Everything you need to run and pay a global team

Rippling can help you address every step of your international growth while allowing you to transition easily between stages.

Hiring in the UK? Rippling handles local complexity and compliance so you can focus on growing your business.

Currency: Pound Sterling (GBP)

Capital: London (GMT+1)

Payroll cycle: Monthly

Official language: English

We value your privacy. Learn more.

Set up new hires in the UK with everything they need, from country-specific trainings to apps like Slack.

Pay all of your employees in the UK without waiting on transfers or conversion.

Understanding and complying with the UK laws is hard work. Rippling does it for you.

Juggling multiple systems for your team? That creates silos and busy work. Rippling does it all — in a single system.

Rippling can help you address every step of your international growth while allowing you to transition easily between stages.

“Our CEO describes Rippling’s ability to scale globally as 'priceless.'”

Annabel Tomlin

VP of Operations

“Before Rippling, I would have had to coordinate with seven different people in different time zones. But I was able to do it for myself in 15 minutes — it was surprising and delightful, and inspirational.”

Varun Sharma

CEO

“I feel safe with Rippling—much more safe compared to Deel.”

Jisselle Baldwin-Todd

Head of HR

“We were originally working with Remote, as Deel was too expensive — but we knew we needed an all-in-one platform for future growth, and that was the key differentiator with Rippling.”

Christoper Welz

General Manager of Operations

“Rippling has eliminated tedious manual work, improved accuracy, and enabled faster, more efficient people operations, making HR and IT processes far more scalable and strategic.”

