Door op 'Rippling bekijken' te klikken, gaat u akkoord met het gebruik van uw gegevens in overeenstemming met de Privacyverklaring van Rippling, inclusief voor marketingdoeleinden.

Deze content is nog niet beschikbaar in the Netherlands.Terug naar startpagina van NL

Global all-in-one

Everything you need to run a global team

Global overview

Hire, pay, and manage people worldwide

Rippling simplifies the complexities of managing a global team—from local compliance and currency conversion, to onboarding, offboarding and everything in between.

Onboard employees and contractors in 90 seconds

Set up new hires with everything they need to be productive—from devices to trainings—no matter where they are.

Pay everyone in their local currency—in minutes

Pay all of your employees and contractors around the world without waiting on transfers or conversion.

Manage HR, IT, and Finance in one unified system

Using multiple systems for your global team? That creates data silos and busy work. Rippling unifies all your systems.

Automate your global compliance work

Understanding and complying with local laws abroad is hard work. Rippling does it for you.

Global onboarding

Onboard new hires anywhere, end to end

Set up employees and contractors across the globe with everything they need—from offer letters to benefits to corporate cards—in just 90 seconds.

Global payroll

185+ countries. 50+ currencies. 90 seconds to run payroll.

Pay everyone in their local currency

Seamlessly pay workers around the world without waiting for any bank transfers or conversion.

Automatically file taxes globally

Rippling instantly calculates and files payroll taxes for your employees worldwide.

Sync all your HR data with payroll

Sync hours, time off, deductions, and more with payroll from a single global system.

Use one GL integration for global spend

Save hours of reconciliation work each month with payroll and expense data that's automatically categorized and synced to your general ledger.

Securely offload payroll tasks

Precisely define which roles have access to payroll data and admin privileges—from approving hours worked to hitting “Run.”

Automate nearly any payroll process

Easily build custom workflows to notify people of important changes and automate administrative tasks—like triggering a reminder to pay a bonus.

Customer-first global payroll

Rippling isn’t a third-party payroll aggregator. We built our software from the ground up to give you error-free, delay-free, and limitless payroll in one easy-to-use solution.

Run payroll days before payday—not weeks

Do away with manual data entry

Make self-serve payroll adjustments

Process off-cycle pay runs

Pay every kind of employee in one payroll system

Change your initial pay schedule

See exact breakdowns of taxes, deductions, and more on pay stubs

Internationaal HRIS (HR-informatiesysteem)

Meer informatie over Rippling voor internationale teamsEén HR-systeem voor uw team Overal

Met Rippling kunt u eindelijk alle medewerkersgegevens van over de hele wereld in één systeem samenbrengen. In Rippling wordt alles dynamisch gelokaliseerd op basis van de werklocatie, zoals velden, documenten en valuta's.

Support your global workforce straight out of the box

No messy integrations. No siloed systems. With Rippling, you get all the tools and platform capabilities you need to support a global team.

Manage domestic and international teams in a single system

Build unified reports using both your domestic and international HR data

View your entire workforce in a single org chart

Customize policies by country

Manage your employee’s time & attendance in the same system

Manage all of your employee expenses, corporate cards, and bills in the same system

Remotely manage your IT—like devices and apps—in the same system

Automatically assign and manage country-specific compliance trainings

Ervaring van internationale medewerkers

Uw beleidsregels, secundaire arbeidsvoorwaarden en bedrijfscultuur aan elk land aanpassen

Rippling biedt u de tools om uw internationale personeel een ervaring te bieden die zo gestandaardiseerd (of gelokaliseerd) is als u wilt.

Apply Globally | Medewerkers in India | Medewerkers in de VS | Medewerkers in het VK | Medewerkers in Australië | Medewerkers in Frankrijk | Medewerkers in Duitsland | Medewerkers in Canada | |

|---|---|---|---|---|---|---|---|---|

Create a custom holiday calendar for every country | Diwali, Oct 24 Paid Holiday | Thanksgiving, Nov 23 Paid Holiday | Boxing Day, Dec 26 Paid Holiday | Anzac Day, Apr 25 Paid Holiday | Bastille Day, Jul 14 Paid Holiday | German Unity Day, Oct 3 Paid Holiday | Canada Day, Jul 1 Paid Holiday | |

