Payroll so powerful it can run itself

Pay employees and contractors, anywhere in the world, in seconds. File your taxes, automatically.

G2

4.9 Star Rating

Capterra

4.9 Star Rating

INSTANT AND RELIABLE

Run payroll in 90 seconds

Rippling syncs all your business’s HR data with payroll, so you never have to use a calculator or manually enter data, like hours and deductions. All you need to do is click “Run.” It’s that easy.

Pay Period

Review Payroll

Review & Approve Payroll

Automatic Compliance

From I-9's to W-2's, Rippling automatically handles your compliance work and ensures your company is always in compliance with all relevant forms, laws, and regulations so you never have to worry about it.

Automatic Tax-Filing

Rippling automatically calculates your payroll taxes and files them with the IRS and other federal, state, and local agencies at the right time, every time—even when employees move locations. You never need to lift a finger.

MANAGE GLOBAL PAYROLL

Pay people across the world

With Rippling’s payroll service, you can pay employees and contractors in minutes, wherever they are, from your company HQ to a satellite office in Timbuktu.

TIME TRACKING SOFTWARE

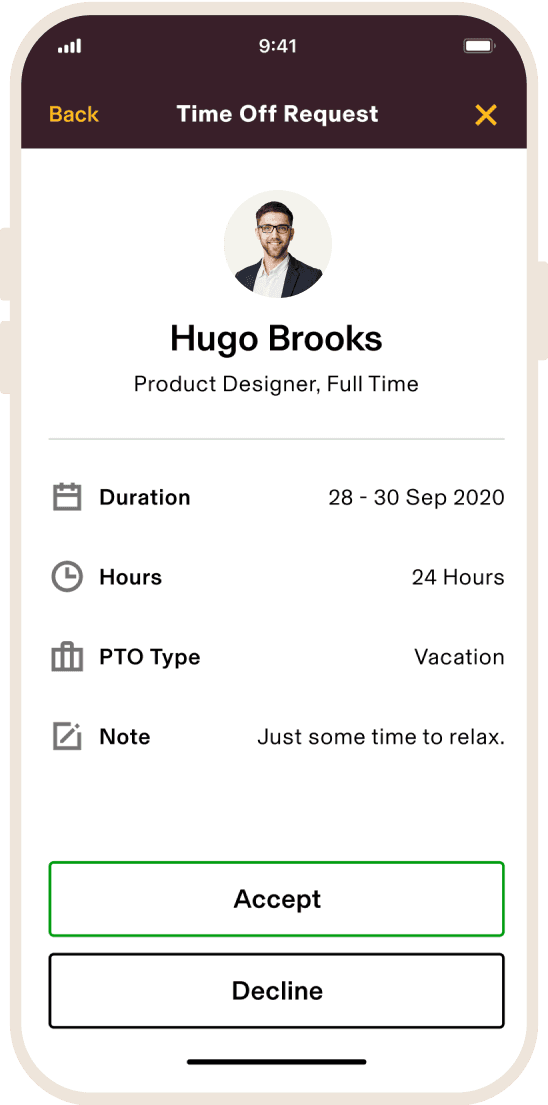

Track hourly work and PTO effortlessly

Customize your business’s PTO policy, then review and approve employees' time off requests with a click—knowing all the while that approved working hours and PTO automatically sync with payroll.