Selina Purdie

Head of People

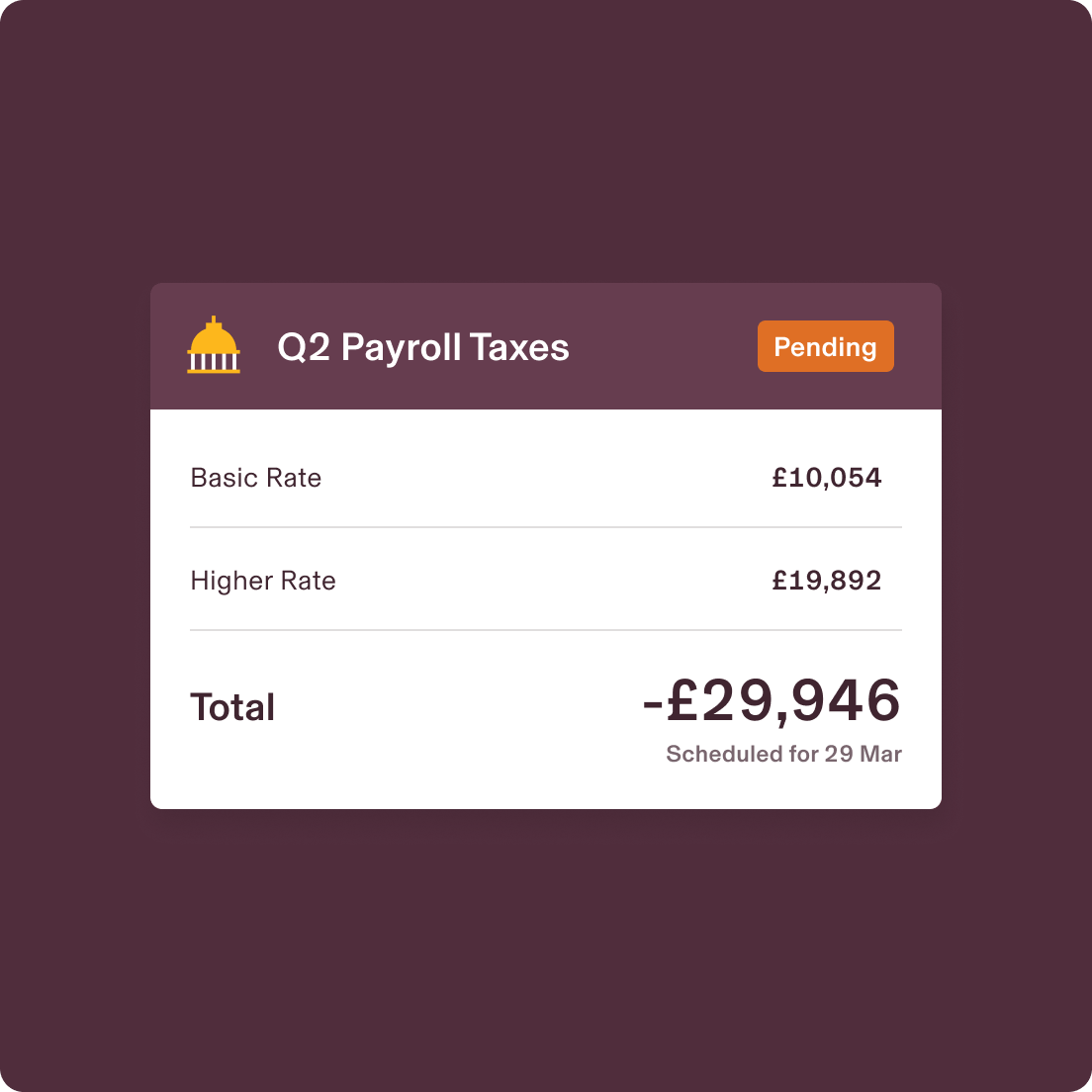

To run payroll in the UK, you need to register with HMRC, collect key employee information, pay in GBP, and handle all tax and National Insurance deductions through the PAYE system. Rippling simplifies the entire process with one system for payroll, compliance, and reporting. Since UK employers are responsible for calculating and remitting deductions, it’s important to keep these core obligations in mind:

The rates change on 1 April every year.

From April 2025, the rates (per hour) are:

In the UK, income tax is collected through the Pay As You Earn (PAYE) system. Employers don’t pay income tax themselves but are responsible for withholding and remitting it on behalf of their employees to HMRC using a PAYE reference number. Most employees receive a £12,570 tax-free personal allowance. Earnings above that are taxed at:

For high earners, the personal allowance tapers off above £100,000 and is fully removed at £125,140. Non-residents may receive reduced or no allowance depending on residency status and tax treaties.

National Insurance contributions (NICs) are payments made by both employers and employees to fund state benefits like unemployment, retirement, illness, and parental leave. For 2024–2025, employees pay 12% on weekly earnings between £242 and £967, and 2% on earnings above that. Rates vary based on earnings and employment category.

