How to compliantly pay contractors around the world

Since the pandemic, millions of workers worldwide left the supervision of a single employer to become their own bosses. Now, the global gig economy is surging, expected to reach more than $455 billion by 2030.

The rise of the freelancer offers new opportunities. Contractors set their own schedules, work from wherever, and take on trial projects with multiple clients in search of their best fit. Companies save on equipment, training, and benefits costs, all while having more staffing flexibility to account for the ebbs and flows of their business needs.

But companies can ruin this arrangement if they don’t pay contractors their hard-earned income quickly, with minimal strings attached. What’s the best way to do this if your workforce is spread across cities, countries, or continents—each with their own pay regulations?

This guide will walk you through paying international contractors quickly and compliantly. Learn how to onboard them, distinguish them from full-time employees, and all your options when it comes to running payroll.

For more information, watch our webinar on how to pay global contractors.

Preparing compliant contractor agreements

Unlike hiring employees, you don’t need to enroll new independent contractors in benefits or deduct taxes on their behalf. But before they start any work, they need to sign a contractor agreement. These legally binding contracts establish the terms of the working relationship and should always include:

- Job responsibilities

- Timeline, with start date and deadline

- Hourly expectations

- Payment structure (whether per project, on retainer, or for time and materials)

- Payment frequency

- Payment currency for international contractors

- Termination policy

Agreements should also outline what happens if a contractor doesn’t fulfill their responsibilities, include non-disclosure agreements to safeguard proprietary information, and set IP protections to determine who owns rights to the produced work.