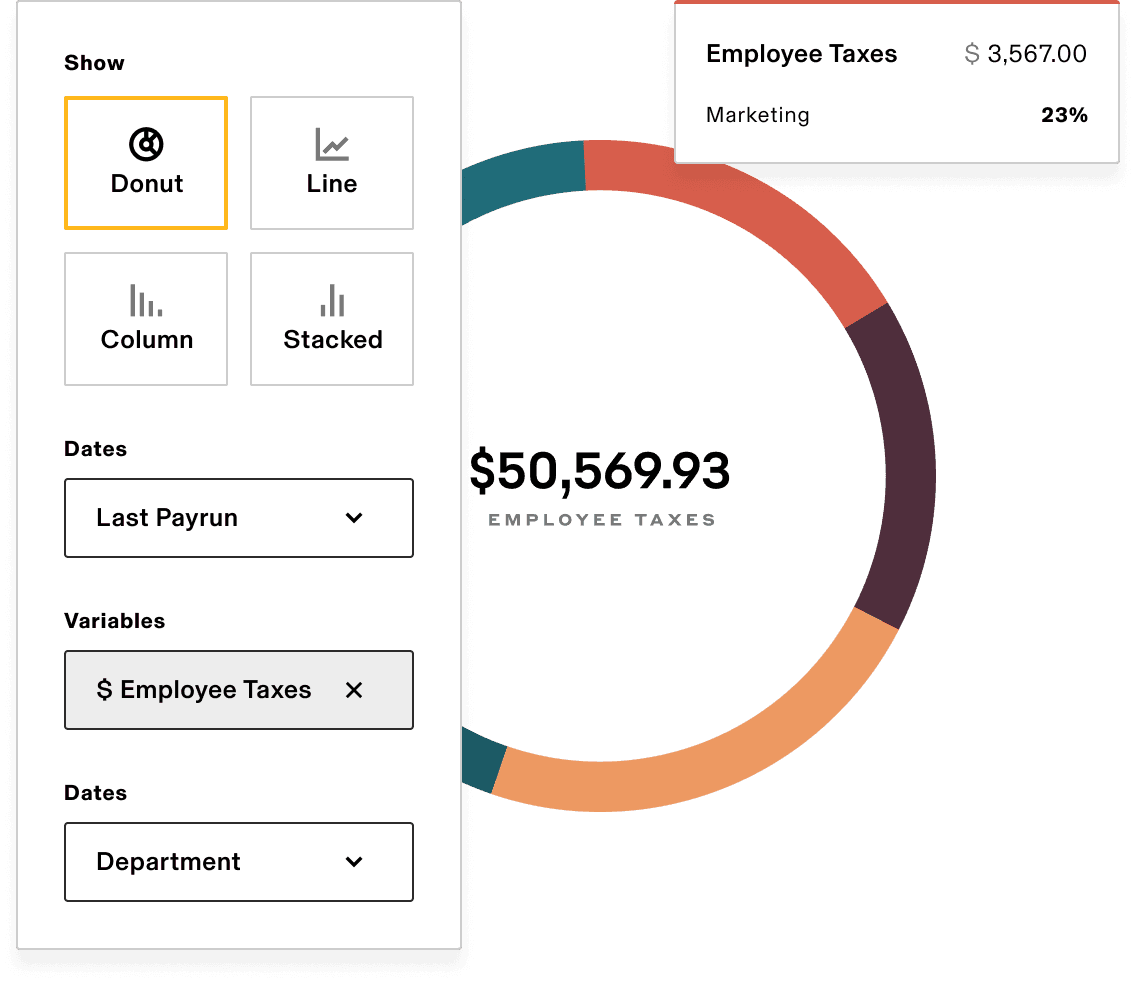

Powerful Reporting TOOLS

Create any report you can think of

Use our library of pre-built reports or create custom ones using any employee information in Rippling. You can visualize and share reports too, so every department can make faster, better decisions and well-informed plans for your company's future.