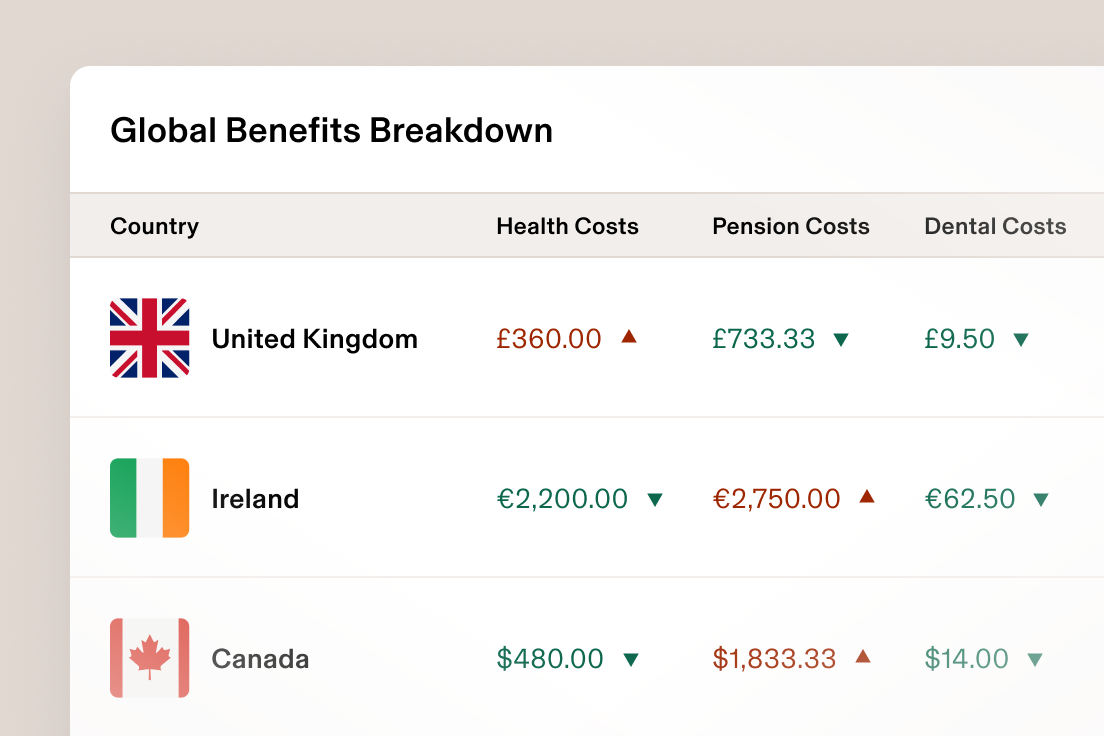

Employers must auto-enroll eligible employees into a workplace pension and contribute at least 3% of qualifying earnings.

You must submit a Full Payment Submission (FPS) to HMRC each payday and pay any tax due by the 22nd of the month to avoid penalties.

Before running payroll in the UK, make sure your workers are correctly classified as employees or contractors. Misclassification can trigger serious penalties from HMRC.

If they’re employees, you’re responsible for PAYE taxes, pensions, and statutory benefits.

Employees are more integrated into the company, follow employer direction, receive benefits like insurance and paid leave, and are generally engaged for ongoing indefinite roles, with the employer responsible for workplace protections.

Contractors have greater control over how they work, use their own tools, aren’t entitled to employee benefits, and typically work on short-term projects while managing their own taxes and liabilities.

When hiring employees in the UK, it’s important to offer the right benefits to stay compliant with UK labor laws. UK employees are entitled to more statutory protections than in countries like the US. This includes automatic pension enrollment, paid sick leave, maternity leave, and a minimum of 5.6 weeks of annual holiday. Make sure these benefits are built into your employment contracts from day one.

You are required to automatically enroll employees in workplace pensions if they meet the following criteria: They’re between the ages of 22 and 66. They can be classified as a “worker.” And they’re earning a minimum of £10,000 per year.

As the employer, you’re required to provide Statutory Sick Pay (SSP) to employees who are too ill to work. You have to pay them a minimum of £109.40 per week for up to 28 weeks.

The UK affords mothers up to 52 weeks of maternity leave. This is divided into 39 weeks of Ordinary Maternity Leave plus 13 weeks Additional Maternity Leave. During their maternity leave, women are also entitled to statutory maternity pay for up to 39 weeks.

Employers are required to provide employees with at least 5.6 weeks of holiday leave per calendar year.

As you move through the onboarding process, you want to be sure you’re in compliance with UK labor and employment laws at every step. Otherwise, the penalties can be harsh, including hundreds of thousands of GBP in fines and potential jail time.

Be mindful of the following regulations when hiring in the UK:

There are two categories of statutory minimum wage that employees can be paid. The National Living Wage is paid to employees ages 23 and up. And the National Minimum Wage is paid to employees ages 22 and younger.

You must provide a reason for dismissing employees, and all employees are entitled to a written notice of their dismissal. They can only be dismissed immediately without notice if they engage in gross misconduct.

UK employees can join one or more trade unions, including those that their employer doesn’t negotiate with.

No. You can hire employees in the UK either by setting up your own legal entity or by using an Employer of Record (EOR). An EOR handles compliance, payroll, and benefits on your behalf — letting you hire without forming a local company.

You must:

To run UK payroll, you must:

Mandatory UK employee benefits include:

If a company fails to file its tax return on time, HMRC will issue penalties based on how late the submission is:

We value your privacy. Learn more.