CORPORATE CARDS

The corporate card with a built-in back office

No personal credit checks or guarantees required.

We value your privacy. Learn more.

Category Leader: Spend Management on GetApp

Overall Leader: Expense Management on G2

4.9 stars 3k reviews on GetApp

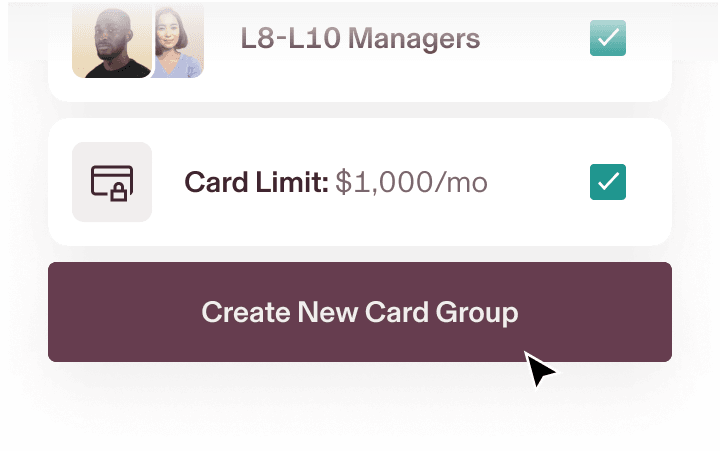

Issue corporate cards to employees in the blink of an eye

With Rippling, you can issue corporate cards to your team, control their spending, and reconcile expenses with nearly zero effort.

Physical Cards

Virtual Cards

You’ve never had control over card spend like this

Rippling unifies your employee data and spend data. As a result, you can create hyper-custom card policies and automatically control how, when, and where employees can spend.

Spend analytics

Give every team the right visibility into their spend, instantly

Rippling allows you to control access and visibility based on role. That means every team has the power to run in-depth reports on their own slice of spend—and no one else’s.

