We value your privacy. Learn more.

This content isn’t available in Italy yet.Back to IT home

Rippling expense management

Automate expenses with complete control

Hyper-custom policies

Effortlessly block out-of-policy expenses

The world’s most advanced spend policy engine

Only Rippling's expense management software can support expense policies based on all your employee data. Build hyper-custom policies in minutes and spend less time manually reviewing expenses.

Automate the most tedious parts of expense management

Simplify approval chains with role-based rules

Automate your approvals with granular rules using employee data like role, department, and level, or transaction data like specific vendor, transaction category, and amount.

Keep costs in check with automated workflows

Instead of reviewing weeks-old charges at month end, build automated workflows that monitor company spend in real time and trigger actions, like sending alerts when team spending suddenly increases.

Give every team instant visibility into their spend

Rippling lets you control who can see which data based on their role. That means everyone automatically has the power to run in-depth reports on their own slice of spend—and no one else’s.

Global expense management

Reimburse employees globally in their local currency—in minutes

- Reimburse people in 100+ countries

Rippling offers the fastest way to handle expense reimbursement for employees and contractors, wherever they are in the world.

- Issue payments in any currency

When you reimburse employees through Rippling Payroll, you can pay them in their local currency, and report on it in yours.

- Collect receipts in any language

When an employee submits a receipt, Rippling translates its line items and convert its currencies for the reviewer.

Cross-currency reconciliation

Review expenses in your currency. Reimburse employees in theirs.

It’s painful to reconcile foreign expenses, especially with business travel. Rippling converts expenses into each user’s local currency.

