Rippling and its affiliates do not provide tax, accounting, or legal advice. This material has been prepared for informational purposes only, and is not intended to provide or be relied on for tax, accounting, or legal advice. You should consult your own tax, accounting, and legal advisors before engaging in any related activities or transactions.

What's new in Rippling — April '25 Release

Managing the end-to-end employee lifecycle is easier than ever with new automations and capabilities from Rippling. Save time filling out candidate information with resume parsing, EOR now supports 80 countries, and survey heat maps help you quickly identify trends. Dig in to all our latest updates and launches below.

Featured

Easily visualize survey results with heat maps

The new heatmap visualization mode in the Surveys app helps you quickly interpret and act on survey results by identifying hot spots, patterns, and trends with easy-to-read color coding. And with results baselined against the overall company performance, you can confidently compare how individual teams and departments stack up.

Platform

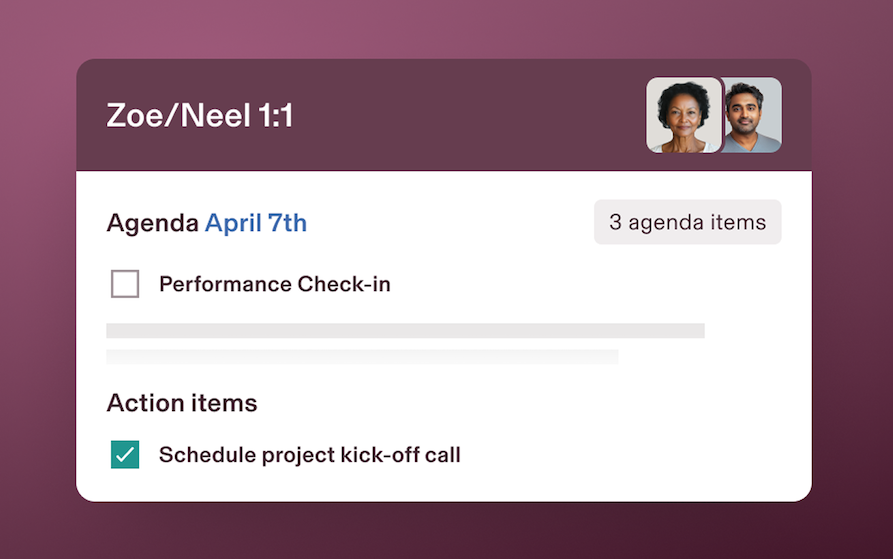

Better understand your Supergroups with membership Check

Supergroups are dynamic membership lists that let you apply policies, access, and more to the right people, automatically. Not sure why an employee is or isn’t included in a Supergroup? Now you can simply click "Can’t find someone?", search their name, and get a clear explanation of their group membership status based on the group’s rules.

Improve your documents with new editing tools

The enhanced editor in the Documents app lets you create polished documents aligned to your company's needs with new tools to add images, improved copy-paste and import functionality, advanced tables, and updated list features.

HCM

Streamline hiring with resume parsing for recruiters and candidates

Rippling Recruiting now automatically populates candidate information when a resume is uploaded by candidates, recruiters, and via referrals. The system parses both English and non-English resumes, saving recruiters and candidates from having to manually enter information.

Stay staffed when it matters most with time off limit periods

New time off limit periods give you greater control over staffing. With customizable rules, you can limit the number of approved time off requests, establish submission deadlines, or block time off entirely during crucial operational periods.

Control visibility of individual leave policies

Remove the confusion of leave policies. Now, you can display leave balance on employee payslips, display leave policies in employees’ Time Off overviews, and choose whether to

allow employees to submit requests for this policy.

IT

Manage all third-party and custom integrations in one place

With our new Third-Party Access app, you can see the connection status of each integration, filter by status, and take action to install, remove, or troubleshoot—all in one place. You can also install new integrations from the App Shop or build your own custom connections using SAML, SCIM, or dashboard links.

Global

Hire and pay employees in 80 countries

With our latest EOR launches, you can now compliantly hire, pay, and manage global employees across 80 countries. This latest update includes Bangladesh, Cambodia, Cameroon, Estonia, Ghana, Italy, Malawi, Mauritius, Mongolia, Rwanda, Senegal, Serbia, Tanzania, Uganda, and Zambia.

Get support for localized HRIS in 91 countries

Rippling automatically provides country-specific fields based on a worker's location, like the country’s tax I.D., address structure, and more. This month, we added localized HRIS support for Bermuda, Cayman Islands, and Ecuador.

Spend

Access three new features for more control over bill pay

We've rolled out three improvements to Bill Pay. Now you can track all vendor comms in a searchable inbox, customize vendor-specific defaults for payment accounts and departments, and edit tax information directly without requiring new W9 uploads.

Speed up monthly close with accounting coding suggestions

The Spend platform now offers tailored code suggestions across transactions, expenses, bills, and accounting grids—intelligently improving over time as you make new categorizations.

See you next month!

Disclaimer

Author

Vanessa Kahkesh

Content Marketing Manager, HR

Vanessa Kahkesh is a content marketer for HR passionate about shaping conversations at the intersection of people, strategy, and workplace culture. At Rippling, she leads the creation of HR-focused content. Vanessa honed her marketing, storytelling, and growth skills through roles in product marketing, community-building, and startup ventures. She worked on the product marketing team at Replit and was the founder of STUDENTpreneurs, a global community platform for student founders. Her multidisciplinary experience — combining narrative, brand, and operations — gives her a unique lens into HR content: she effectively bridges the technical side of HR with the human stories behind them.

Explore more

What's new in Rippling — March '25 Release

See the new product and feature releases from Rippling in March.

What's new in Rippling — January '25 Release

See the new product and feature releases from Rippling in January.

What's new in Rippling — October '25 Release

See the new product and feature releases from Rippling in October.

What's new in Rippling — September '25 Release

See the new product and feature releases from Rippling in September 2025.

What's new in Rippling — November '24 Release

See the new product and feature releases from Rippling in November.

What's new in Rippling — August '24 Release

See the new product and feature releases from Rippling in August.

What's new in Rippling — 2024 Year in Review

Look back at our biggest and best product launches and updates from 2024.

A guide to share codes in 2025: UK Right to Work compliance

Discover how to check share codes correctly in 2025 to stay compliant, avoid fines, and simplify your Right to Work process.

See Rippling in action

Increase savings, automate busy work, and make better decisions by managing HR, IT, and Finance in one place.