I’ve worked with enough expense tools to know that a lot of them talk a big game when it comes to time and money saved, yet somehow you’re still left toggling through tabs and cells and fields when it's time to actually close the books and reimburse employees. Rippling takes a bigger swing — aiming to connect expense management with payroll, HR, and accounting in a single platform — so I spent time testing how it actually performs against similar tools.

In this review, I’ll share my honest thoughts on how Rippling stacks up, from setup and implementation to pricing to workflows.

10/10 Verdict

Rippling’s expense management software pulls expenses, reimbursements, and corporate cards into one place for a truly unified spend management system. And because every transaction ties back to an employee record in Rippling, you get deep visibility on how much, where, and why teams spend.

With that visibility comes powerful expense management automation that does everything from routing claims for approval to applying policy rules to reimbursing. By the time something langs in your queue most of the matching, flagging, and coding work has already happened.

Beyond the administrative benefits — fewer spreadsheets, email chasers, and weekends lost to reconciliations — you benefit from an unprecedented level of insight around spend, including whether it’s actually moving the needle. (One report found that 17% of finance leaders have no clear view on the connection between employee expenses and ROI.)

If your finance team holds responsibility for distributed teams or multiple departments, I’d recommend Rippling in a heartbeat. The amount of time saved by reconciling card spend and processing reimbursements under the same umbrella alone justifies a switch from separate expense, payroll, and card solutions. Likewise, as one of the few tools capable of handling local-currency reimbursements while letting you report in your own, it’s the best option for organizations paying staff across borders.

Rippling Expense Management Key Features

In addition to table-stakes stuff like AI-driven receipt analysis and automated expense categorization, Rippling offers some distinctive features that set the platform apart from comparable spend and expense solutions.

The functions below allow Rippling to connect expense management to your broader finance workflow, which means you have more context, but less manual work.

Create custom policies using any combination of employee attributes to automatically flag non-compliant spend

Reimburse team members in over 185 countries

Issue payments in any currency while reviewing and reporting on transactions in yours

Address reimbursement questions inside payroll — no more switching between siloed systems

Automatically remind employees to complete their expense reports, add receipts, or update memos

Instantly translate receipts and convert transaction amounts from foreign currencies

Flag mismatches between transactions and receipts, even when dealing with foreign currency

Flag duplicate expenses, warn the submitter, and earmark for review

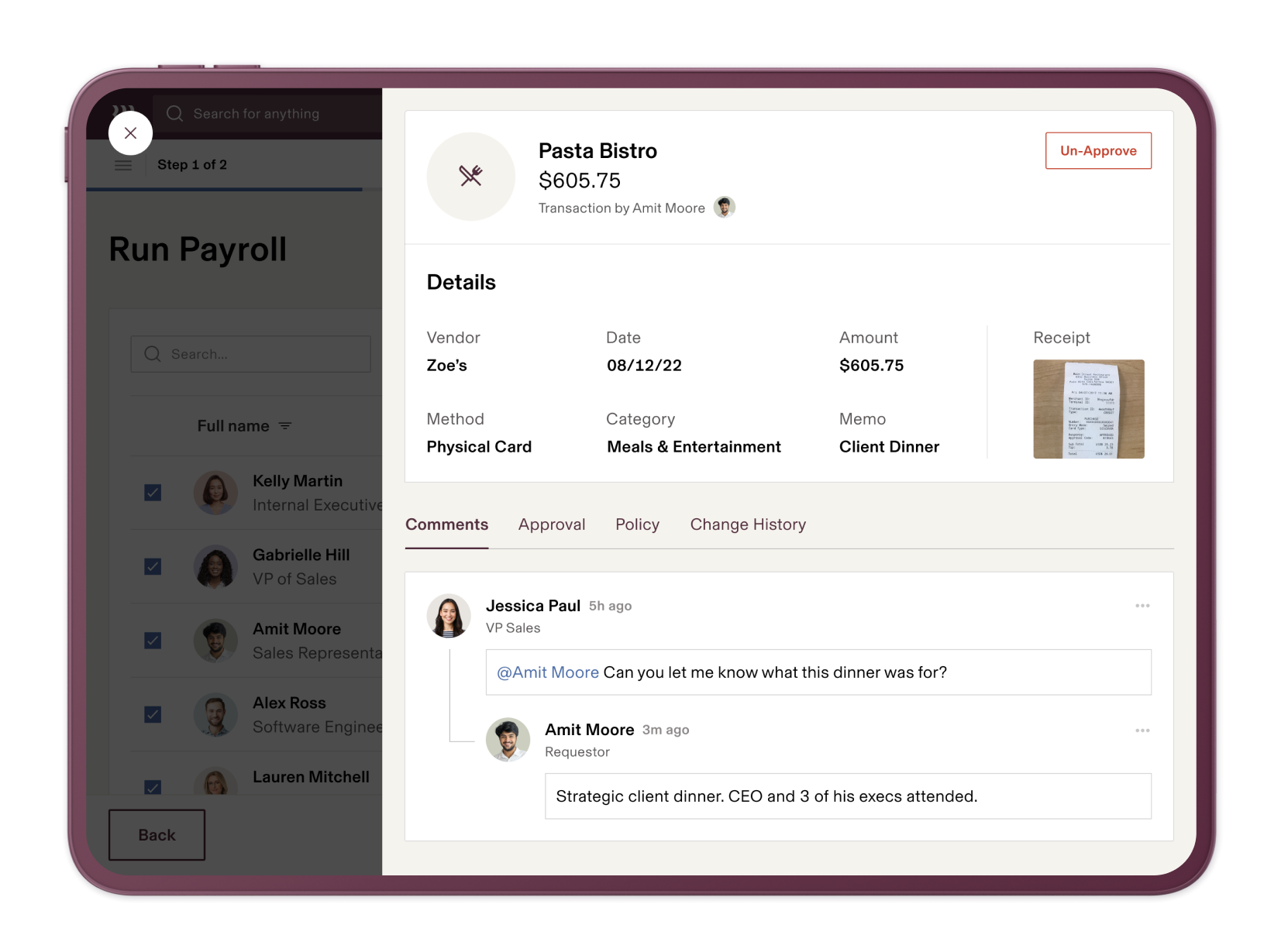

Comment directly on ambiguous requests so approvers and admins can resolve issues efficiently

|

Employees can upload and match receipts directly from the mobile app | Fewer export customization options than some standalone tools |

