Total control. Zero admin work.

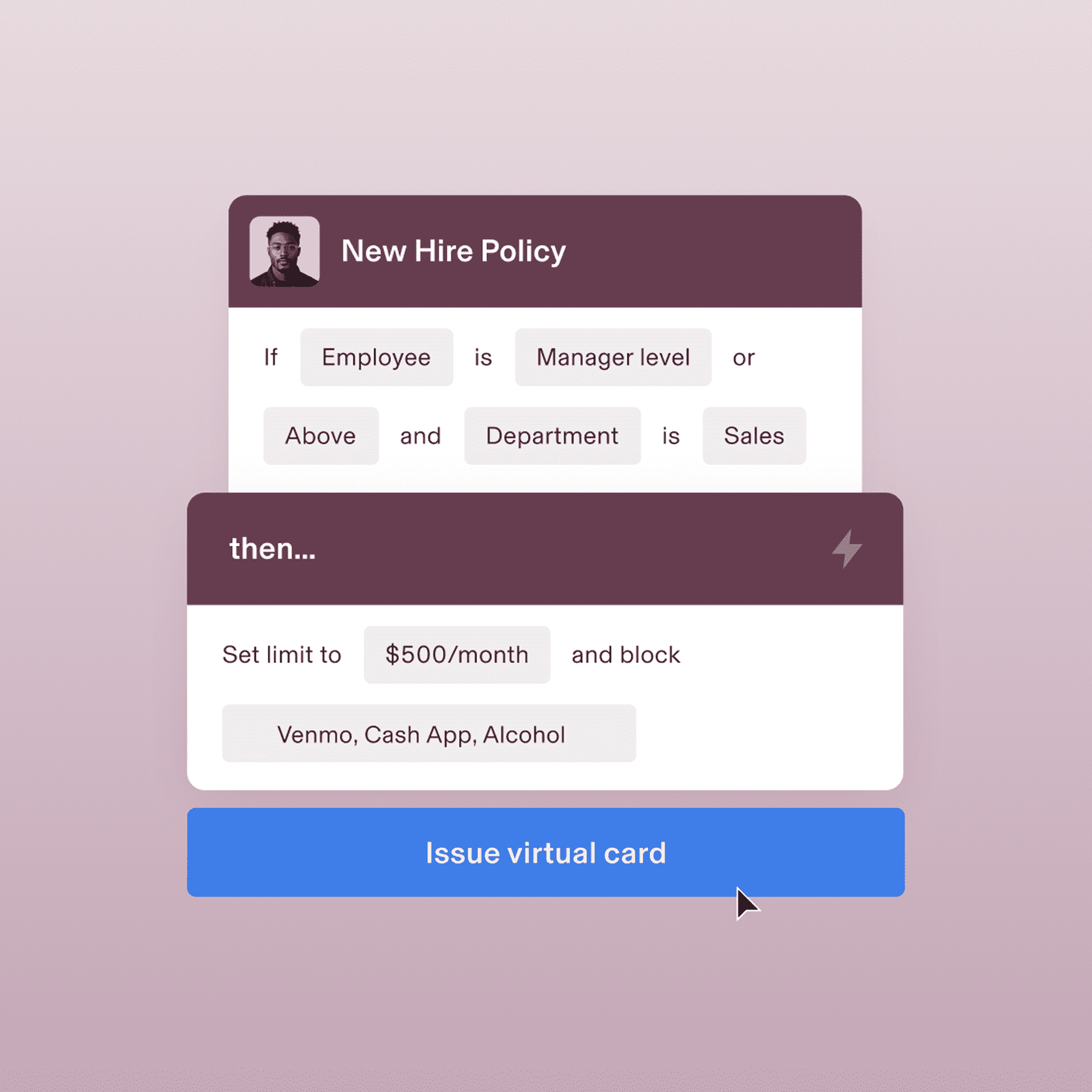

Card controls

Control spending before it happens with custom policies based on employee record, vendor, and transaction amount.

