By clicking "See Rippling," you agree to the use of your data in accordance with Rippling's Privacy Notice, including for marketing purposes.

Employer of Record Services

Hire and pay global employees with EOR services

Get started at super speed. Rippling automatically handles the hard parts of international EOR entities and compliance. Bring your global workforce and tools into one human resources and payroll system.

The challenge

Employing internationally can be complex, as it is not always clear what requirements or considerations may be unfamiliar.

The solution

Rippling relieves your stress with expert global HR services

Global employer of record services enable you to hire and pay employees compliantly anywhere. Streamline day-to-day HR, IT, and Finance operations by managing everything your global workforce needs in one place — so you can focus on high-priority initiatives.

Onboard in minutes

Hire and onboard new global employees to maximize productivity on day one. Rippling handles everything from local employment agreements to benefits enrollment to setting up software licenses.

Pay locally in days—not weeks

Pay employees worldwide without delay. Rippling handles calculations and fund transfers on your behalf, allowing you to focus on what matters most.

Automate global compliance

Double-checking compliance risks takes time. Rippling runs securely in the background, continuously flagging potential risks. Rely on a team of worldwide HR experts whenever you have a compliance question.

Unify HR, IT, and Finance

Data entry and duplicate systems reduce efficiency. Each team has a single source of employee data, enabling automation to replace manual tasks.

The payroll experience

Pay around the world 3× faster

Shorten payroll lead times

Rippling offers the fastest payroll lead times—just 5 days to payday in popular markets, and 12 days in less common markets. Other EOR solutions typically take three or more weeks.

Run payroll quickly

Instead of manual uploads, Rippling speeds up pay runs by auto-calculating payroll inputs for you—such as hours worked, expense reimbursements, or time off

Calculate payroll accurately

Rippling provides industry-leading visibility for both employers and employees. You can see that taxes are managed correctly and trust that funds are always directed to the right place.

Compliance & Support

The global partner who doesn’t cut corners

Rippling sets a new industry standard for efficiency and reliability. Every aspect of EOR management and legal compliance is addressed meticulously—without compromise.