Automatically flags duplicates and out-of-policy expenses | No 24/7 phone support, though live chat support with screen sharing is available |

Deeply customizable reporting at the individual field level, including custom fields, formula fields, and pivot tables. | |

In-line comments for fast resolution and clear audit trails | |

Reimburse employees and contractors in 185+ countries | |

Pays in local currency with reporting in your own | |

Rippling expense management pricing

Rippling uses a modular pricing model, which I like because it means you only pay for what you actually need. That’s a big difference from other popular spend tools like Ramp and Brex, which use tiered pricing and fixed feature bundles that can lead to paying for bells and whistles that don’t add value. That said, the customization can make it tricky to understand what you’re getting without a sales demo, so I’ll break it down.

|

Pricing | $14 PEPM | $35 per month + $14 PEPM | $35 per month + $14 PEPM +$8 PEPM | $35 per month + $14 PEPM +$8 PEPM + $8 PEPM |

Total PEPM | $14 | $49 | $57 | $65 |

With Rippling, you’ll pay $14 per employee per month for expense management, but I actually recommend adding the core Human Resources Information System (HRIS) platform for a flat $35 per month. Technically, you can skip this, but running Rippling Expense Management on top of the Rippling HRIS layer means you can build policies and approval chains on a foundation of employee data points like role, manager, or department, so your spend control happens automatically.

Likewise, running Rippling Expense Management with Rippling Payroll lets you create a truly seamless workflow where reimbursements flow straight from approval into employee paychecks without you having to do… anything. Add in Rippling Corporate Cards for $8 PEPM and now you’re cooking with gas. All your spend gets logged in real-time and you stop employees from making unauthorized purchases before they even have the plastic in their hands.

That’s a lot of functionality for a comparatively low price point. To get the same bang for your buck with similar tools generally means starting out at the Enterprise level. That’s bad news if you’re a startup or mid-sized business looking to scale. Likewise, your overall total cost of ownership at the tech stack level is almost certain to surpass what you pay for Rippling, since you’re looking at multiple tools to handle HRIS, spend, payroll, and other core HR and Finance functions, each with its own subscription.

But even if you’re just looking for pure expense management, Rippling delivers enterprise-level control without enterprise pricing.

|

Rippling | $14 PEPM | Unified expense tracking, reimbursements, policy controls, and accounting sync tied to live HR and payroll data |

Expensify | $5 PEPM | A lightweight receipt tracker and approval flow; no real-time enforcement or connection to payroll data |

Ramp | $15 PEPM + platform fee that increases with team size | Card-first controls but limited visibility with reimbursements and depends on third parties for HR & payroll functionality; better on spend limits than on visibility |

Brex | $12 PEPM + custom fee for corporate cards | Card-based spend management with analytics, but dependent on third-party systems for reimbursements, payroll, and employee data |

Paylocity (via Airbase) | Upon request | Expense management add-on to an HR suite; functional, but lacks automation and cross-system visibility |

Ease of Rippling expense management use and interface

I looked at Rippling Expense Management from both the employee and the admin side, and it’s a refreshingly clean and straightforward experience compared to heavier financial tools that can bury even simple actions under layers of configurations.

For employees

Rippling Expense Management will feel familiar to anyone who’s ever filed an expense report, minus a lot of the tedium. To submit an expense, employees upload a receipt or a photo, add a short memo, and choose a category. That’s it. Then Rippling’s AI takes over, extracting vendor, date, and amount and matching the transaction. If something looks off, the system will flag it for automatic review.

Complete claims flow automatically to the correct approvers based on your pre-built rules, and employees who need nudges to add receipts or other supporting docs receive them right where they work via Slack or email, so nothing falls through the cracks.

