By clicking “Talk to an adviser”, you agree to the use of your data in accordance with Rippling's Privacy Notice, including for marketing purposes.

Global Hiring

When should global contractors become employees?

27% of HR professionals have misclassified a global hire, resulting in costly risk. Rippling can help you expertly navigate workforce transitions and manage global contractors and employees.

Contractors

Contractors provide an easy start to global hiring

Contractors save you money

When you hire contractors, you’re not responsible for payroll taxes, benefits, or paid time off which keeps costs down.

Getting started is fast

Contractors can sign and complete KYC verification, enter payroll details, and get a company email address — all in one flow.

Admin is easier

Currency flexibility and no obligation to provide local tax and benefits doesn’t just save money. It saves you day-to-day admin.

Future-Risk management

When should you convert a contractor to an employee?

You should regularly assess whether to convert individuals classified as contractors to employees in order to mitigate costly risks that can hinder your organisation's next stage of growth.

Fundraising preparation

71% of HR professionals believe that VCs are less likely to invest in a startup that has faced compliance issues. You'll need to constantly reassess your compliance practices to be ready for your next round or M&A.

Misclassification risk

If you're not careful, a terminated worker — even if they chose to be a contractor — may pursue legal action on the grounds of misclassification. Being proactive about risk protects you in the event of a future dispute.

IP protection

Protect your intellectual property with an employer-employee structure, which maintains stricter and more enforceable policies than contractor IP agreements.

Hiring considerations

As you scale your global workforce, you’ll need to offer a competitive benefits package and compliant employment model or immigration support to win top candidates.

