Everything you need to run and pay a global team

Rippling can help you address every step of your international growth while allowing you to transition easily between stages.

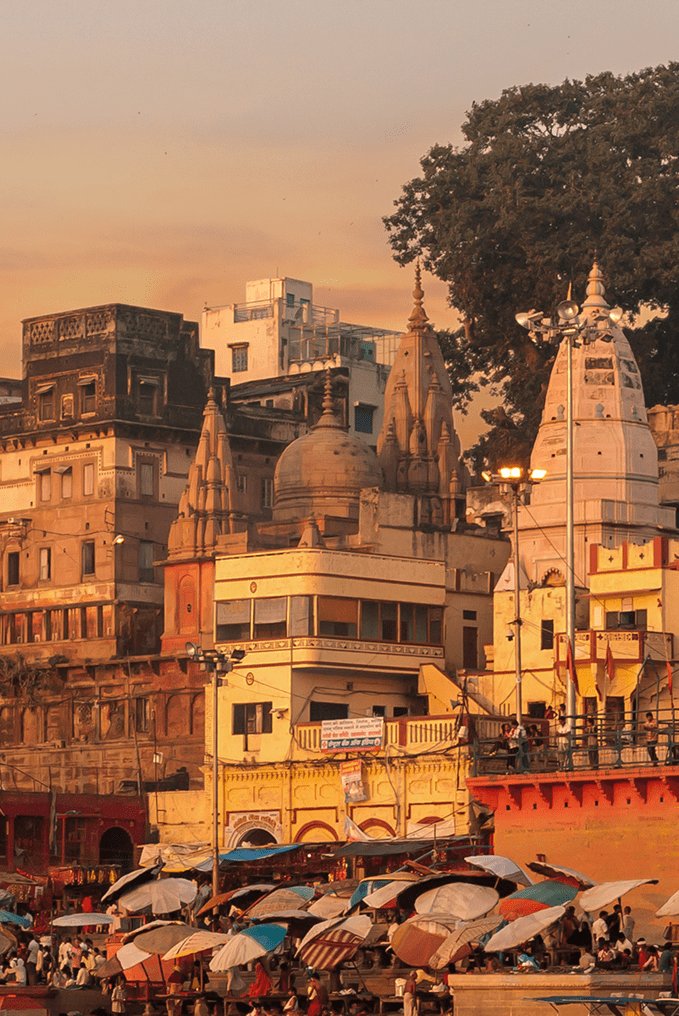

Hiring in India? Rippling handles local complexity and compliance so you can focus on growing your business.

Currency: Indian rupee (INR)

Capital: New Delhi (GMT+5:30)

Payroll cycle: Monthly

Official language: Hindi and English

We value your privacy. Learn more.

Set up new hires in India with everything they need, from country-specific trainings to apps like Slack.

Pay all of your employees in India without waiting on transfers or conversion.

Understanding and complying with Indian laws is hard work. Rippling does it for you.

Juggling multiple systems for your team? That creates silos and busy work. Rippling does it all — in a single system.

Rippling can help you address every step of your international growth while allowing you to transition easily between stages.

“Our CEO describes Rippling’s ability to scale globally as 'priceless.'”

Annabel Tomlin

VP of Operations

“Before Rippling, I would have had to coordinate with seven different people in different time zones. But I was able to do it for myself in 15 minutes — it was surprising and delightful, and inspirational.”

Varun Sharma

CEO

“I feel safe with Rippling—much more safe compared to Deel.”

Jisselle Baldwin-Todd

Head of HR

“We were originally working with Remote, as Deel was too expensive — but we knew we needed an all-in-one platform for future growth, and that was the key differentiator with Rippling.”

Christopher Welz

General Manager of Operations

“Rippling has eliminated tedious manual work, improved accuracy, and enabled faster, more efficient people operations, making HR and IT processes far more scalable and strategic.”

