Run global payroll in minutes. Compliance built in.

Rated #1 on G2 — stay compliant everywhere, streamline payroll, and cut manual work by 90%.

- Automate payroll and tax filings worldwide

- Stay compliant with local laws everywhere

- Run international and local payroll in one system

We value your privacy. Learn more.

A powerful way to run global payroll quickly and compliantly

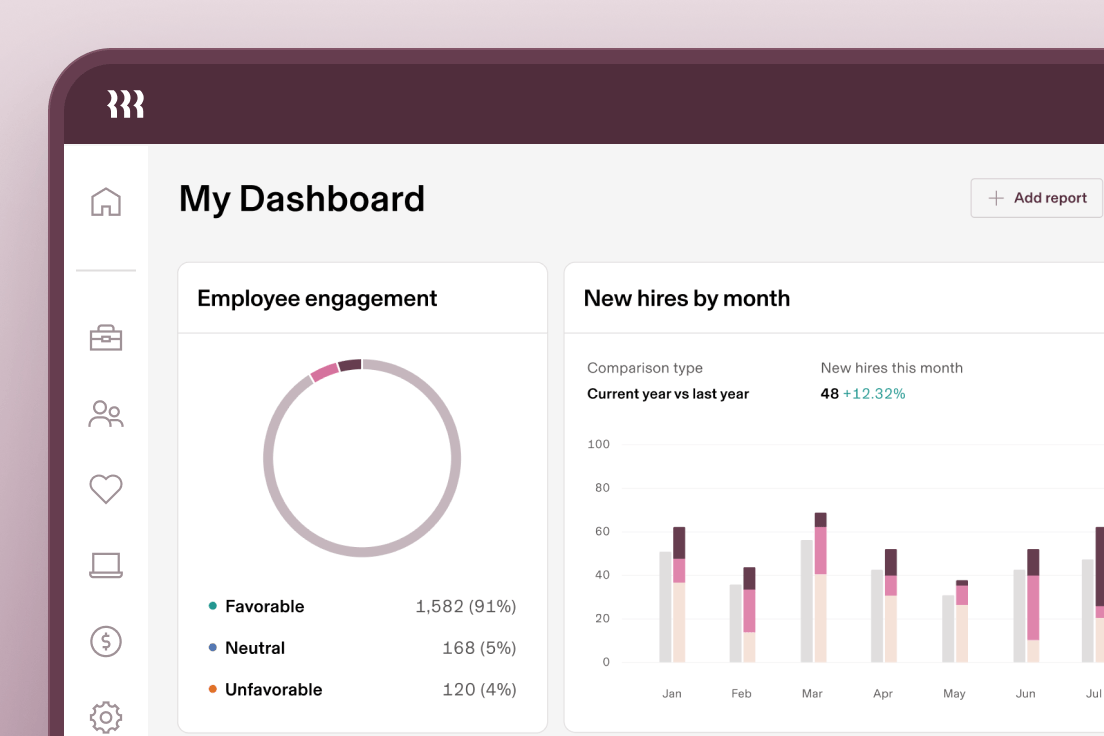

Take the human error out of payroll with Rippling's fully native, integrated global payroll software.

