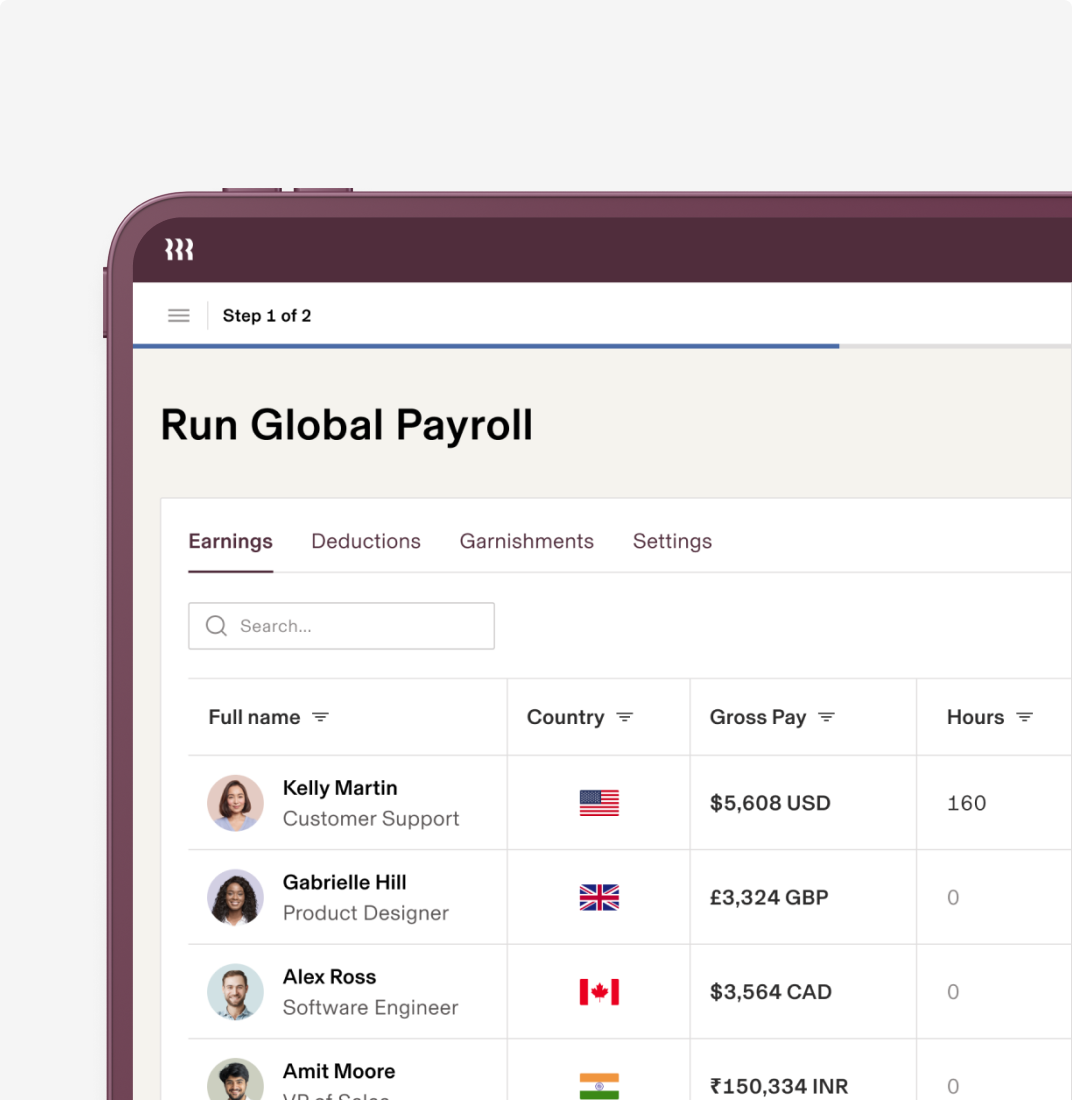

Everything you need to run and pay a global team

Rippling can help you address every step of your international growth while allowing you to transition easily between stages.

Hiring in Canada? Rippling handles local complexity and compliance so you can focus on growing your business.