For administrators

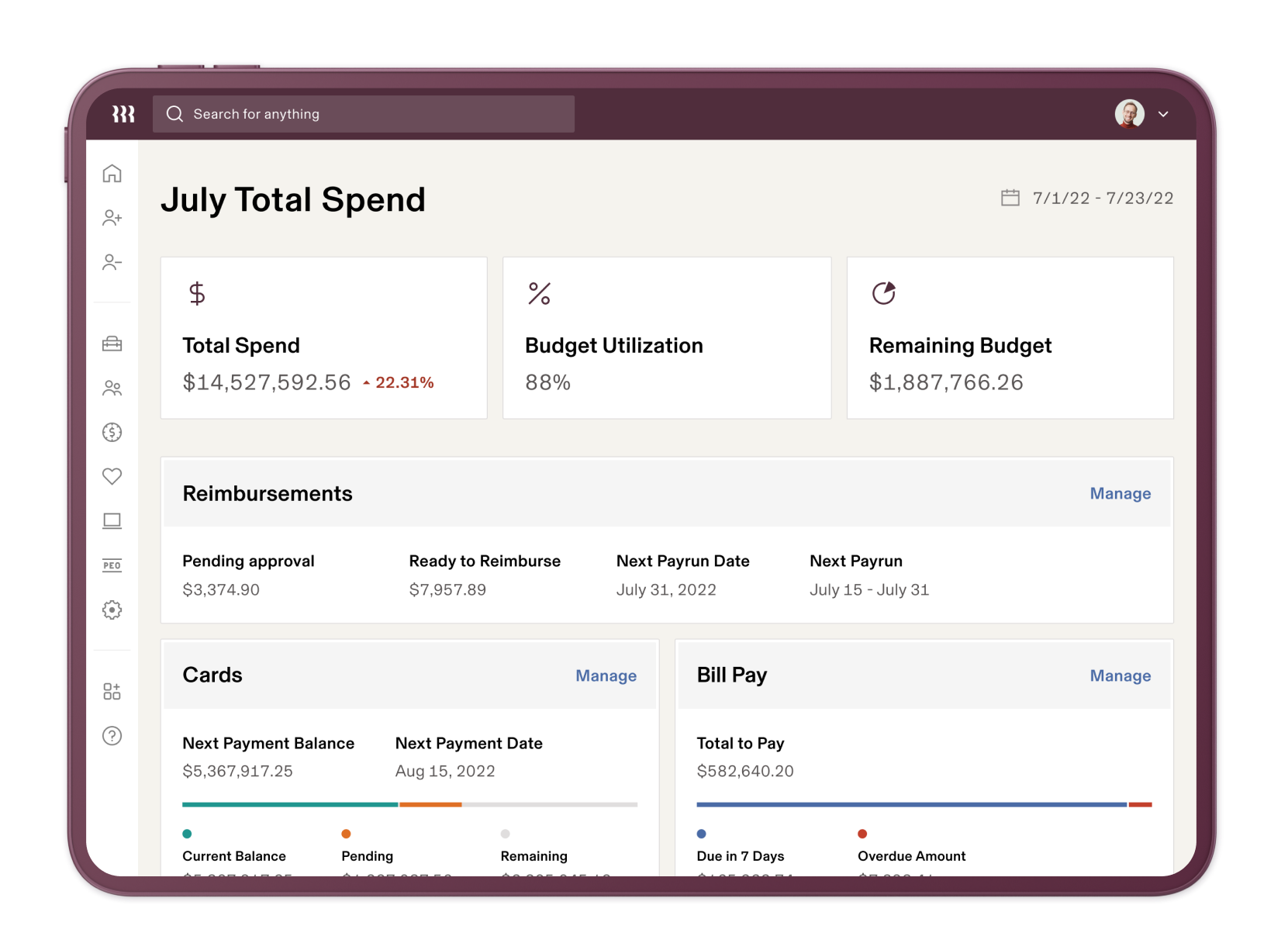

The admin dashboard likewise removes a lot of the friction that slows down expense management. It manages to be both clean and information-dense, with budgets, policy alerts, and pending approvals all accessible from a single view. You can view pending approvals, recent transactions, and policy flags without switching tabs..

Approvals happen in-line, with the option to start comment threads when something needs clarification. Expenses get reimbursed directly in payroll, or through Rippling’ payments system.

In simplest terms, the admin view transforms reviewing, approving, and reimbursing from discrete tasks into a single, seamless flow.

On mobile

I like that the mobile experience feels just as smooth as the desktop. Employees can capture receipts, submit claims, and check reimbursement status inside the app. Expense management feels like something that happens in real-time, which creates a strong incentive to stay on top of it. Managers get notifications for pending approvals, so reviews can happen just as easily from a phone as a laptop.