Design worldwide and country-specific policies | PTO Policy 15d + 1d per year of tenure | PTO Policy 15d + 1d per year of tenure | PTO Policy 15d + 1d per year of tenure | PTO Policy 15d + 1d per year of tenure | Waarschuwing - niet-conform beleid | PTO Policy 15d + 1d per year of tenure | PTO Policy 15d + 1d per year of tenure | |

Offer rich and affordable benefits in every country | Meal Coupon ₹26,400 / year | 401(k) Match 3% | Pension Contribution 3% | Superannuation 11% | Meal Voucher €25 EUR / day | Pension Plan 9.35% | RRSP 2% | |

Offer equity to everyone, everywhere | Option Grants 40,000 | Option Grants 40,000 | Option Grants 40,000 | Option Grants 40,000 | Option Grants 40,000 | Option Grants 40,000 | Option Grants 40,000 |

Global compliance automation

Effortless compliance at home and abroad

Guidance when you need it. Automation when you don’t. Rippling makes compliance a breeze by automatically flagging risks as they pop up.

Global minimum wage enforcement

Global overtime enforcement

Global leave enforcement

Global compliance training

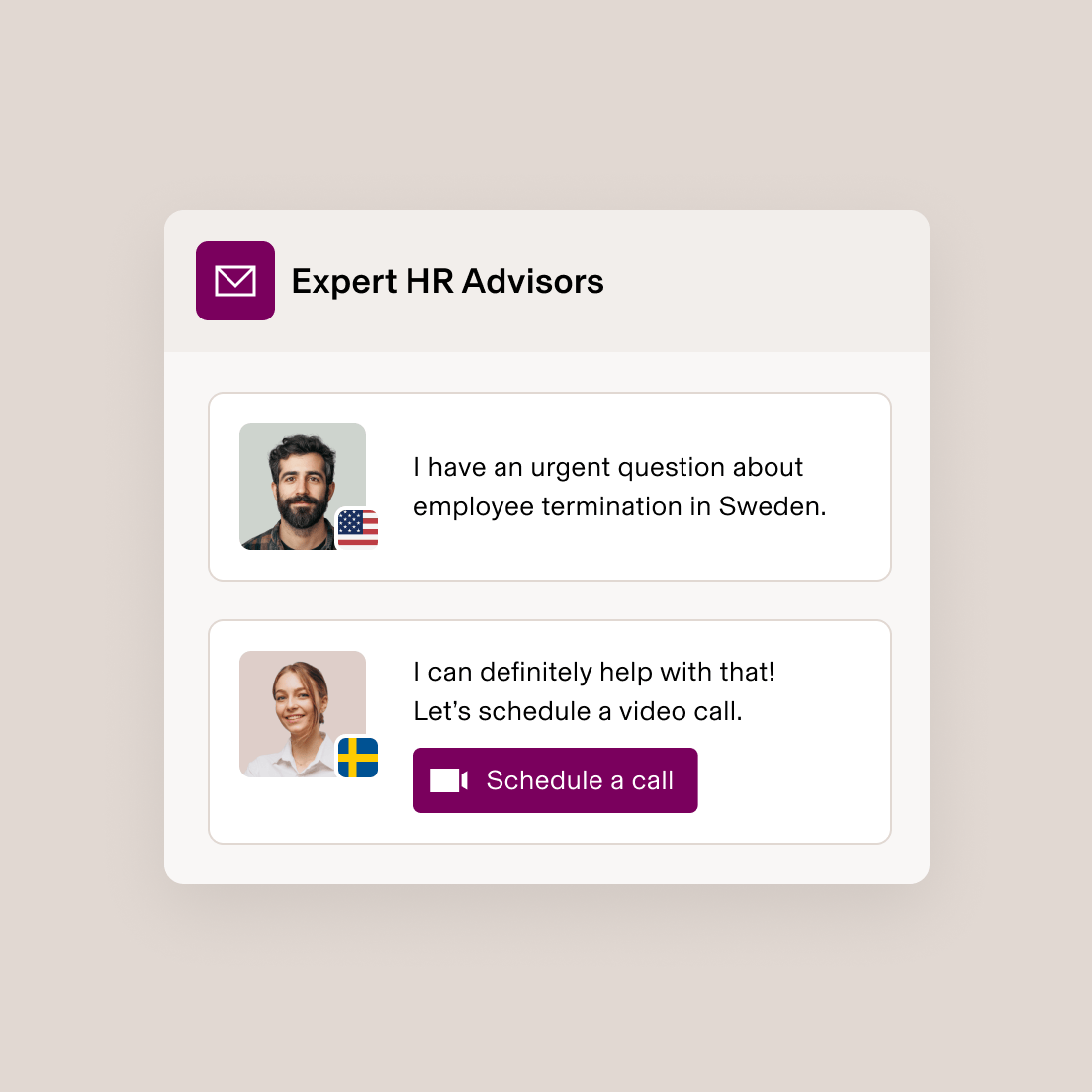

Vertrouw op nalevingsexperts voor elk land

Hulp nodig bij gevoelige arbeidskwesties of landspecifieke wetgeving? Neem contact op met onze HR-adviseurs, die tientallen jaren ervaring hebben in de betreffende rechtsgebieden.

Global workforce reporting

Report on all your employee data across the world in one place

Global all-in-one

Everything you need to run HR, IT, and Spend globally

Global payroll at scale

Go global without the headache

Rippling can help you address every stage of your international growth, no matter how you employ or where you operate.

Global contractor payments

Hire and pay contractors globally. No entity required.

Global Employer of Record (EOR) services

Hire and pay employees globally. No entity required.

Global Payroll via your entities

Run payroll for employees globally via your own entities.

FAQs

What is global payroll?

Global payroll is a system that allows companies to manage all their employees' payroll, including global employees, on a single platform. It enables the management of employees in multiple countries, handling various aspects such as tax calculations, tax filing, and payment infrastructure.

What is EOR?

An Employer of Record (EOR) is an organization that legally employs and pays global employees on behalf of their clients. Businesses often choose to use an EOR to employ talent internationally to avoid setting up local entities, which can be complex, expensive, and time-consuming. EORs take on the liability of employing international employees, ensuring compliance with local employment laws, and can help with tasks like paying salaries and taxes, immigration, protecting IP, and more

How do I pay international contractors?