Currency: Canadian Dollar (CAD)

Capital: Ottawa (GMT-4)

Payroll cycle: Biweekly

Official language: French and English

By clicking “Get started,” you agree to the use of your data in accordance with Rippling's Privacy Notice, including for marketing purposes.

Set up new hires in Canada with everything they need, from country-specific trainings to apps like Slack.

Pay all of your employees in Canada without waiting on transfers or conversion.

Understanding and complying with Canadian laws is hard work. Rippling does it for you.

Juggling multiple systems for your team? That creates silos and busy work. Rippling does it all — in a single system.

Rippling can help you address every step of your international growth while allowing you to transition easily between stages.

“Our CEO describes Rippling’s ability to scale globally as 'priceless.'”

Annabel Tomlin

VP of Operations

“Before Rippling, I would have had to coordinate with seven different people in different time zones. But I was able to do it for myself in 15 minutes — it was surprising and delightful, and inspirational.”

Varun Sharma

CEO

“I feel safe with Rippling—much more safe compared to Deel.”

Jisselle Baldwin-Todd

Head of HR

“We were originally working with Remote, as Deel was too expensive — but we knew we needed an all-in-one platform for future growth, and that was the key differentiator with Rippling.”

Christoper Welz

General Manager of Operations

“Rippling has eliminated tedious manual work, improved accuracy, and enabled faster, more efficient people operations, making HR and IT processes far more scalable and strategic.”

Selina Purdie

Head of People

To run payroll in Canada, you need to collect required employee details, pay in CAD, and file T4 taxes and deductions to CRA. Rippling simplifies the entire process with one system for payroll and compliance. Since employers are responsible for calculating payroll deductions, it’s important to keep the following costs in mind:

The minimum wage in Canada differs by province and territory. For people working in provinces or territories where the minimum wage rate is higher than the province where they live, the higher rate applies. Hourly minimum wage (CAD) ranges from 14.00 CAD to 16.75 CAD.

5.95% (capped at C$66,600 wages)

2.282% (capped at C$61,500 wages)

In Canada, employers must file and distribute T4 forms by the end of February each year. The T4 reports an employee’s income, tax deductions, CPP/QPP contributions, and EI premiums for the prior year. Late or missing T4s can result in penalties. Rippling automates this process to ensure compliance.

Before onboarding your workers, and certainly before you run payroll, it’s crucial to understand who you’re paying in the eyes of Canadian law: Are your workers employees or contractors?

It’s essential to classify them correctly to avoid big fines. Also, if they’re employees, there are payroll deductions that you’re responsible for, including federal income tax, employment insurance, and pension plans (which vary by region).

Employees are more integrated into the company, follow employer direction, receive benefits like insurance and paid leave, and are generally engaged for ongoing indefinite roles, with the employer responsible for workplace protections.

Contractors have greater control over how they work, use their own tools, aren’t entitled to employee benefits, and typically work on short-term projects while managing their own taxes and liabilities.