Core Rippling expense management functionalities

1. Expense tracking and reporting

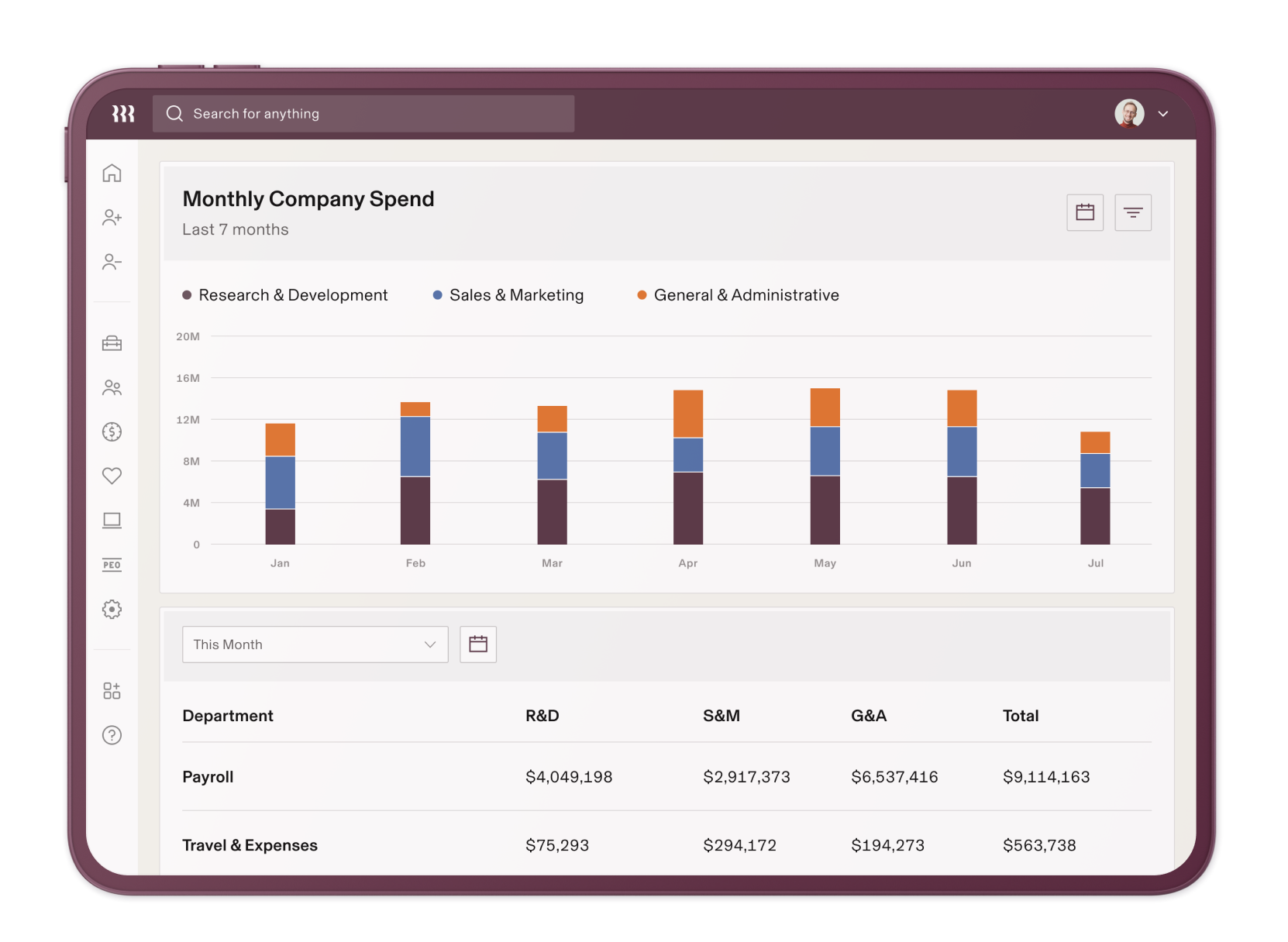

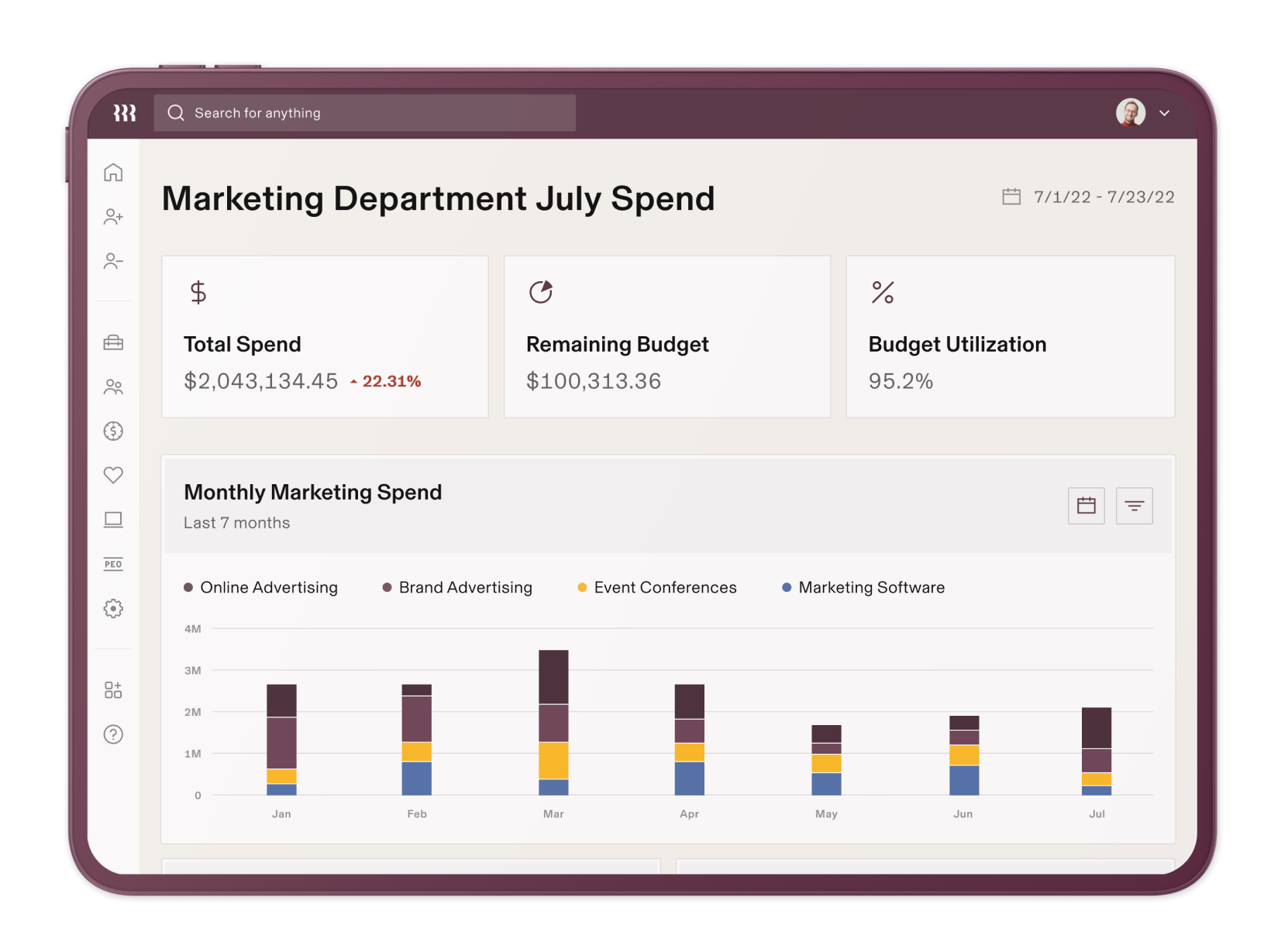

I’ve seen teams lose entire workdays trying to untangle the rationale behind specific spend decisions and map expenditures to budgets and priorities. Rippling eliminates that kind of big picture detective work. You open the dashboard and have instant clarity on who spent what and under which policy.

It’s a live, unified view of company spending. That means every swipe, reimbursement, and vendor change shows up in your dashboard and reporting as it happens, not just when you’ve closed the books.

Continuous updates also mean targeted, precise controls. Transactions flow in automatically from connected accounts or Rippling Corporate Cards, and every expense gets automatically tagged to the right person, project, or department at the moment of submission. You have immediate insight into where and how employees spend and can update policies before budget drift morphs into a full-blown variance.