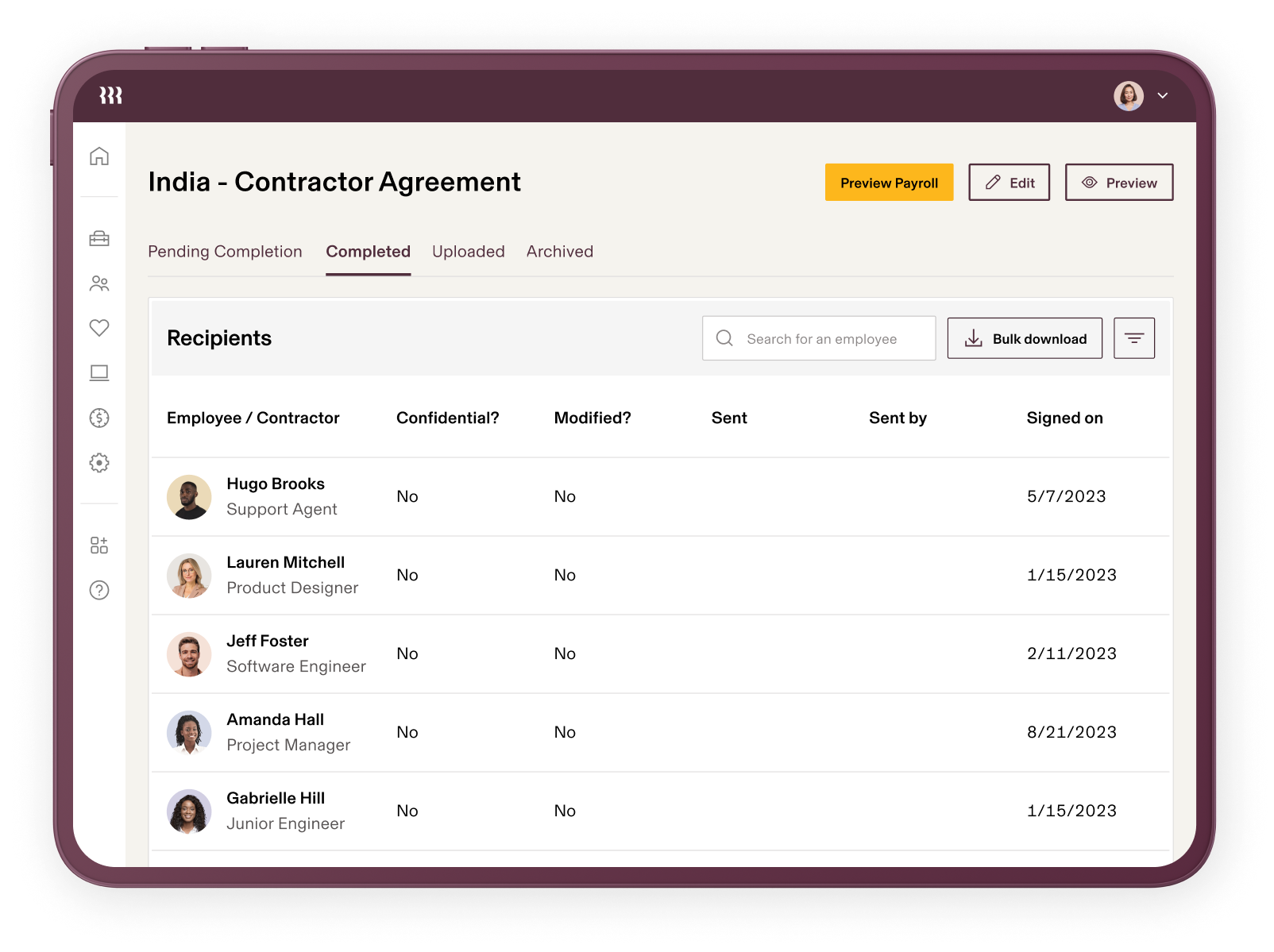

It’s crucial for contractor agreements to comply with local labor laws in the self-employed worker’s jurisdiction. Since employment laws vary between countries, you need to adjust agreements if you’re hiring across multiple regions. Consider tapping local legal experts to tailor contracts to specific countries and avoid any compliance issues. You could also use a contractor management solution like Rippling, which provides pre-vetted contractor templates for more than 50 countries that are both compliant with local regulations and customizable. They’re also safely stored within the Rippling platform and easily accessible for reference, so that companies and independent contractors always know expectations.

The risks of misclassification

While hiring independent contractors can be a boon for your company, it’s vital to ensure they are, in fact, contractors and not employees in disguise. Misclassifying employees can result in steep fines and penalties, owing back pay and retroactive benefits, and civil lawsuits. In the US, for instance, the IRS charges $50 for each W-2 that isn’t paid, as well as unpaid FICA taxes and other penalties, whether the misclassification was accidental or not.

Real-life examples of misclassification’s severe consequences include:

- In 2021, Dutch courts ruled that Uber drivers were employees entitled to backpay and benefits, and hit the company with a €50,000 fine. Then, the US Supreme Court ruled the same, with Uber paying out $8.4 million to settle a class action lawsuit with California drivers.

- In 2015, FedEx paid out $228 million after misclassifying drivers as independent contractors in California. The company was found to have violated state labor laws by not providing drivers with benefits like overtime pay and workers’ compensation insurance.

- In Canada, misclassification suits have been on the rise; damages claimed in recent lawsuits range from $30 million to $200 million.

So, how do you draw the distinction between contractor and employee?

- Contractor: An individual or business that provides goods or services to another entity under terms specified in a contract.

- Employee: An individual hired by an employer to work for a company on a regular basis who is entitled to certain benefits.

While no single factor is determinative, the main factors companies need to consider when delineating employees from contractors are as follows:

Contractor

Employee

Degree of control

The contractor controls key aspects of how they complete their work.

An employee’s day-to-day work is overseen by the company, which can dictate how the work is done.

Permanency of the relationship

The agreement tends to have a defined end date.

The agreement doesn’t have a defined end date (though many countries permit fixed-term employment agreements).

Degree of integration

Doesn’t participate in typical company processes; a true contractor’s work isn’t considered integral to the business.