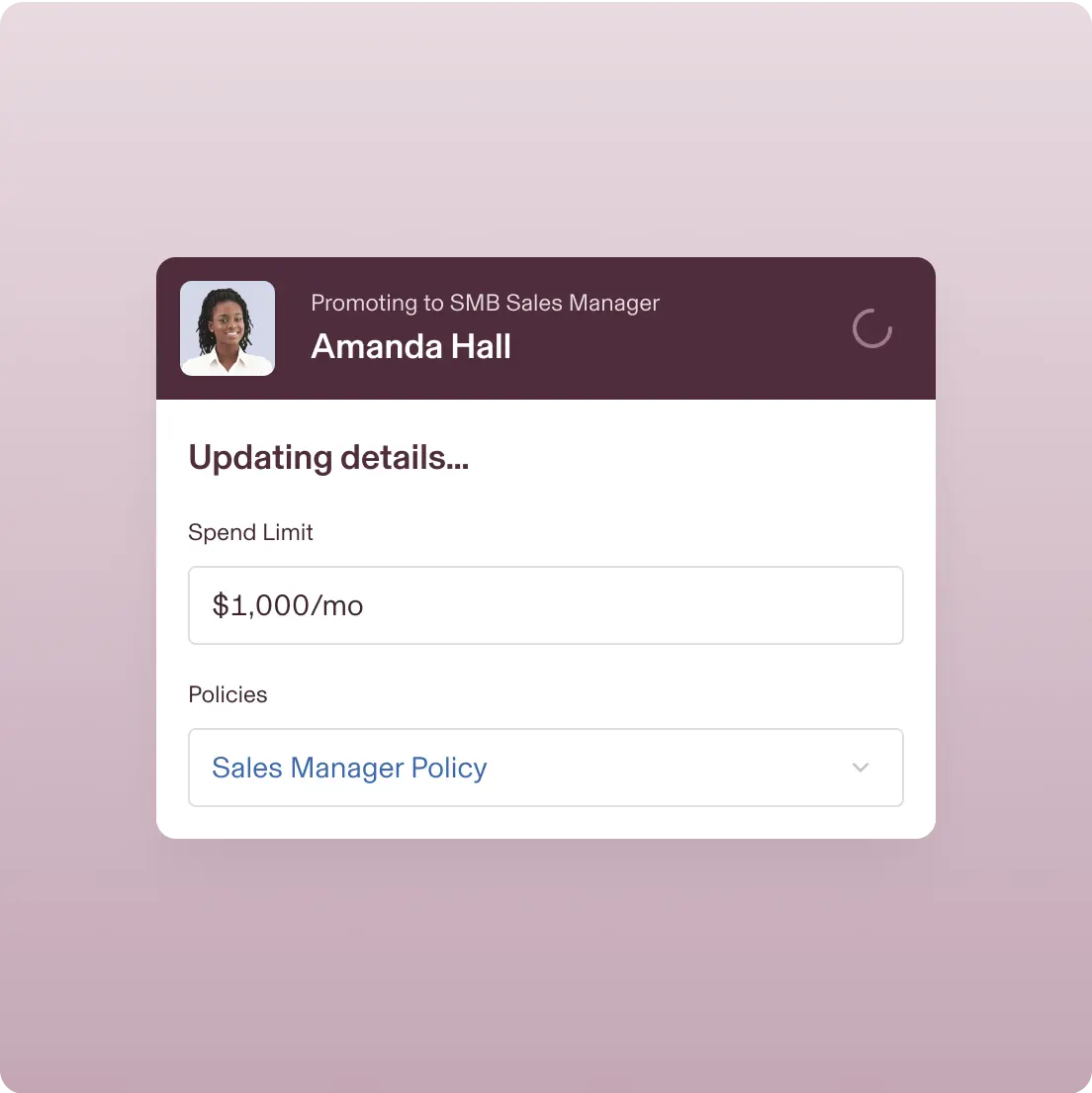

Automated card management

From instant issuing to auto updates to deactivation, everything runs on autopilot.

Real-time spend visibility

See your company's complete spending picture in one dashboard, always up to date.