Integrated payroll

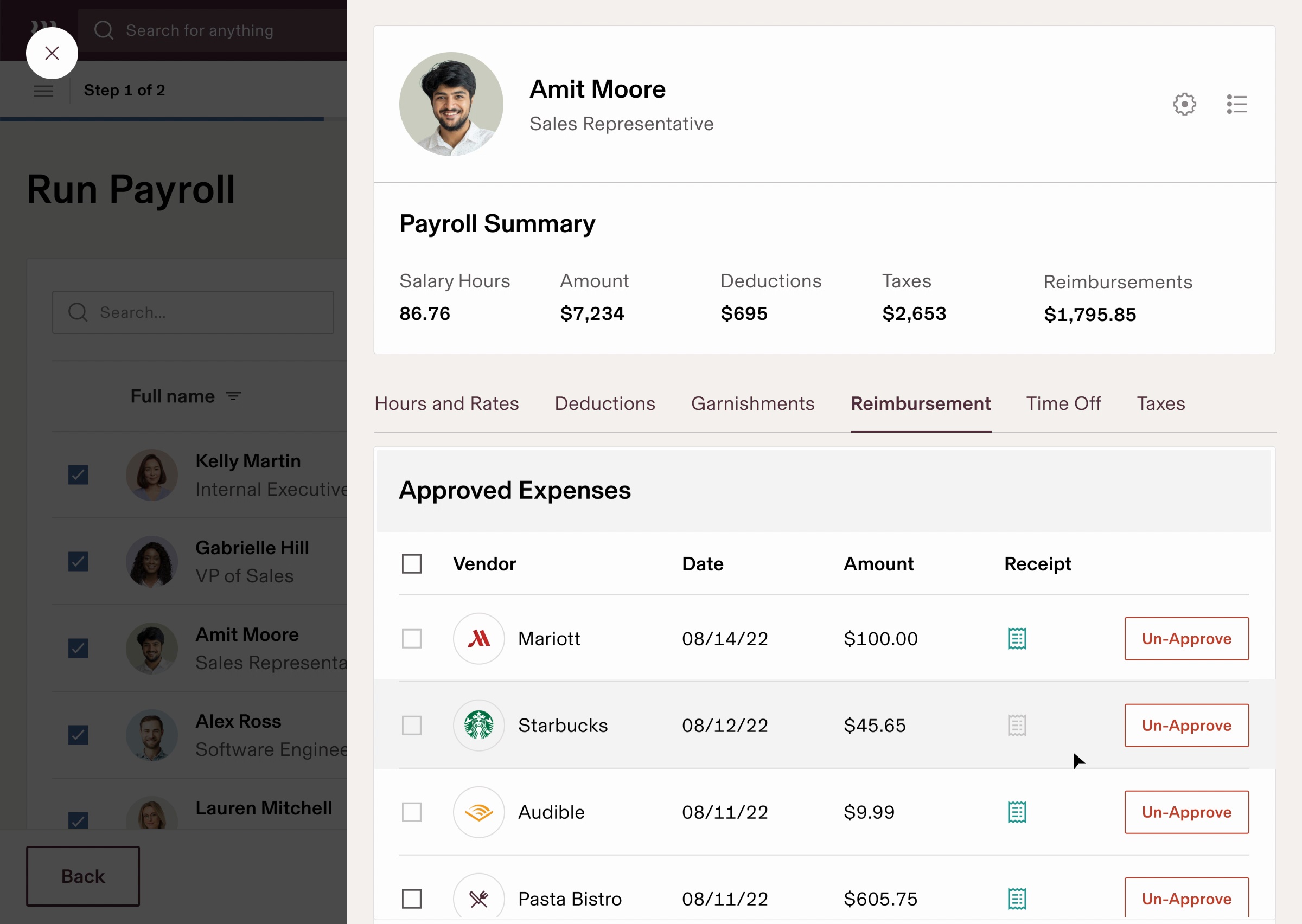

Answer reimbursement questions right inside payroll

With Rippling, you don’t need to switch between siloed payroll and third-party systems to answer questions like, “Why are we reimbursing this person $500?”

Admin experience

Let Rippling take care of the reconciliation work

Dedupe expenses automatically

Rippling instantly catches duplicate expenses, warns the submitter, and then flags it for review if they still choose to submit.

Catch receipt mismatches instantly

Rippling flags mismatches between the transactions employees enter and the receipts they upload—even in different currencies.

Employee experience

Make it easy for employees to manage their expenses

Forward receipts via email

Employees can match digital email receipts with their expenses simply by forwarding them to Rippling.

One app for pay stubs and expenses

Rippling has the only mobile app where employees can view their pay stubs and expenses in one place.

Modern expense management software

Close the books in days, not weeks

General ledger sync

Sync expenses to your general ledger and automatically categorize each expense’s fields, saving your finance team painstaking hours of work.

Easily audit expenses

All spend in Rippling has an audit trail, making it easy to quickly view who changed which expenses.

Start threads on expenses

Every expense can be commented on directly, so approvers and admins can quickly resolve ambiguous spend.

Manage expenses on the go

With Rippling’s mobile app, it's easy to manage employee expenses, even when you're away from your computer.

Diverso dalle fondamenta

Analizza, automatizza e orchestra tutto quello che vuoi

La maggior parte del software "all-in-one" è costituito da sistemi acquisiti. Questi moduli sono scollegati tra loro, quindi lo sono anche i tuoi dati. Rippling applica il concetto di piattaforma, creando prodotti basati su un'unica fonte di informazioni per tutti i dati aziendali correlati ai dipendenti, una fonte di dati ricca e flessibile che rende disponibile una serie di funzionalità avanzate.

650+ integrations with your favorite apps

Get started today with Rippling Spend

Rippling is a single platform that can help your business manage all of its employee data and operations, no matter its size.

Domande frequenti

How does expense management software work?

Expense management software streamlines the entire process of handling business expenses. Typically, employees submit expense reports digitally, and the software facilitates expense tracking by organizing and categorizing expenses. Expenses are then routed for approval based on pre-defined company policies and workflows, which can be configured with rules based on various factors like department, expense type, or amount. Many systems also include corporate card transactions. Finally, the software facilitates the employee reimbursement process by sending through payments to the employee.

The goal of this software is to make the expense process more efficient, reduce errors and the hassle associated with manual data entry, improve spend controls, and provide better real-time visibility into expense data for the finance team.

What features should I look for in expense management software?

When deciding what expense management system to use, look for features that address your specific business needs—whether that’s seamless receipt capture, customizable workflows to approve expenses, or the ability to set and enforce expense policies. Integration with your existing systems, such as accounting software like QuickBooks or Netsuite, is crucial for efficient reconciliation. Strong reporting features that provide insights into employee spending are also essential. Finally, consider an expense management solution with a user-friendly interface that makes it easy for both employees and administrators to manage expense reports and the overall process.

Can I manage corporate cards within expense management software?

Yes—many expense management solutions, including Rippling, offer the ability to manage corporate credit cards. This feature can give administrators enhanced spend controls through spending limits that monitor card transactions in real time. Integrating corporate cards within the expense management system can also simplify reconciliation and provide a comprehensive view of business expenses in one place. You can often set company policies that specifically apply to corporate card usage, ensuring better policy compliance.

Who is Rippling’s expense management software for?

Rippling’s expense management platform is designed for businesses of all sizes, from small businesses to larger enterprises. Rippling enables any company that wants to streamline its expense management process, enforce company policies effectively, and gain better visibility into their expense data. Whether you're a startup looking to implement initial spend controls or an established organization seeking to optimize your existing approval process, Rippling’s provides a comprehensive and intuitive solution.

How does Rippling's expense management software differ from competitors?

Unlike traditional expense management tools, Rippling's solution is built on a unified platform that connects expense data with HR, IT, and Finance systems. This integration enables unique capabilities like role-based permissions that automatically update as employees join, move within, or leave your organization. Additionally, Rippling's policy engine can leverage any employee attribute to create highly specific expense rules that would be impossible in standalone systems.