Automate corporate card management, from end to end

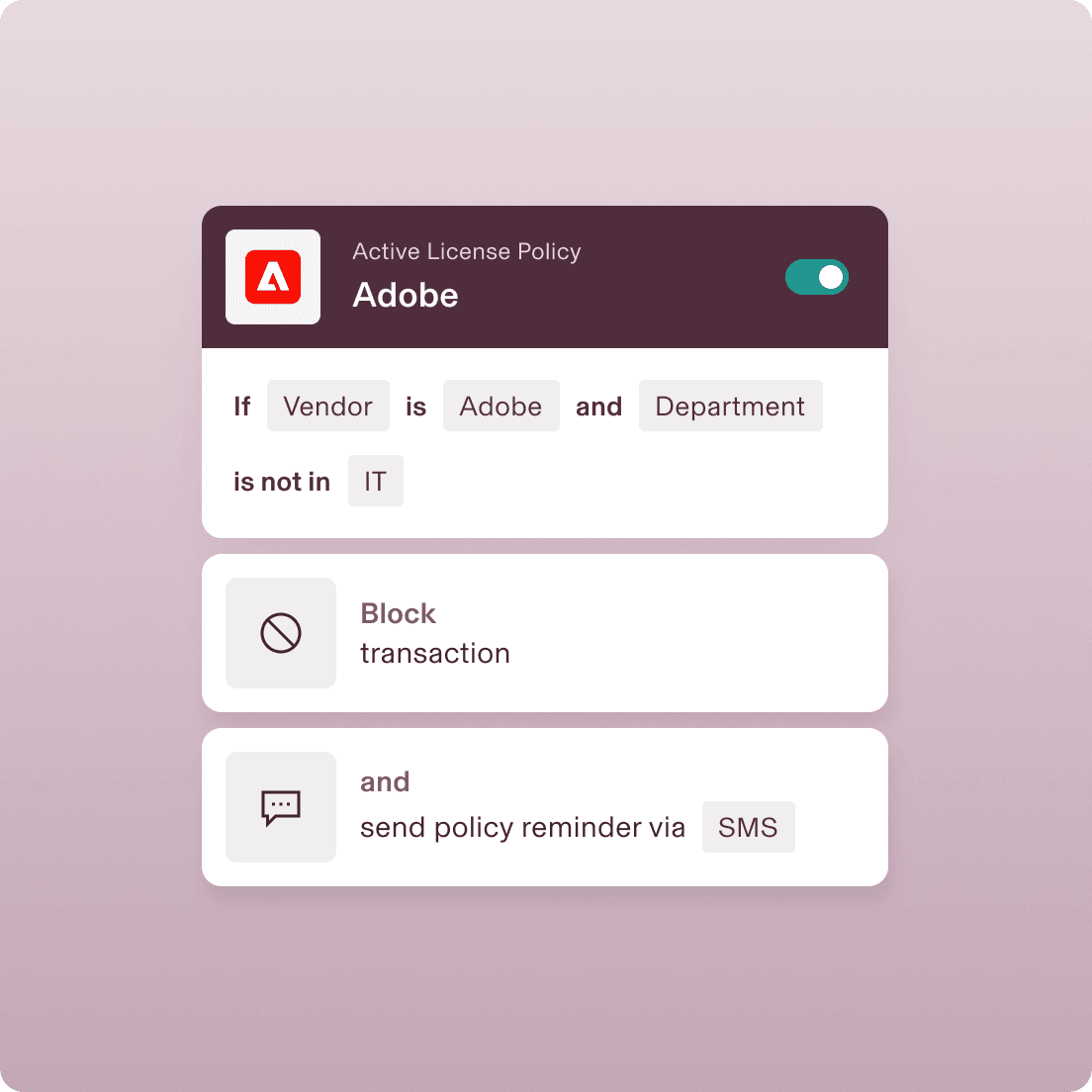

HYPER-CUSTOM policies

Instantly enforce policies other systems can't

Most spend solutions require hours of vigilance to enforce any policy more complex than a $500 limit. Since Rippling houses your employee data, it’s possible to quickly build hundreds of granular policies that enforce card spend exactly the way you would.