Assessment

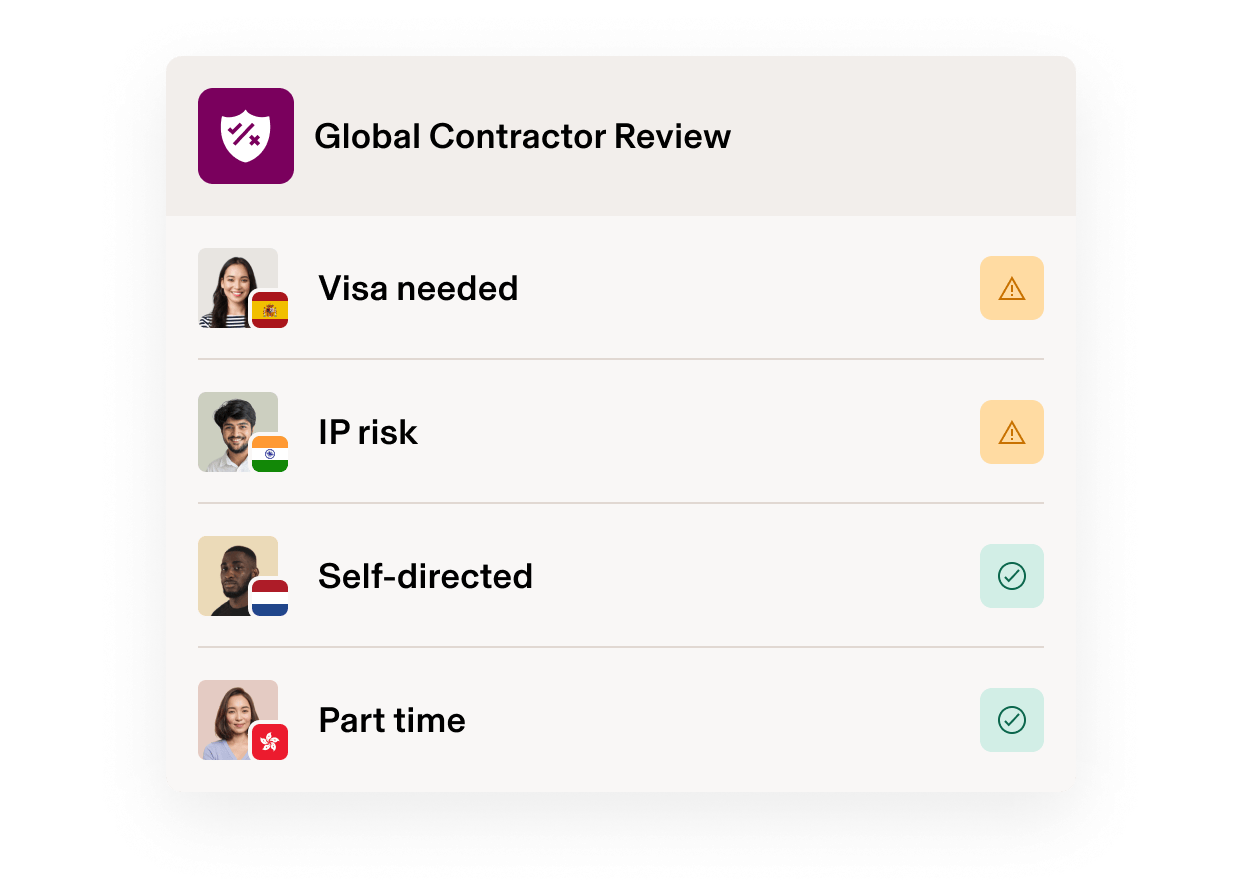

Conduct a case-by-case evaluation

You can determine if you should convert any of your contractors by understanding your risk and considering which employment model makes the most sense.

Contractor to employee

Rippling makes the transition seamless

Make the change in minutes

Converting a contractor to an employee is easily done in a simple transition flow, and compliance is automatic.

Keep your employee history

An all-in-one solution maintains comprehensive data for each worker regardless of their status.

Everything is in one place

There’s one org chart, one place for reporting, and one set of policies for all.

Employer of Record

An EOR is the easiest way to employ internationally

Rippling lets you easily hire, pay and provide benefits to employees in markets where you don’t have an entity. Manage everything from one platform that scales with you as you grow.

Fast and easy hiring

Rippling’s onboarding flow handles everything from offer letter and benefits enrolment to assigning required training courses, so your employees can start immediately.

Compliant payroll

Not only do you get the fastest, most accurate payroll, Rippling calculates taxes and manages lodgings for you.

Attractive benefits

Attract top talent with high-quality local benefits from in-country providers. Rippling provides all legally required plans so you know you’re in compliance.

Global contractor management

Keeping contractors is convenient, too

Rippling makes it easy to hire on demand, with everything you need to quickly and compliantly hire, pay, and manage global contractors.

Locally compliant contracts

Access our library of dozens of local contractor agreements, reviewed by in-country legal counsel.

Pay in 185+ countries

Rippling provides easy, transparent invoicing and ultra- fast payment processing, including cross-border payments and currency conversions in 50+ currencies.

Simple administration

Pay-runs are synced with invoices, policies and approvals are automated, and contractors are managed from the same place as the rest of your workforce.

Rippling is here to help

Our experts can show you how Rippling can effortlessly onboard and manage your global workforce.

FAQs

What is EOR?

An Employer of Record (EOR) is an organisation that legally employs and pays global employees on behalf of their clients. Businesses often choose to use an EOR to employ talent internationally to avoid setting up local entities, which can be complex, expensive and time-consuming. EORs take on the liability of employing international employees, ensuring compliance with local employment laws, and can help with tasks like paying salaries and taxes, immigration, protecting IP, and more

What is an independent contractor?

An independent contractor provides services under a contract without being employed by the client. Unlike employees, contractors handle their own taxes and benefits, and they usually work on a project or term basis.

When should you convert a contractor to an employee?

You should consider converting a contractor to an employee when you need a long-term role filled, require regular work hours, or need to have direct control over how the work is performed. Converting also helps in aligning with legal compliance and reducing misclassification risks.

Why should employers convert contractors to employees?

Converting contractors to employees can enhance compliance with labour laws, provide greater control over work processes, and foster team cohesion by integrating workers fully into your organisation's culture and benefits system.

How to convert your contractor to an employee?

When converting a contractor to an employee, begin by assessing the need for a permanent role and ensuring compliance with local labour laws. Next, draft a formal employment offer, restructure their payment to a salary basis, enrol them in your HR systems and update their tax, benefits and compliance statuses.

Can every company convert contractors to employees?

Not all companies will find converting contractors to employees straightforward due to various legal and operational constraints. It depends on the business structure, the nature of the work, the contractor's consent, and compliance with both local and international employment laws.