Key capabilities:

Live expense tracking through connected accounts and Rippling cards

Automatic categorization based on existing policies and past behavior

Department, project, and location tagging for cleaner, more consistent reporting

Real-time dashboards for finance and department heads

Role-based visibility that keeps information managers actually need front and center

2. Reimbursements

Reimbursements are where Rippling really earns its reputation for automation and ease. If you’re working with Rippling payroll, approved expenses get paid out automatically as part of the next pay cycle.

Approve an expense on Tuesday and it’s reimbursed automatically in Friday’s pay run — no exports and no follow-ups. And if someone needs an urgent reimbursement, Rippling provides unlimited off-cycle payruns.

If you’re using Spend as a stand-alone product, the payment system sets up a direct deposit with no intervention needed.

It’s a setup that, in my view, solves a big pain point in finance ops: disconnected reimbursements that keep employees waiting and force teams to manually adjust ledgers later. Rippling eliminates that gap. Everything gets tracked, approved, and paid in one flow inside the same platform, with policy checks and duplicate detection built in.

Key capabilities:

Unified reimbursement and payroll flow that pays out approved expenses automatically

Mobile-first submission process favors time-strapped employees

AI receipt capture and policy validation before approval

Custom approval chains by role or department

Real-time policy enforcement and duplicate detection

3. Corporate cards

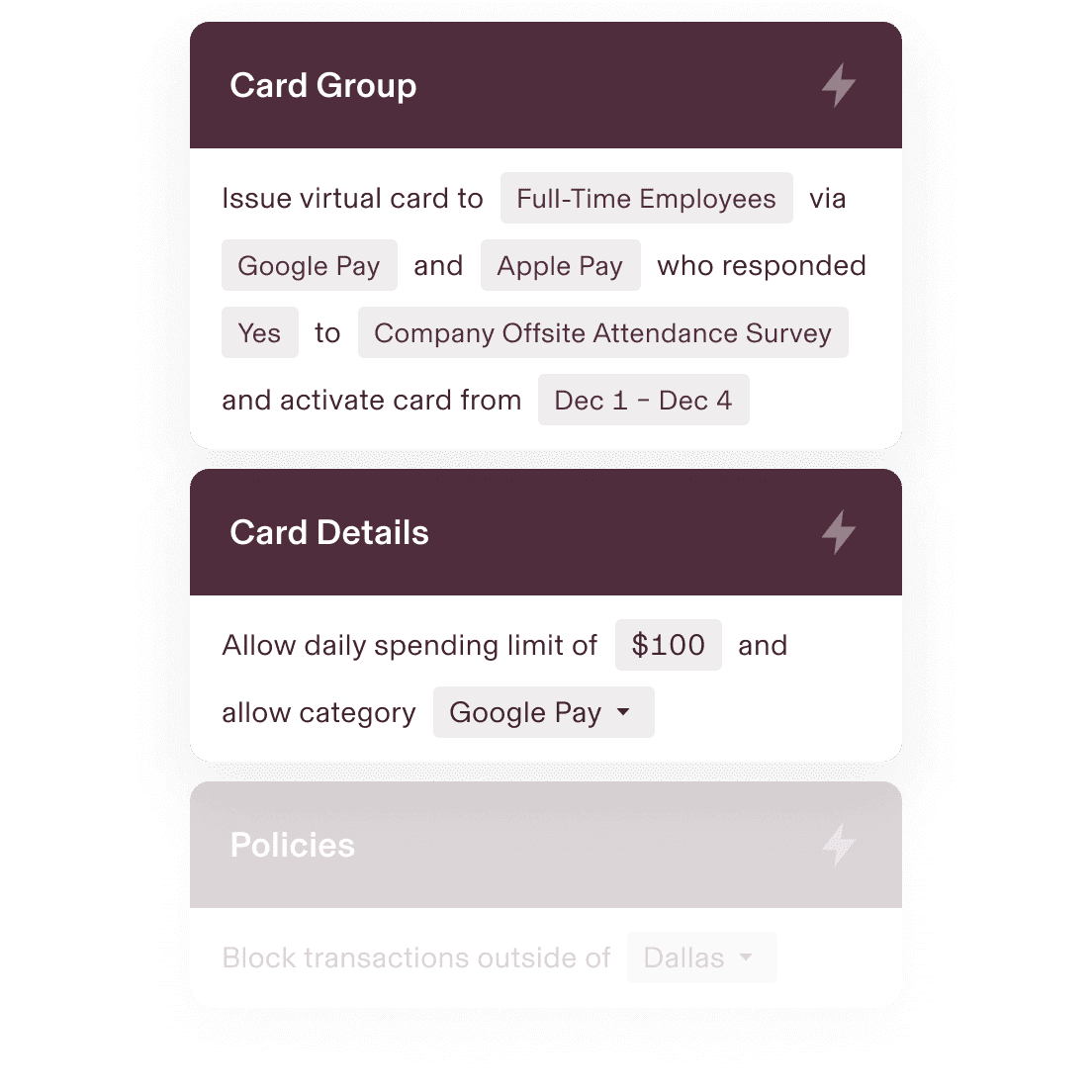

Rippling’s Corporate Cards add an extra layer of visibility and control to company spending (not to mention convenience). Because they’re part of the same system that manages expenses and reimbursements, every transaction automatically links to the right person, policy, or department. Again, you’re seeing spend as it happens and not as a static, end-of-month snapshot when the statement lands.

