Payroll and benefits. Handled by us. Simplified for you.

Run payroll in 90 seconds

Pay employees accurately, lightning-fast, and on time every pay run, as many times as you need, at no extra cost. No calculator required.

Automatically calculate and pay taxes

Rippling automatically calculates your payroll taxes and files them with the right federal, state, and local agencies at the right time, every time.

Sync benefits with payroll to automate deductions

Rippling’s Benefits Administration is integrated with Payroll, eliminating manual data entry by automatically applying updates like a new marital status changing an employee’s payroll deductions.

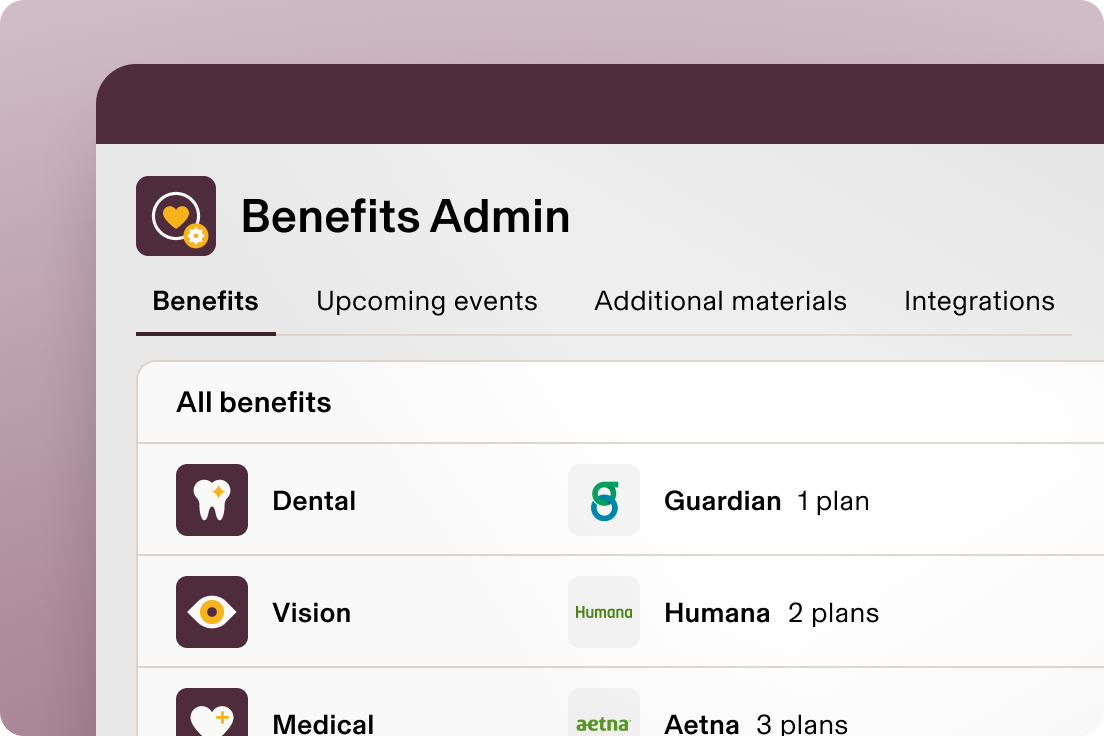

Manage all employee benefits in one place

Rippling brings your entire benefits administration experience — plan selection, broker partners, payroll, and HRIS — into one place, ensuring seamless integrations and automating your benefits busy work.

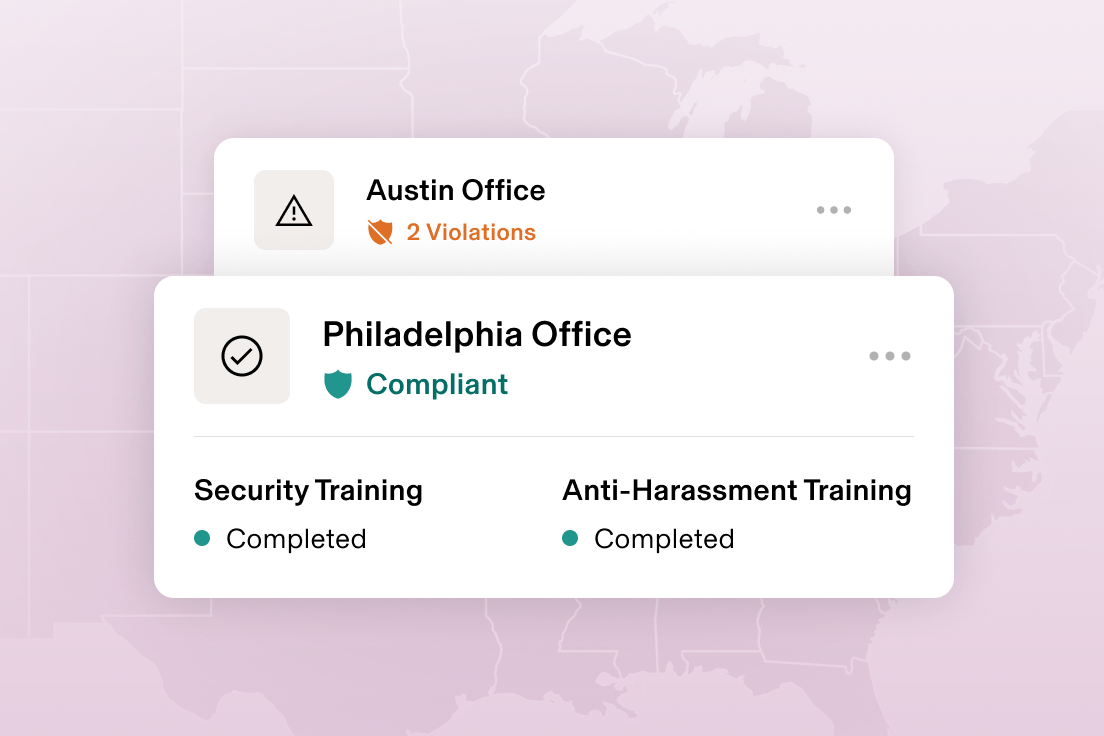

Maintain airtight compliance with always up-to-date policies

Enforce compliance with hundreds of pre-built workflows that monitor and flag violations related to minimum wage, mandatory trainings, overtime, and more, so you can avoid legal risk and financial penalties.