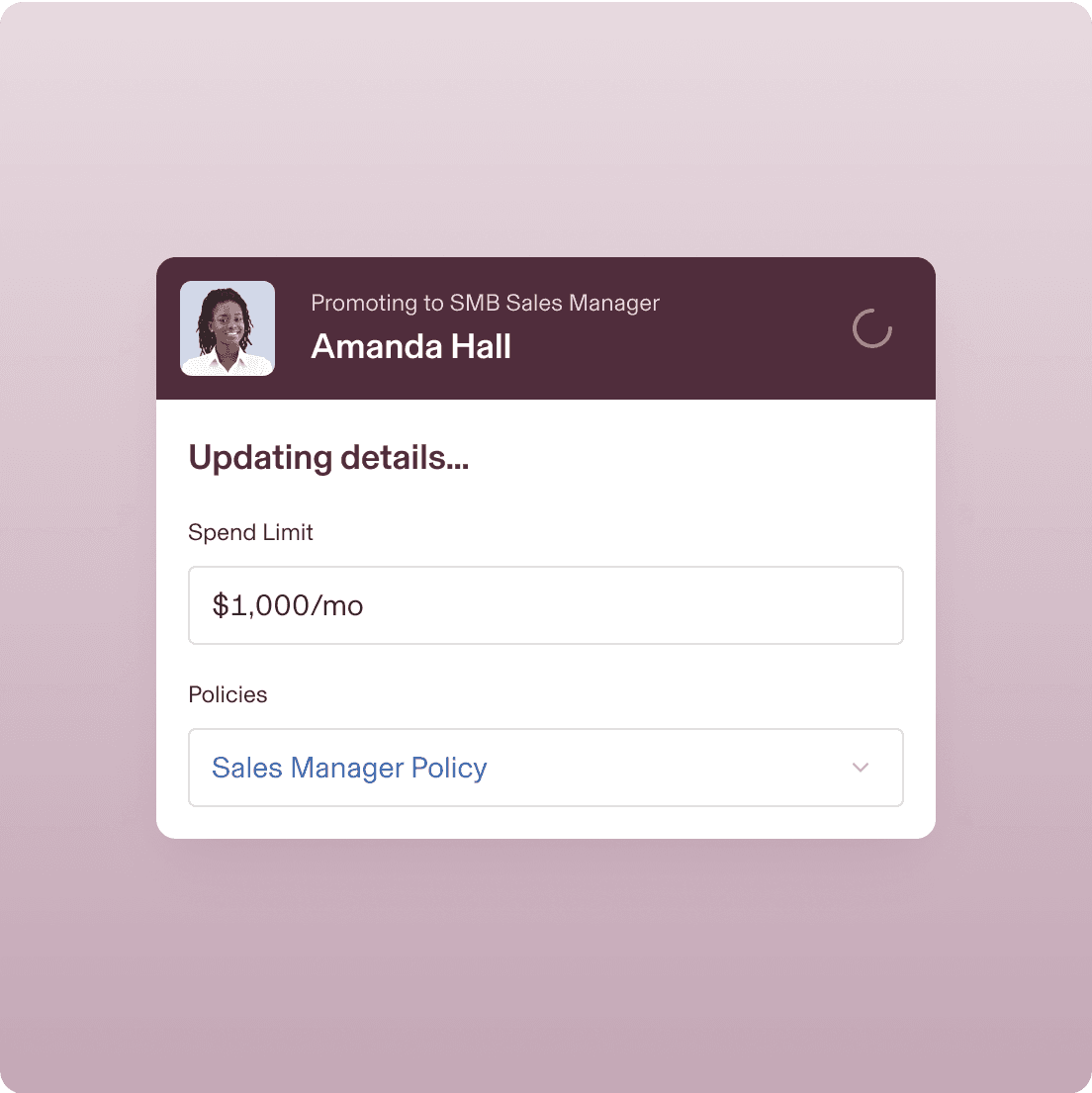

CARD LIFECYCLE AUTOMATION

Automate every step, from issuing to revoking

Rippling automates the entire cardholder lifecycle, from updating card policies when employees are promoted to reassigning cards after they offboard, so your business never misses a beat.