Selina Purdie

Head of People

To run payroll in India, you need to determine each worker’s employment status, collect key employee details, and pay in INR (as required by law). Rippling simplifies the entire process with one system for payroll, tax compliance, and reporting. Since employers are responsible for withholding income tax and calculating payroll deductions, it’s important to keep these costs in mind:

There is no minimum wage for Indian organizations in the private sector. The regulated “factory” sector has its own set of minimum wage requirements. Some states set their own wages, often dependent upon the industry and level of skill required.

This is a social security scheme that provides retirement payments to Indian workers. Employers generally contribute 12% of an employee’s salary to the fund, with 8.33% going into a pension scheme.

You must also contribute to India’s Employee State Insurance (ESI) scheme. This covers benefits for medical care, sickness, maternity, disability, and so on. Most companies with 20 or more employees must contribute 4.75% of a worker’s wages to the scheme.

Employers must withhold income tax based on India’s tax slabs, which range from 0% to 30% depending on income. Some payments — like salaries and commissions — are also subject to immediate withholding under India’s Tax Deducted at Source (TDS) rules. Rippling automates tax calculations and filings to simplify compliance.

Before onboarding workers — or running payroll — you need to understand how Indian law classifies them: Are they employees or independent contractors?

Misclassifying full-time employees as contractors is a common mistake that can lead to compliance issues, penalties, and a strained working relationship. In India, classification affects tax obligations, benefit entitlements, and legal protections.

Here are the key differences:

Employees are more integrated into the company, follow employer direction, receive benefits like insurance and paid leave, and are generally engaged for ongoing indefinite roles, with the employer responsible for workplace protections.

Contractors have greater control over how they work, use their own tools, aren’t entitled to employee benefits, and typically work on short-term projects while managing their own taxes and liabilities.

The Ministry of Labour and Employment sets forth the statutory minimums (required benefits) in India. If you fail to adhere to these benefit requirements, you could wind up facing harsh penalties and fines.

So, it’s best to understand what you’re responsible for offering. Mandatory benefits include:

Vacation leave policies vary among India’s 28 states. Typically, employees are entitled to around 15 days of time off (or earned leave) per year.

Employee benefits in India can vary significantly depending on province or territory — and statutory holidays are no exception. There are a few nationwide holidays, however, including New Year’s Day, Good Friday, Canada Day, Labour Day, and Christmas Day.

Employees are entitled to at least 12 days of paid sick leave per year. This can be used for illness (both for the employee and family members) or bereavement purposes.

Pregnant employees who have worked with the same employer for 80 days in the last year are entitled to 26 weeks of paid leave for the first two children, with 12 extra weeks for each subsequent child. They will receive 100% of their salary during this time.

If an employee works at least five years continuously for the same company (with 10 or more employees), they’re eligible for gratuity payments.

Compliance is one of the most critical parts of hiring in India. But India’s labor laws can be complex — regulations vary by industry, state, and company size. Missing a requirement can lead to costly penalties.

Here are key Indian labor laws to keep in mind:

“Workmen” (or non-managerial employees) are governed by a different set of laws than “non-workmen” (or managerial employees). This means termination requirements and other employee protections will vary.

You need reasonable cause to involuntarily dismiss an employee. Otherwise, you’ll need to provide notice or pay them out.

The Trade Unions Act gives workers the right to register a trade union and use it for collective bargaining. Employers are prohibited from refusing to bargain with a registered trade union.

No. With Rippling’s Employer of Record (EOR), you can legally hire and pay full-time employees in India without setting up a local entity. Rippling takes care of payroll, benefits, contracts, and compliance.

Here’s the information you need from salaried employees for payroll processing:

Rippling withholds and remits mandatory contributions such as Provident Fund (12%), Employee State Insurance (4.75%), and income taxes based on India’s tax slabs. We handle tax filings and compliance automatically.

The average annual salary for employees in India is INR 387,000, according to data from Jobted — but this varies widely by industry and occupation.

For example, on average, data scientists make more than twice that at INR 793,400 a year, while security guards make INR 197,400.

Wir respektieren Ihre Privatsphäre. Weitere Informationen finden Sie in unserer Datenschutzerklärung für Benutzer. Es gelten die Nutzungsbedingungen von Rippling.