You can use Rippling to pay international contractors. Rippling will automatically create invoices for fixed-rate contractors or hourly contractors who track time in Rippling. Otherwise, contractors can submit their own invoices based on project milestones or externally tracked time. Approved invoices will automatically sync to payroll to pay contractors in 185+ countries and 50+ currencies.

How is this different from international PEO?

An EOR (Employer of Record) is another word for an international PEO. Rippling offers a US PEO for US employers employing in the US and EOR services to employers who wish to employ in countries they don’t have an entity in.

What is the difference between global payroll and local payroll?

Global payroll is a single system that allows you to seamlessly pay employees no matter what country they operate in. While local payroll requires a different system for every country you employ people—creating management problems, a disconnected employee experience, and zero unified reporting.

Why do you need a global payroll provider?

A global payroll provider is necessary to ensure accurate tax calculations, employee payments, and annual deduction limits. It helps in managing all employees' payroll, including global employees, on a single platform. The provider also supports the entire life cycle of a company through every stage of growth, managing various use cases from having contractors and employees in different countries to entities in multiple countries.

How do I offer benefits to my international employees?

Rippling EOR includes locally competitive and compliant benefits coverage for your international employees. If your company already has their own international entities, Rippling Global Benefits allows you to manage enrollments that seamlessly sync with onboarding, terminations, and payroll.

Is global HRIS included?

The Global HRIS is included in Rippling's platform. It is designed to house global employees from an HR and IT perspective, providing a unified system for employees across different countries. The platform offers localization features, including localized data, onboarding flows, holiday calendars, minimum wage rules, working time rules, break policies, and vacation and sick leave. Additionally, it provides default global policies for compliance, such as time off policies, work hour policies, weekend policies, holiday policies, overtime policies, and break policies. Every Rippling customer uses Rippling HRIS to unify their global team on a single employee graph.

Does Rippling offer international payroll?

Yes, Rippling offers international payroll. Our Global Payroll product covers all aspects of international payroll and is full of robust products and automations designed to simplify the payroll experience for both your organization and your employees.

Zie Rippling in actie

Meer kosten besparen, routinetaken automatiseren en betere beslissingen nemen door HR, IT en Financiën centraal te beheren.