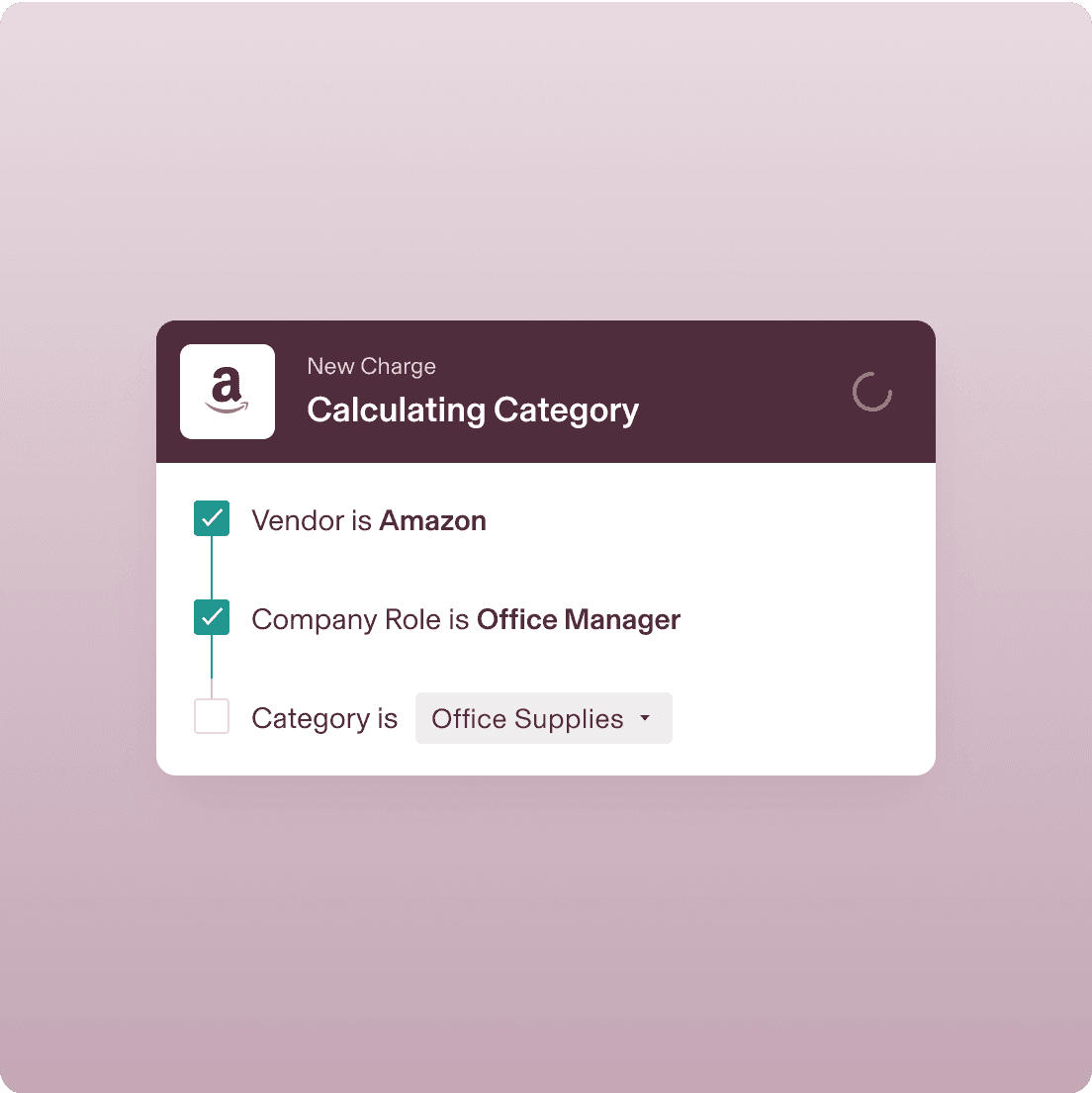

General Ledger

Close the books in days instead of weeks

With Rippling, you can sync card transactions to your general ledger and use policies to automatically categorize each transaction’s fields, saving your team the painstaking work of matching every transaction to a GL category.

Modern Business Corporate Cards

Run on the Visa network. Built for a modern world.

Proactively block spending

Block non-compliant spending before it happens with automatic, real-time enforcement of your company policies.

Tap to pay with Digital Wallet cards

Rippling’s corporate card is compatible with Apple Pay® and Google Pay™, so employees can make charges on the go.

Magically match receipts

After making a charge, employees can text a picture of their receipt for your records, making it easier to close the books for everyone.

global corporate cards

Global card control puts you in charge

Monitor transactions, stay compliant, and eliminate unnecessary spend at the entity level.

Automatically issue local-currency cards*

Issue corporate cards to global employees based on team, level, location, and more.

Monitor global transactions in real-time

Gain total visibility into all transactions with controls at the card or employee level to prevent unauthorized spend and ensure compliance with your spend policies.

Sync spend with accounting

Save hundreds of hours of manual reconciliation thanks to direct integrations with major accounting software systems and automatic receipt-matching across transactions.

No other solution can automatically control spend like this

Company Offsite Expenses

Field Sales Expenses

Remote Employees Expenses

Manager Expenses

Built different

Analyze, automate, and orchestrate anything

Most "all-in-one" software consists of acquired systems. These modules are disconnected, so your business data is, too. Rippling takes a platform approach, building products on a single source of truth for all the business data related to employees. This rich, flexible data source unlocks a powerful set of capabilities.

Permissions

Automatically govern what each person in your company can see, do, and access.

Policies

Build custom policies that enforce your business’s unique rules and procedures.