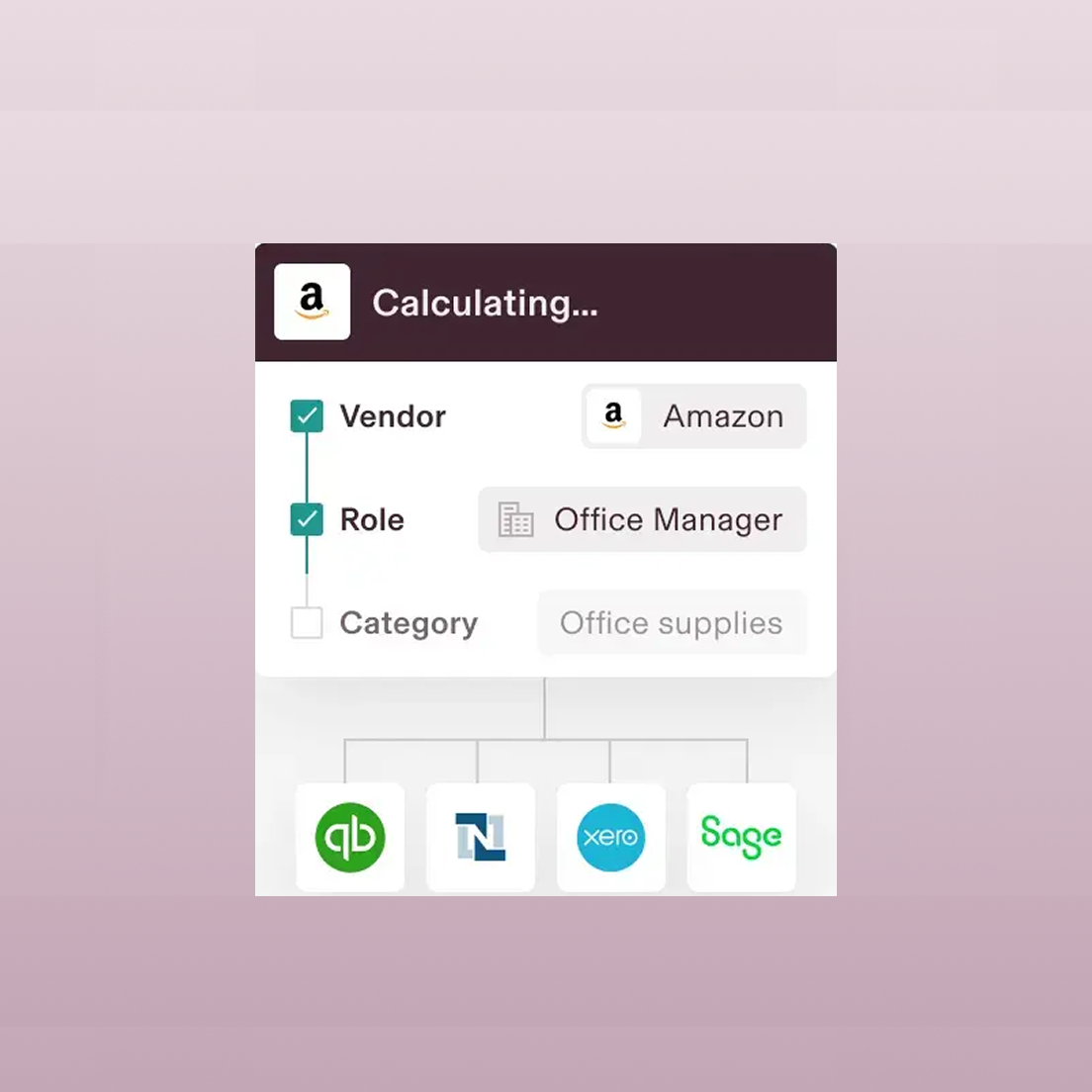

Close the books in hours

Transactions auto-categorize, receipts match instantly, and everything syncs to your GL.

Tap to pay with digital wallet cards

Rippling’s corporate card is compatible with Apple Pay® and Google Pay™ so employees can make charges on the go.

Magically match receipts

After making a charge, employees can text a picture of their receipt for your records, making it easier to close the books for everyone.