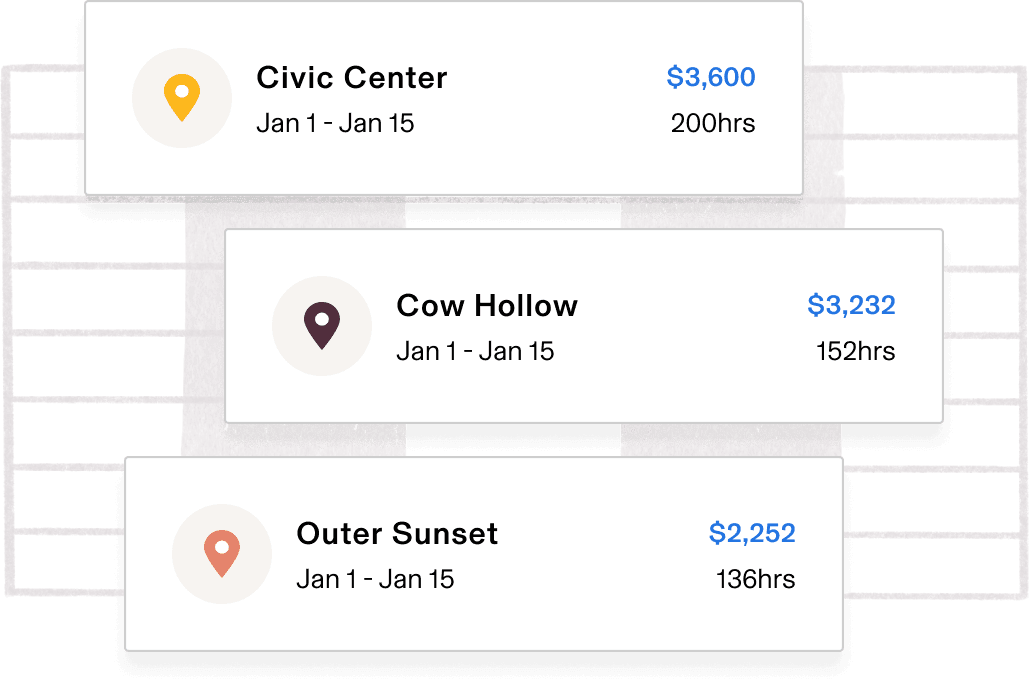

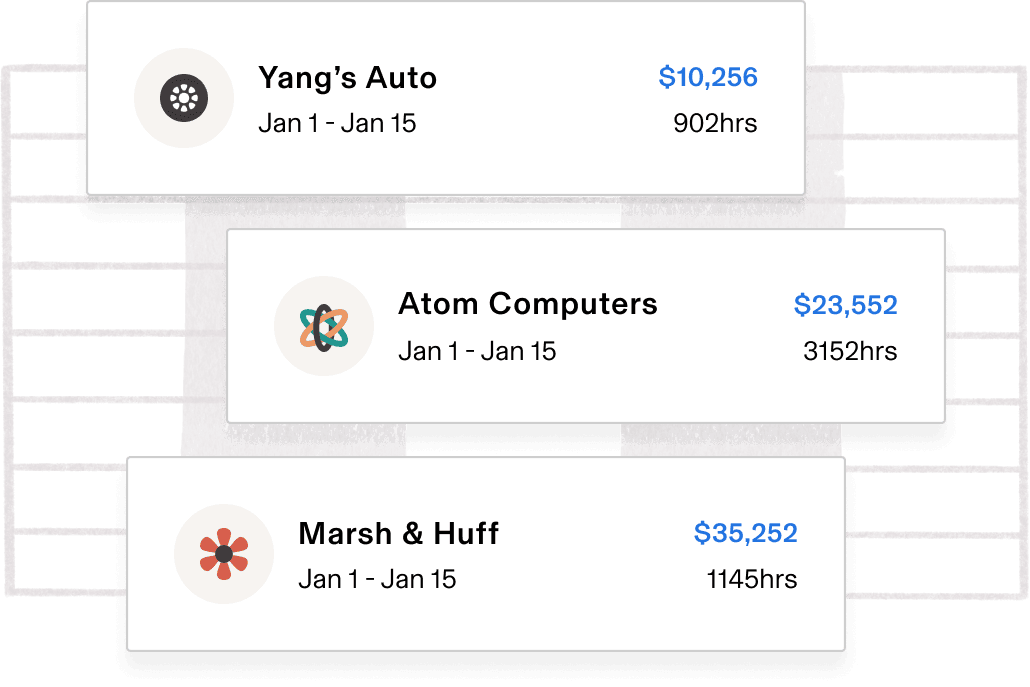

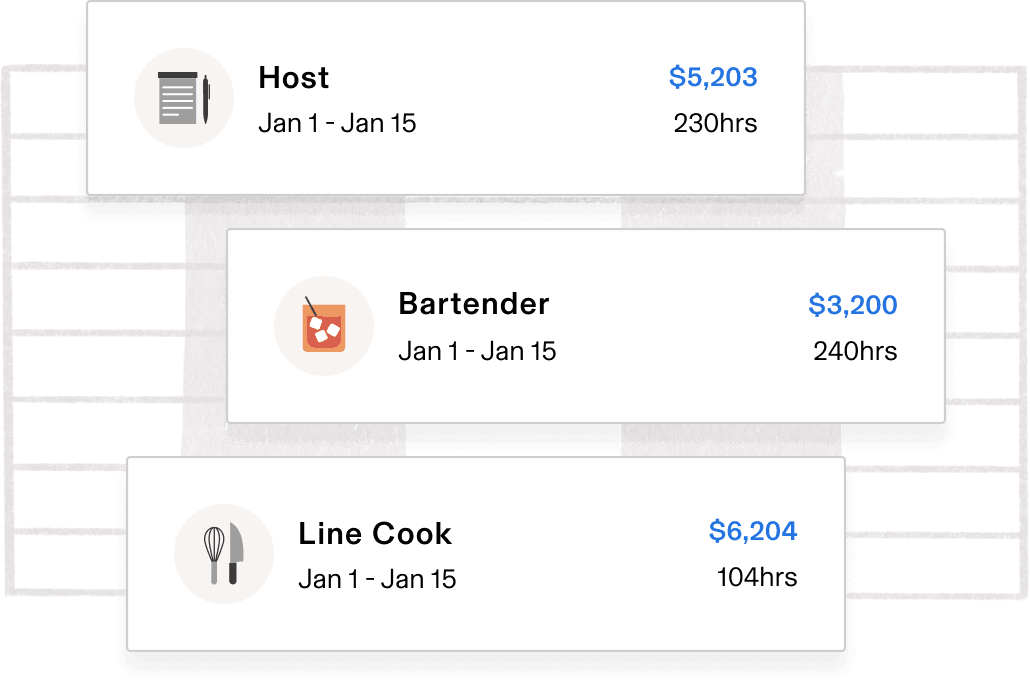

Job Codes

See where employees’ time is going—and what it's costing you

Job Codes allow you to track where your peoples’ time goes and the cost of that time—by location, client, task, and more. You can also change employees’ pay rates as they move from job-to-job. All automatically.

Location

Client

Task

supported INTEGRATIONs

Sync all your systems with payroll

Rippling automatically keeps your payroll and general ledger up to date by syncing with over 400 apps—from accounting software like Quickbooks and NetSuite, to time tracking tools like TSheets and Deputy.

View all integrations

PRODUCT FEATURES

Payroll built for all sizes, from small businesses to large

All 50 states & international

Pay employees and contractors in seconds, wherever they are in the world.

Federal, state, & local tax filing

Rippling automatically calculates and files your payroll taxes with the IRS and other federal, state, and local agencies at the right time, every time.

W2, W4, 1099, & new hire filing

Rippling automates your compliance work and ensures your company is always up-to-code, so you never have to worry about it.

Workers' compensation

Easily add 'pay as you go' workers' comp insurance through our integration with AP Intego.

Garnishments

Rippling supports all garnishment types and can even pay them out on your behalf.

Time tracking

Effortlessly track your employees' hours and PTO. It's all automatically synced to payroll—no more spreadsheets, CSVs, or headaches.