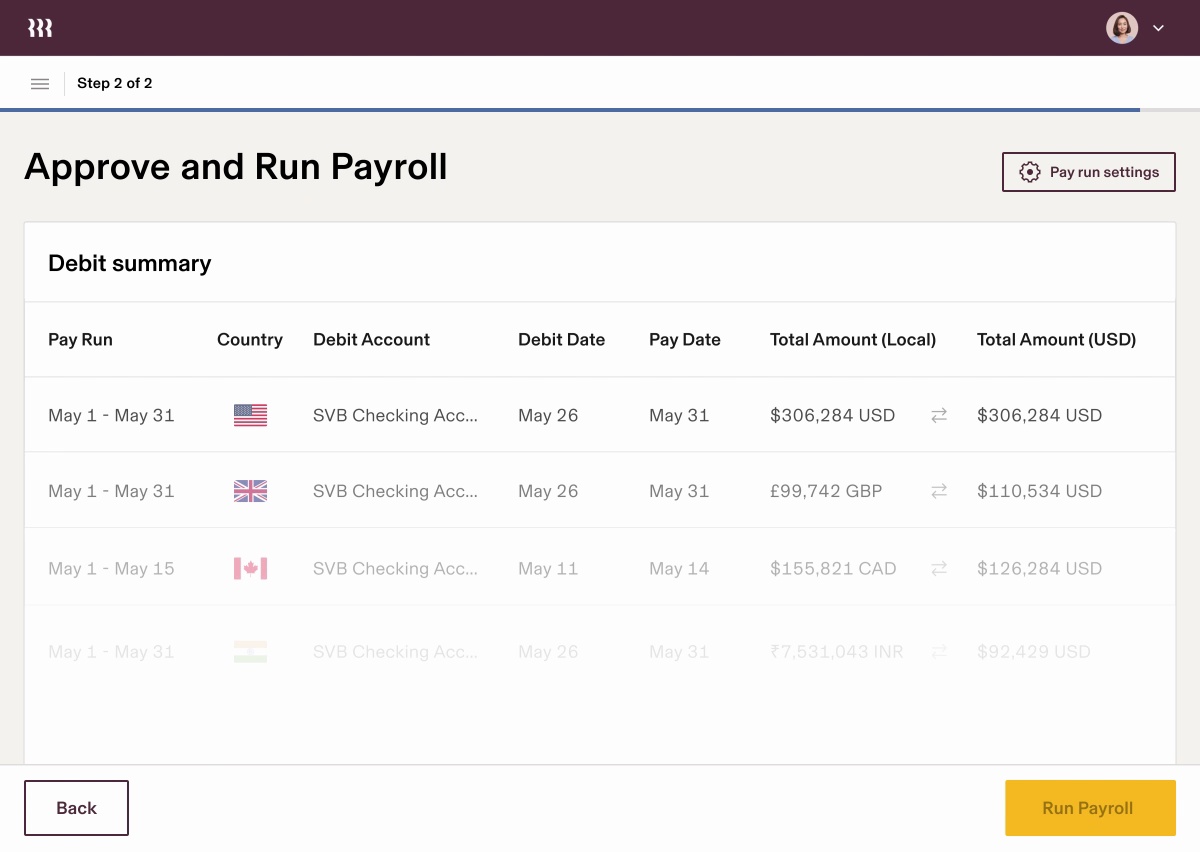

Pay all of your employees and contractors around the world without waiting for transfers or conversion.

Rippling is certified to calculate and transmit payroll taxes and mandatory benefits at the national, local, and industry-specific level.

Build trust with transparent payslips, robust reporting, automated payments, and reliable GL integrations.

Everything you need to run and pay a global team

Rippling can help you address every step of your international growth while allowing you to transition easily between stages.