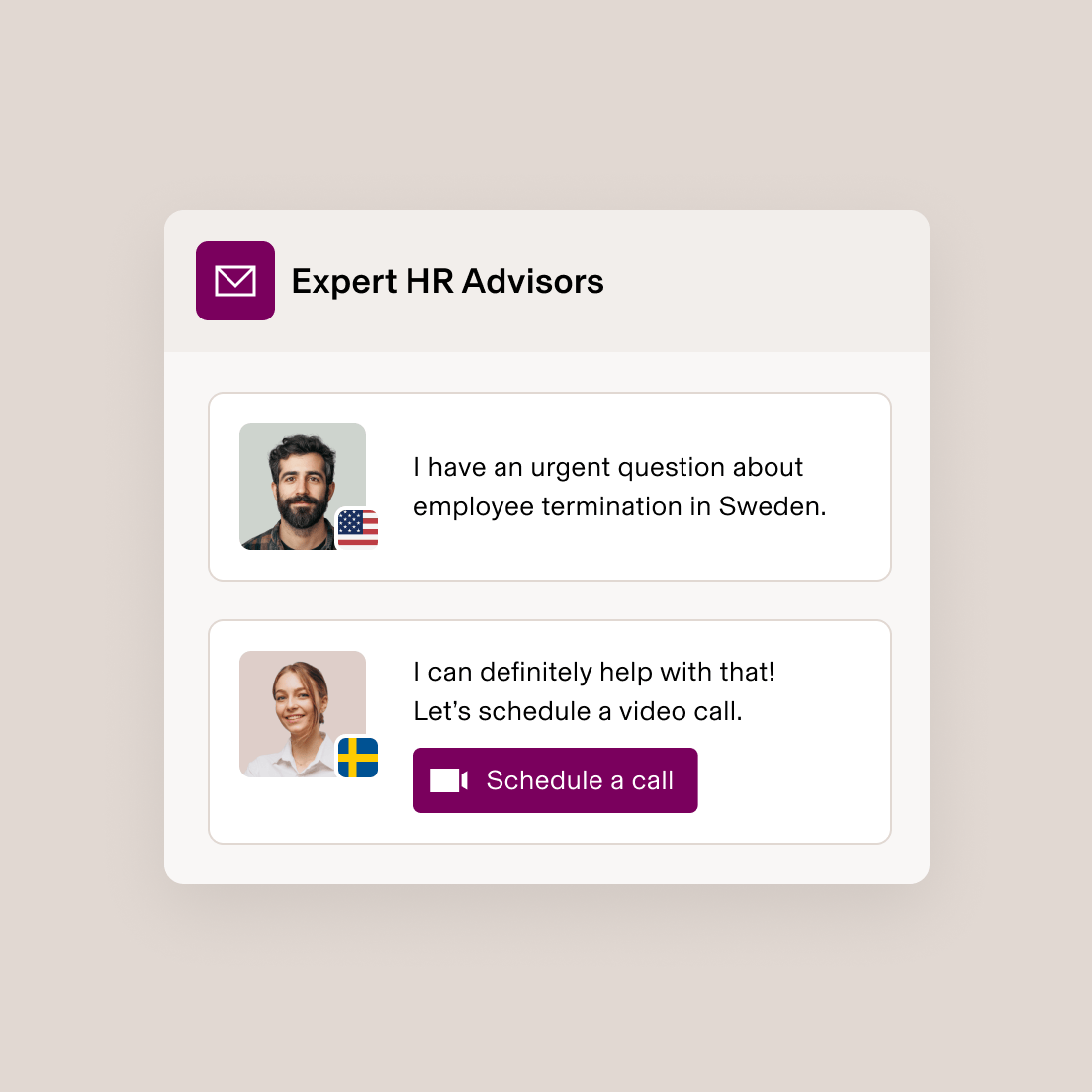

Expert local advisors

Advisors with local expertise and an average of more than 10 years of HR experience provide guidance on your questions. For more complex employee matters, you can speak with specialists who understand local culture and regulatory requirements.

Locally aligned benefits

Attract top talent with quality benefits that fit the requirements and culture of each country. Employees have visibility and control over their benefits packages, while payroll deductions automatically sync, giving you peace of mind.

Continuous compliance

Get compliance right from the outset. From employee agreements to in-product guardrails, Rippling goes beyond baseline requirements to comply with local labour laws and protect employers from legal, reputational, and financial risks.

Support you can count on

When support is needed, Rippling responds in under 30 seconds. Local experts provide timely, high-quality answers.

EOR foundations

An EOR service built to scale

Rippling creates a home base for your global talent, so you can consolidate the people you hire and the tools you use. Use the power of this data with our robust reporting.

Built-in HRIS

We go beyond the basics of document management and time off. Robust permissions, policy management, and customisable workflows mean all organisations can save time on daily HR administration.

Seamless tools for daily work

Reduce complexity and time spent managing clunky integrations by choosing Rippling’s native solutions for LMS, time tracking, and expenses. As your organisation grows, add advanced tools such as performance management.

Robust reporting

Prepare for board meetings and plan ahead for international hiring without manually pulling workforce data. Rippling is the only employer of record solution that provides centralised, granular reporting.

Built different

Learn more about the Rippling platformAnalyse, automate, and orchestrate anything

Most “all-in-one” software consists of acquired systems. These modules are disconnected, resulting in disconnection of business data. Rippling takes a platform-based approach, building products on a single source of truth for all employee-related business data. This rich and flexible data source unlocks a powerful set of capabilities.

650+ integrations with your favorite apps

See Rippling in action

One of our experts can show you how Rippling can effortlessly onboard and manage your global EOR.

FAQs

What's an EOR?

An EOR, or Employer of Record, is a service provider that enables organisations to hire employees in countries where they do not have a local entity. Establishing a local legal entity in a foreign country is time-consuming and costly. If a company is not prepared to make a long-term commitment to building a workforce in a particular country, an EOR provides an excellent alternative to employ internationally compliantly, without the administrative burden of establishing an entity. An EOR employs your international talent on your behalf and is responsible for payroll, remitting local taxes, providing required benefits, and meeting other compliance obligations.

What is an EOR platform?

An EOR platform is a secure online portal where payroll, documentation, and HR compliance for global teams are managed. Processes from employee onboarding — including signing local employment contracts and agreements, payroll processing, and employee benefits administration — to offboarding are managed through an EOR platform.

What is the difference between an EOR and a PEO?

A professional Employer Organisation (PEO) is a co-employer model in the U.S., where the PEO is responsible for specific employer responsibilities, typically payroll, taxes, benefits, and workers’ compensation insurance. An EOR, by contrast, is a global service where the EOR is the sole employer of record; the EOR employs workers on behalf of client companies without requiring them to establish a local entity.Learn more here

How does an EOR work?

An EOR works by legally employing your international employees through its own entity in various jurisdictions. EORs have expert knowledge and familiarity with local employment laws, and can ensure compliance regarding onboarding, payroll, compensation, benefits, severance and termination, and more. The EOR co-signs the employment contract with the employee, and then assigns the employee to your company through a service agreement. Your company remains responsible for the daily management of the employee.

How do you choose the right global employer of record for your business?

To choose the right EOR for your business, it is important to consider several key factors that will ensure smooth and compliant international employment:

- Understand your global expansion goals: Determine which new markets you plan to enter and ensure the EOR has experience in those specific countries. This is crucial for navigating local regulations and legal employer responsibilities.

- Evaluate the EOR's expertise in international employment: The right EOR should have a deep understanding of local laws, tax regulations, and workforce management to prevent issues such as misclassification and non-compliance.

- Consider pricing: Compare pricing across different providers to ensure you are getting a cost-effective rate without compromising service quality.

- Check for robust data security measures: Protecting your employee and company data is vital. Ensure the EOR has strong data security protocols in place to safeguard against breaches.

- Look for comprehensive global payroll and tax compliance services: The EOR should handle complex tasks like tax withholding, social security, and competitive benefits packages seamlessly to avoid legal and financial pitfalls.

- Verify support for in-house teams: The EOR should complement your existing HR infrastructure, offering support and resources that align with your company's goals and culture.

By carefully evaluating these factors, you can select an EOR partner that aligns with your business objectives and supports your international expansion strategy effectively.