Workflows

Automate virtually anything with hyper-custom triggers and advanced workflow actions.

Analytics

Make better decisions faster with real-time, unified data in an easy-to-use report builder.

Get started today with Rippling Spend

FAQs

What are corporate cards?

Corporate cards are designed to help businesses manage their spending. Think of them as business credit cards equipped with a built-in back office, allowing you to issue cards to employees, implement granular spending controls, and automate expense reconciliation. Unlike traditional business credit cards, Rippling’s corporate cards don't require personal credit checks or guarantees, making them accessible to a wider range of companies, from small business and startups to enterprise companies.

What is the difference between a business card and a corporate card?

While both business cards and corporate cards serve the purpose of facilitating business purchases, there are key distinctions. Traditional business cards are often tied to the business owner's personal credit and may offer less sophisticated spend management features. Corporate cards like Rippling's provide advanced spending controls, detailed expense reports, and often integrate with accounting systems to simplify reconciliation.

What are the benefits of a corporate credit card program?

Implementing a corporate card program helps support your business needs by giving you unparalleled visibility and control over business spend, allowing you to set budgets, enforce customizable policies, and monitor transactions in real-time—helping prevent unauthorized spending and ensure compliant spending. A corporate card like Rippling’s can streamline everything from card issuance and revocation to expense reports and general ledger reconciliation, saving your finance team valuable time and resources.

What are Rippling’s corporate card eligibility requirements?

Rippling Corporate Card is available to registered legal entities with the exception of sole proprietorships. Businesses must have an Employer Identification Number (EIN) and cannot operate in a restricted industry. Meeting these eligibility requirements does not guarantee that your application for a Corporate Card will be approved or that credit of any particular limit will be extended to you.

What are Rippling’s corporate card payment terms?

Rippling Corporate Card currently offers daily, weekly, bi-weekly and monthly payment terms depending on the risk profile of your business. At the end of your payment term, your Corporate Card expenses are consolidated into one payment that is deducted automatically from your linked bank account. You do have the ability to pay off your balance prior to the end of the term.

Does Rippling require a credit check or personal guarantee? Do you require credit life or accident and health insurance?

Rippling Corporate Card does not require a personal credit score check and your credit score will not be affected. Unlike personal credit cards, Rippling corporate cards focus on your business's financial standing. Rippling Corporate Card does not require a personal guarantee.

How does Rippling determine a company’s credit limit?

Rippling offers credit limits based on the size and health of your business, as determined by the company’s financial information and bank statement balances. As part of its process, Rippling evaluates a company’s available cash, spending patterns and history with Rippling amongst other factors to dynamically determine a credit limit for your business. Companies can appeal for a larger credit limit than initially offered, and may be required to include additional information for Rippling to make a decision to grant the request.

Are there any fees on Rippling corporate cards?

Rippling Corporate Card does not charge any annual fees or interest on your card for transactions denominated in U.S. Dollars placed with merchants in the United States. Transactions denominated in foreign currencies and/or placed with merchants abroad are subject to fees charged by Rippling or its partners and vendors, as detailed in the Corporate Card Program Terms .

The Rippling Corporate Card is issued by Fifth Third Bank, N.A. Member FDIC, or Celtic Bank, subject to approval. Cards are issued pursuant to a license from Visa® U.S.A. Inc. Visa is a trademark owned by Visa International Service Association and used under license. Apple, Apple Pay, and the Apple logo are trademarks of Apple Inc., registered in the U.S. and other countries. Google Pay and the Google Pay logo are trademarks of Google LLC. Third parties listed are not affiliated with Fifth Third Bank or Celtic Bank and are solely responsible for their products and services. All trademarks are the property of their respective owners.

Rippling Payments, Inc.’s (NMLS No. 1931820) California loans made or arranged pursuant to a California Financing Law License.

*Rippling corporate cards are available in a variety of jurisdictions. Please review all applicable card program terms to determine the respective issuing bank responsible for local issuance.