a local legal entity. Rippling handles compliance, payroll, tax filings, and benefits administration on your behalf.

Misclassifying employees as contractors can lead to fines and back taxes. Rippling’s Worker Classification Analyzer helps you determine the correct status of each worker, reducing risk and ensuring you stay compliant with IRS and Department of Labor rules.

US employment taxes vary by state and include federal income tax, Social Security, Medicare (FICA), federal unemployment tax (FUTA), state taxes, and local taxes. Rippling automatically calculates, withholds, and files these taxes to the right agencies.

While the US has fewer federally mandated benefits than many countries, you may be required to offer Social Security, Medicare, unemployment insurance, and workers’ comp. Rippling can also help you offer competitive voluntary benefits like health insurance and 401(k) plans.

With Rippling, you can typically onboard a US employee in just a few days. We manage offer letters, compliance documents, payroll setup, and IT provisioning — all in one unified platform.

By clicking “See Rippling”, you agree to the use of your data in accordance with Rippling’s Privacy Notice, including for marketing purposes.