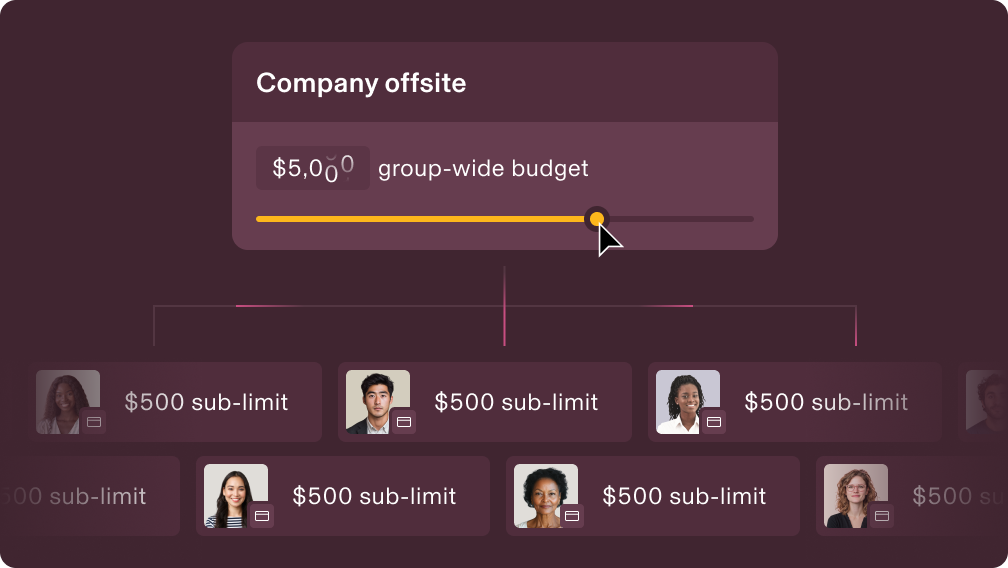

Each card, whether physical or virtual, comes preloaded with your policy rules, spend limits, and category settings that mirror your org structure. That means out-of-policy spend gets blocked at the source, cutting down on cleanup and post-close adjustments.

You also have the option to freeze, cancel, or adjust limits on the fly if you notice unusually exuberant activity. And all of this happens in the same interface you use for reporting and reimbursements.

Key capabilities:

Physical and virtual card options issued directly from Rippling

Real-time transaction syncing to your expense dashboard

Automatic blocking of out-of-policy or over-limit spend

Configurable limits by employee, department, initiative, or vendor

Instant card controls

4. Spend policies and controls

Every company has expense policies. Rippling ensures that yours actually work. You can build rules that reflect how your organization actually operates on a day-to-day basis. Think: capping client meals at $100, auto-approving low-value subscriptions, or adding a second approver when a vendor invoice suddenly spikes. Team dinner goes $20 over the per diem? Rippling instantly pings the manager for review.

Something I noticed about Rippling: you can get hyper specific with your approval chains. I was able to build a multi-person approval flow with unique rules that required individual signoffs in a few minutes. It’s that powerful.

“Internal policies and controls are better with Rippling because we require fields not to be bypassed. But at the same time, we're able to override and put exceptions in certain things if they meet certain requirements. For instance, you can say all spend over this amount requires approval with the exception of a person or a department, which is really cool.

Tuyen Nguyen

Controller at Rhythm Energy

Add Rippling Corporate Cards, and your policies go live at the point of purchase. Out-of-policy spend gets blocked at the source, making enforcement prevention, rather than cleanup.

Once created, your policies live inside Rippling’s employee data, so they move with the people to whom they apply. A manager who changes departments automatically inherits the right limits and approval chains without you having to adjust settings manually.

“The fact that we can link permissions to our Rippling data structure and centralize it around who people report to and what department they're located in a way that's all driven from employee data in an updated system is very helpful, rather than trying to integrate to another expense platform.

Key capabilities:

Custom spend policies tailored by role, department, vendor, or amount

Dynamic rules that update when employee data changes

Conditional alerts and approvals triggered by real spend behavior

Real-time blocking of non-compliant card charges

Full audit trail for every rule, alert, and action

5. Integrations with Accounting and HR

Disconnected systems kill clean books. At least, you end up with so many red “attention!” fields that it feels like they do. When expenses, payroll, and HR live in walled-off systems, every reconciliation introduces risk: misclassifications, missed accruals, longer close. Rippling’s integrations reduce the opportunities for error by feeding your expense data straight into your accounting platform, already tagged with the right codes, departments, and cost centers.

And since Rippling pulls directly from employee records, approval chains and expense mapping stays up-to-date without manual upkeep. When someone changes departments, Rippling adjusts their cost center and approvers automatically.

Key capabilities:

Automatic sync with major accounting systems like QuickBooks Online, Xero, NetSuite, and Sage Intacct

Direct connection to Rippling payroll for reimbursements

Approval routing powering by employee data

Automatically categorizes expenses and maps to cost centers

Audit-ready expense data that cuts down on manual reconciliations

“Our main issue with Brex was that it was just another tool to manage. Someone had to remember to log in, check transactions, or adjust card limits. Adding or removing users was particularly tedious and frankly, annoying. Brex also didn't prioritize integration with our ERP or other essential tools, complicating our reconciliation processes.

Rippling expense management reporting and analytics

Rippling reporting tools make it almost impossible not to understand where company money goes. While some people really enjoy the process of building intricate dashboards, I confess that I’ve never seen the appeal. Too easy for the signal to get lost in the noise of multiple competing widgets. Rippling’s pre-built dashboards help you avoid missing the forest for the trees by instantly surfacing spend by department, category, or timeframe.

And if you really do need more detail, Rippling supports custom reports tailored to how you plan, whether that’s by cost center, manager, or project. You can also pull quick insights like your top five vendors by spend or which departments submit the most reimbursements each month.

Exports are as flexible as you’d expect: CSV, PDF, or direct sync to your ERP. If you already use Rippling Analytics, the expense data rolls right in, so Finance, HR, and Ops are all looking at identical numbers.

“It’s significant. It's time. It's a lack of frustration. It's very easy to be able to go to NetSuite and reflect back to Rippling what we're seeing — it's one to one. We no longer have to upload it — it interfaces, and it's mapped to the accounts that we want.