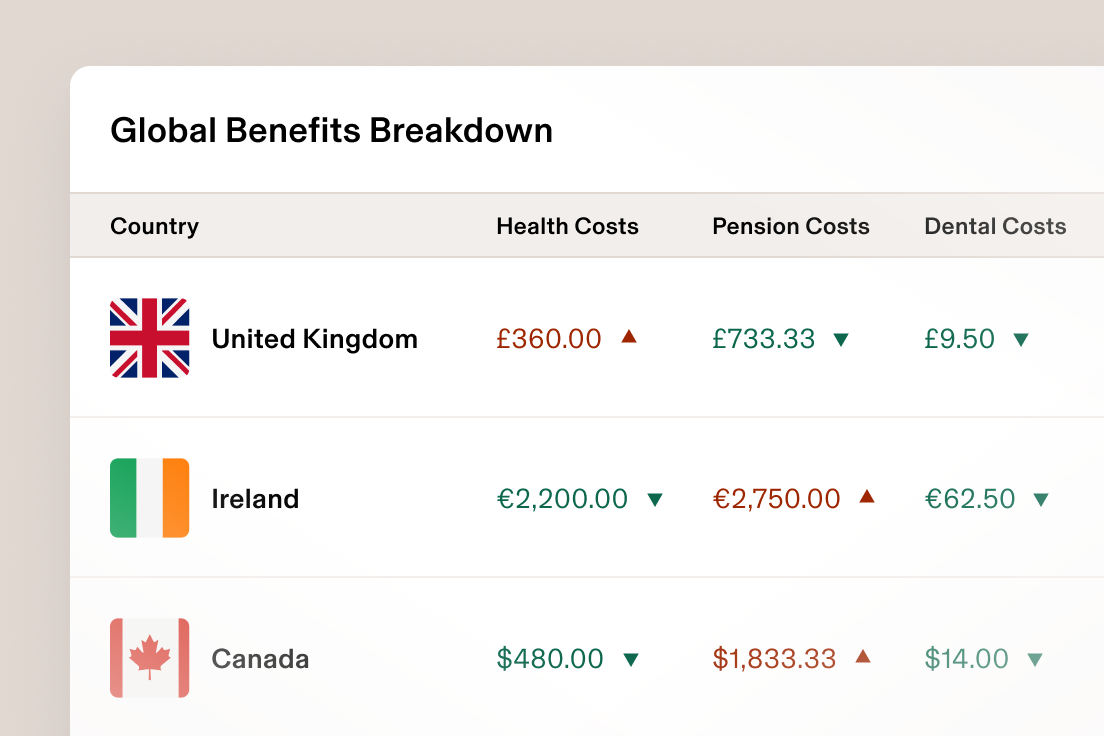

When hiring employees in Canada, it's crucial to offer them the right benefits package to stay compliant with Canadian labor laws, as Canadian employees enjoy more rights and protections than workers in many other countries (including the US).

In Canada, both employers and employees contribute a percentage of the employee’s earnings to the Canada Pension Plan (CPP). Canadians in Québec, however, are covered by the Québec Pension Plan (QPP) and pay different percentages than other Canadian regions.

Most employees in Canada are entitled to employment insurance (EI) that equals 55% of their average weekly earnings up to a maximum. EI is commonly used to provide income to Canadians who take parental leave, but also covers sickness, critical illness, and compassionate care leave. Benefits vary for Canadians living in Québec, as they are covered by the Québec Parental Insurance Plan (QPIP).

Minimum vacation entitlements vary by province or territory and years of service. The lowest minimum (regardless of the aforementioned factors) is two weeks.

Employee benefits in Canada can vary significantly depending on province or territory — and statutory holidays are no exception. There are a few nationwide holidays, however, including New Year’s Day, Good Friday, Canada Day, Labour Day, and Christmas Day.

Ensuring you’re in compliance with Canadian labor laws is one of the most crucial aspects of hiring. But Canadian compliance work can prove tricky, especially when managing workers across 13 provinces and territories — each with their own rights and standards.

Here are some of the most important regulations you need to know when hiring in Canada:

“Workmen” (or non-managerial employees) are governed by a different set of laws than “non-workmen” (or managerial employees). This means termination requirements and other employee protections will vary.

You need reasonable cause to involuntarily dismiss an employee. Otherwise, you’ll need to provide notice or pay them out.

The Trade Unions Act gives workers the right to register a trade union and use it for collective bargaining. Employers are prohibited from refusing to bargain with a registered trade union.

Employers must deduct and remit Canada Pension Plan (CPP), Employment Insurance (EI), and income tax from employee wages, and also contribute the employer portion of CPP and EI.

Yes — unless you use an Employer of Record (EOR). Setting up an entity requires registering with the Canada Revenue Agency (CRA), getting a business number, and setting up payroll accounts.

Payroll can be run weekly, biweekly, semi-monthly, or monthly. The most common cadence is biweekly. CRA remittance schedules depend on your average monthly withholding amount.

Minimum wage and overtime rules vary by province. Most provinces require 1.5x regular pay for hours worked over 40–44 hours/week, and minimum wage is set provincially and reviewed regularly.

Written employment contracts should clearly state wages, job duties, probation period, termination notice, and applicable benefits, and comply with both federal and provincial employment standards.

By clicking “See Rippling”, you agree to the use of your data in accordance with Rippling's Privacy Notice, including for marketing purposes.