Does participate in company processes; an employee’s work is considered integral to the business.

Chance of profit and loss

A contractor can realize a profit or incur financial losses from their work.

An employee doesn’t bear an economic risk.

Exclusivity of service

A contractor can freely provide services to multiple organizations.

An employee generally works for their employer exclusively.

Our FREE Worker Classification Analyzer will reveal if you’re risking millions in fines

Take the quizCommon payment methods for international contractors

If you’ve hired (and correctly classified) a global contractor, you need to figure out how to pay them. Here are the standard payment methods, along with some of their upsides and limitations.

International wire transfer

The Society for Worldwide Interbank Financial Telecommunication (SWIFT) is a financial system that relays global payments to a network of 11,000 member banks in 200 countries. A contractor provides their bank account number and bank’s SWIFT code, then companies can send international payments.

While this method is secure and reliable (processing in one to four business days), it also comes with steep, often hidden banking fees, unfavorable exchange rates, and potential service charges for every transfer.

Say, for instance, you pay a contractor in the Philippines. The bank transfer may funnel through three or four intermediary banks, all of whom charge a processing fee. So by the time your contractor actually gets paid, they may find a smaller deposit than they expected.

What’s more, SWIFT fees can be volatile; one transfer may incur several while the other has none. This can nag international contractors who are left playing an irksome guessing game.

International money order

Similar to writing a paper check, this method involves sending a physical payment in the mail to a contractor living abroad. Companies usually have to go to a Western Union, bank, or post office to buy the money order, then contractors have to go to their bank for a deposit once it’s received.

While this can be a useful option to reach global contractors who don’t have any digital payment access, these payments take a while to process and require both payer and payee to commute to a physical location, with the contractor making a second trip to deposit the funds, which are held in escrow until the check clears.

Money orders also come with wire fees, unfavorable exchange rates, and may face weeks-long clearing periods that delay a contractor’s access to the money they’re owed.

Digital payments

Digital payments are money transfer services that allow funds to be sent and received online. Most allow money to transfer near-instantaneously. There won’t be hidden fees, but there will be vendor fees (PayPal, for instance, charges about 4% of the total payment). Contractors also need accounts with the specific digital payment service to receive their funds, and some services don’t operate in certain countries.

Of course, instead of implementing a separate method of paying international contractors, the easier option is to pay them alongside employees—all in a single pay run. Rippling allows you to do just that, all while managing localized tax forms, providing flexible currency options, and offering different withdrawal methods—ensuring your global team gets paid on time without error.

Platforms like Rippling can also help you address fluctuating currency conversion rates across countries where you hire contractors. Many countries require workers to be paid in their native currency, so you should never assume an international contractor will be paid in USD.

But foreign exchange rates are constantly changing, which means the currency in which you pay independent contractors in other countries can end up making a big difference to your cash flow and operating expenses. While it’s difficult to take advantage of currency fluctuations manually, Rippling pays contractors in their local currency automatically. You’ll be able to specify any number of different currencies and pay them all out in the same pay run, plus report on the local amounts or USD-converted amounts.

Watch our webinar for more information on determining which currency to use for paying international contractors.

Pay contractors around the globe in 90 seconds

Rippling is the best solution for quickly paying international contractors—all while managing your entire workforce at every stage of your company’s growth.

Rippling simplifies paying international contractors by:

- Providing country-specific consulting agreement templates and storing for e-signature

- Sending payment in local currency or USD

- Paying all contractors in a single pay run, no matter their location

- Consolidating contractor and employee data in the same global HRIS

- Automatically collecting W-8BEN and W-8BEN-E forms (coming soon)

- Tracking and managing invoices (coming soon)

All this while fully managing employees—administering benefits, monitoring compliance, and running payroll—within the same system. Request a demo today to see how Rippling makes paying international contractors quick and easy.

Rippling and its affiliates do not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any related activities or transactions.