Rippling expense management integrations and automations

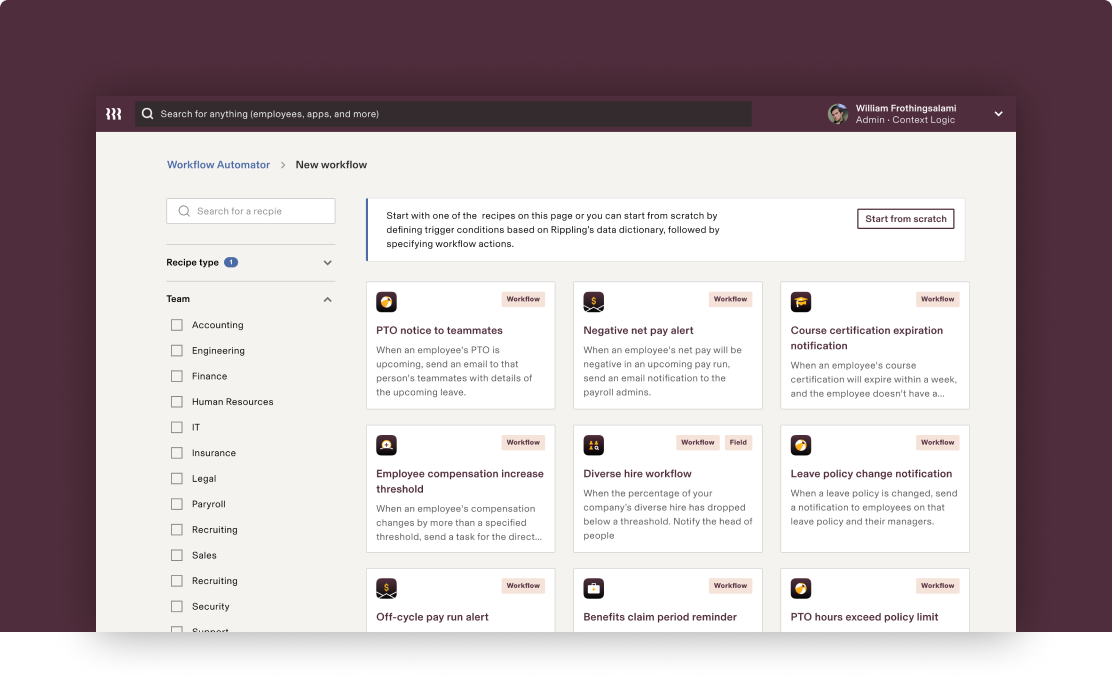

I’ve previously played around with the Rippling Workflow Studio building “recipes” for payroll and HR processes, so I was curious to see what it could do for expense management. It did not disappoint.

The pre-built recipes cover the basics, but I was also able to whip up some relatively complex flows in far less time than it would’ve taken me to design similar systems with Zapier or Make.

|

Employee changes department | When an employee transfers from Sales to Customer Success, Rippling automatically updates their expense policy, reassigns approval routing to the new manager, and remaps their cost center in NetSuite |

Employee submits high-value expense | When an expense over $2,000 is submitted, Rippling routes it to the department head and then Finance for approval. Once approved, it posts to QuickBooks under the correct category and triggers payroll reimbursement |

New hire onboarding | When a new hire is added to the HRIS, Rippling issues a virtual corporate card, applies department-level policy limits, creates a default expense category in the accounting system, and alerts Finance in Slack to monitor early spend |

Month-end close | When the close process starts, Rippling posts all approved expenses to NetSuite, generates a missing-receipt summary, and notifies FP&A in Slack if any department exceeds forecast by more than 10% |

That level of automation depth is rare. Tools like Expensify automate submission and approvals, Ramp focuses on card-level controls, and Airbase manages basic accounting sync. Rippling ties everything together so a single action can ripple (pun intended) across the entire system.

This is why Rippling feels like part of a financial operating system more than “expense software.” It connects natively with accounting tools like QuickBooks Online, Xero, NetSuite, and Sage Intacct, alongside Rippling Payroll, so approved expenses can trigger reimbursements, post directly to the general ledger, and send confirmations to employees.

Factor in the 200+ native integrations to other finance tools, and the automation possibilities really do start to feel endless.

“We've actually taught some of the other people to build workflows too. So I was just in there the other day and I was like, "Look at all these workflows that people are building and not having to ask us to build for them!" It's pretty fantastic! [T]he IT team has maybe 10-15 workflows in there, and Finance is pretty similar as well.

Cassandra Margolin

Head of People at Jasper

Rippling expense management security and compliance

Rippling handles sensitive financial data with the same security standards that it applies across HR data and payroll. All information stays encrypted in transit and at rest, and bank connections are secured with industry-standard protocols. Transaction monitoring runs 24/7, so anomalies get caught before they escalate into breaches or issues.

The Rippling platform is SOC 2 Type II and ISO 27001 certified, and all card processing meets PCI compliance requirements. In layman’s terms, that means Rippling’s systems are regularly audited to the same standards as banks and other financial institutions. Your company and employee data are encrypted, closely monitored, and handled according to strict security controls designed to prevent unauthorized access.

Internally, role-based permissions let finance, HR, and department heads see or access only what they need, while full audit trails give you complete transparency across every expense, approval, and policy change.

Rippling expense management customer support and implementation

Set up for Rippling Expense management starters with a kickoff call focused on targeted questions to help define goals, pain points, and timelines. From there, Rippling develops a structured build plan guided by the onboarding manager. You can expect to work through connecting the ERP system, creating a first spend policy, mapping an approval chain, and preparing cards for issue with direct support. The entire process typically takes a few weeks, with a dedicated session for each of the core functions that includes time to experiment and settle in properly. Once you feel good about the basics, Rippling walks your entire team through a short live demo, so employees can see the tool in action.