Expert payroll support that's as good as the software

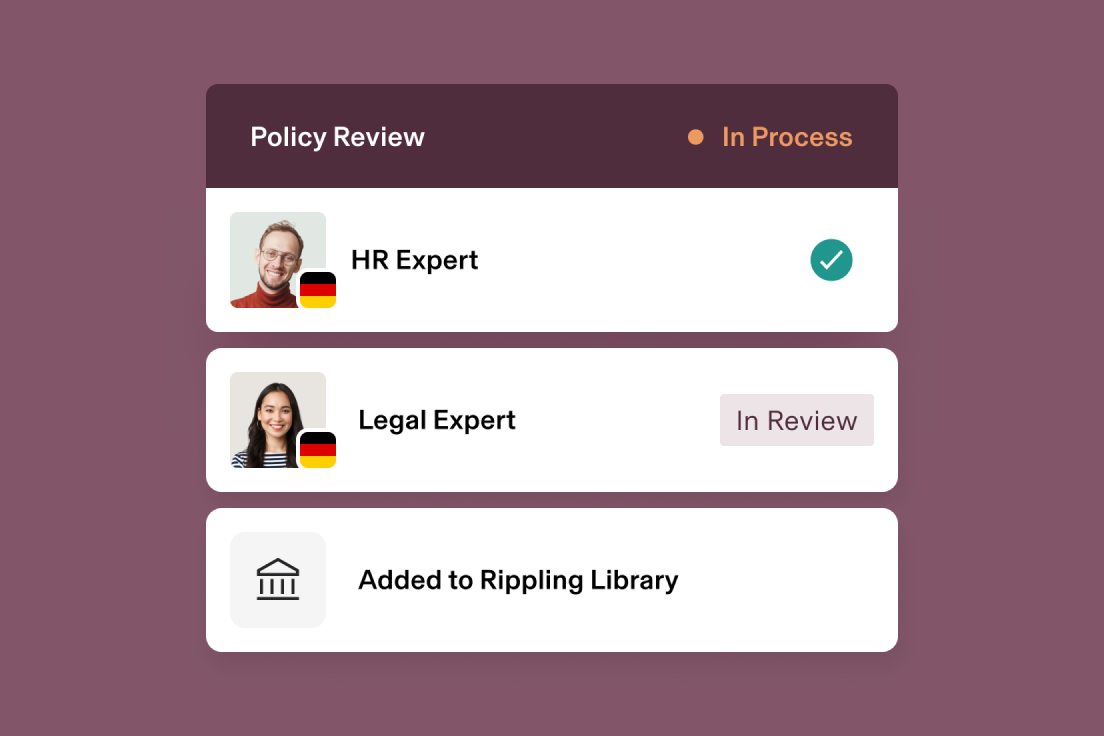

- Global payroll software that's built with oversight from legal, compliance, tax, HR, and payroll experts

- Trusted in-house experts in global payroll

- Access to world-class support fast

See our real-time support metrics.

World-class, award-winning global payroll software

Time for your global payroll to work like your domestic payroll.

See how they run it all on Rippling

Businesses harness Rippling to run their workforce more efficiently, eliminating administrative friction and empowering their employees.

“Our CEO describes Rippling’s ability to scale globally as 'priceless.'”

Annabel Tomlin

VP of Operations

The preferred choice in the industry

Trusted by 25,000+ companies worldwide

Hear stories from our customers

See what Rippling customers are saying

FAQs

What are the components in global payroll services?

Global payroll services typically include payroll processing, tax calculations and filings, compliance management, benefits administration, reporting and analytics, and integration with HR systems.

What is the difference between Global Payroll and Local Payroll?

Global Payroll is Rippling’s product offering for employers who need to pay employees employed via an international entity or subsidiary. Global Payroll involves navigating diverse tax regulations, currencies and employment laws across different jurisdictions.

Rippling also offers Local Payroll. Local Payroll describes Rippling’s payroll offering for companies looking to pay employees based in the employer’s home country. Rippling offers Local Payroll for employers headquartered in major markets including the US, Canada, UK, Ireland, France, Australia and India, with more countries coming soon.

What is the best global payroll provider?

The best global payroll provider varies depending on the specific payroll needs and requirements of each organization. However, a reliable service provider typically offers comprehensive global coverage, advanced technology for automation and integration, compliance expertise in multiple jurisdictions, and excellent customer support.

How can you use Rippling to help you comply with local tax requirements?

Rippling is certified by local tax agencies in applicable countries and handles calculations and transmissions of payroll taxes and mandatory benefits at federal, provincial, and even country- or industry-specific levels. This assists with compliance with local tax laws and regulations.

Can Rippling accommodate shorter lead times for payroll processing?

Yes, Rippling offers significantly shorter lead times compared to most global payroll vendors. With our streamlined processes and self-service functionality, your team can run payroll just days before payday for international employees — simplifying payroll operations, providing flexibility, reducing administrative burdens and ensuring timely payments.

Can independent remote contractors submit their own invoices?

Contractors can generate their own invoices, which Rippling automatically routes for appropriate approvals. When Rippling has the information to generate an invoice automatically (like for contract terms of a fixed rate every month, or hourly contractors who track time using Rippling), Rippling’s multi-country payroll solution can also auto-generate invoices.

Ready to see Rippling Global in action?

We value your privacy. Learn more.