Job costing & multiple pay rates

Track where your employees' time goes and the cost of that time—by location, client, task, and more.

Direct deposit or check

Send payment via direct deposit or check, whichever works best for your employees and business.

Mobile app

Your employees can see their paystubs, request time off, and even view their W2s on-the-go in our mobile app.

Rippling processes over $18B per year in payroll. To gain your trust, we take compliance seriously.

We adhere to GDPR and CCPA while annually auditing for SOC 1 Type 2 and SOC 2 Type 2.

Request ReportsRECIPE LIBRARY

Hit the ground running with hundreds of templates

Choose from hundreds of pre-built workflow templates and install one in seconds. You can use our templates out-of-the-box or tweak them to meet your exact needs.

“Rippling is A+A+ for companies scalingscaling fastfast”

Authenticated Reviewer

Computer Software

“Rippling makes it easyeasy to manage my globalglobal teamteam”

Authenticated Reviewer

IT & Services Company

“Rippling saves time,time, moneymoney andand headachesheadaches”

Authenticated Reviewer

Staffing & Recruiting

“Rippling is a greatgreat choicechoice forfor remoteremote teamsteams”

Authenticated Reviewer

Marketing & Advertising

“AmazingAmazing productproduct for our small business”

Authenticated Reviewer

Venture Capital & Private Equity

See Rippling in action

Learn how Rippling can help you effortlessly onboard and manage your employees, whether you have a workforce of 2 or 2,000.