All in all, implementation requires bout seven hours of dedicated time spaced out over a few weeks, though it can go faster or slower depending on availability and the complexity of the build. Onboarding support includes direct access to a Rippling contact for help with integrations or policy setup. After launch, that shifts to live chat, email, or video call support.

I do think it’s important to note that support is geared to finance and admin users more than employees. Rippling assumes you’ll field questions from folks about how to upload receipts and escalate to them if needed, so be sure to keep the help desk links handy.

“The best part about my initial conversion to Rippling was that my sister was also going through the process at the same time with her company in Massachusetts. I was impressed with how well Rippling handled each of our situations. We each got specific training related to our specific industries and the states we worked.

Rippling expense management customer reviews and ratings

Rippling maintains strong ratings across all the major software review platforms:

G2: 4.8/5 stars (10,000+ reviews)

Capterra: 4.9/5 stars (4,100+ reviews)

TrustRadius: 8.9/10 (2,400+ reviews)

Rippling’s straightforward interface and user-friendly workflows earned kudos from managers across industries and company sizes. “I like that it feels like and looks like it was made this century. The UI and UX don't look like [they were] made before I was born, and I can easily navigate to what I need to do and what I need to procure. I don't feel hassled using this system because I can access different modules and documents easily.”*

HR generalists and lean teams appreciate the centralized approach that keeps work in one place and supports time-saving automations, while leaders in larger operations like the deep customization and advanced policy controls. One manager for an enterprise-level technology company explained, “The ease of use cannot be overstated. Everything with Rippling is intuitive and a breeze to find. The UI is clean, and I have yet to run into any issues. We have seen a seamless rollout to 150+ users.”

Users also call out the advanced automations. Beyond saving time, Rippling’s workflows allow busy teams to mold the tool to their processes — most competitors do it the other way around. “We have automated SO many manual tasks with Rippling,” said one HRIS and payroll manager.

*All quotes are from verified Capterra reviews.

Rippling Expense Management vs. competitors

Rippling Expense Management sits in a different lane that most spend tools. It’s built for finance teams that value a high degree of control coupled with exceptional automation that connects directly to HR and payroll data. It’s not a true ‘standalone’ reporting app.

Competitors like Ramp, Airbase, and Brex do shine when it comes to advanced analytics and budget forecasting, but Rippling is the better fit if your primary concern is understanding how money moves through your business and centralizing your systems for maximum efficiency and visibility.

|

In-house HR/Payroll | Yes | No | No | Yes, due to acquisition by Paylocity | No |

Corporate Cards | Included | Add-on | Included | Add-on | Included |

Real-Time Spend Tracking | Yes | Partial | Yes | Yes | Yes |

Automated Reimbursements | Fully in-house with native payroll | Partial, via third parties | Partial, via third parties | Yes | Partial, via third parties |

Policy Enforcement | Automated | Basic | Yes | Yes | Yes |

Final verdict: Rippling Expense Management is a 10/10

For mid-size and growing companies that want to consolidate HR, payroll, and finance into one platform, Rippling Expense Management hits the sweet spot: an expense management platform that automates busywork, connects spending to real employee data, and delivers high control with minimal complexity.

The automation is genuinely impressive, with expenses routing, syncing, and reimbursing automatically without anyone pushing data manually, and the integrations are deep enough to keep accounting, HR, and payroll in lockstep. Day to day, it’s one of the easiest tools I’ve tested for approving, reconciling, and tracking employee spend.

That said, it’s not a replacement for a dedicated enterprise spend system. If you need advanced financial reporting, forecasting, or complex global spend management, you may prefer a pure finance tool.

For most of us down here in the trenches with our quarterly budgets and approval queues, though, Rippling is just the right kind of boring: accurate, automated, and easy to trust.

FAQs about Rippling Expense Management

What is Rippling Expense Management used for?

Rippling Expense Management is used to track, approve, and reimburse employee expenses in one system that connects to HR and payroll. It automates policy enforcement, receipt matching, and accounting syncs, so finance teams can manage company spend without manual reconciliation. The tools help businesses control costs, maintain compliance, and get live visibility into spending across departments and employees.

How does Rippling automate reimbursements?

Rippling automates reimbursements by linking expense policies, approvals, and payroll together in a single workflow. When an expense is submitted, it’s automatically checked against company rules, routed to the right approver and, once approved, synced to payroll for payment. The entire process runs without jumping between tools, exporting CSV files, or scheduling separate reimbursement runs.

Does Rippling offer company credit cards?

Rippling offers a corporate card that integrates directly with its expense management system. Companies can issue physical cards, set custom spend limits, and apply policies automatically based on employee role or department. Transactions sync to the expense dashboard, where receipts are matched and out-of-policy purchases get flagged before review.

How does Rippling compare to Expensify or Ramp?

Rippling differs from Expensify because it ties expense management directly to HR, payroll, and accounting data. Expensify focuses on receipt tracking and basic approvals, while Ramp emphasizes corporate card controls and spend analytics. Rippling combines both approaches in one platform, managing reimbursements, card spend, and policy enforcement from a single system driven by employee data.

Disclaimer

Rippling and its affiliates do not provide tax, accounting, or legal advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for tax, legal, or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any related activities or transactions.

The Rippling Corporate Card is issued by Fifth Third Bank, N.A. Member FDIC, and Celtic Bank, subject to approval, pursuant to a license from Visa® U.S.A. Inc. Visa is a trademark owned by Visa International Service Association and used under license. All trademarks are the property of their respective owners.

Rippling Payments, Inc.’s (NMLS No. 1931820) California loans made or arranged pursuant to a California Financing Law License.

*Subject to card approval, you’ll earn cash-back rewards on eligible purchase. Learn more here.

![[Blog - Hero Image] Payroll](http://images.ctfassets.net/k0itp0ir7ty4/ETvyHP3pmEXRExpvQNdWq/ad53a7421f19ca588f705a1cc101a308/payroll_-_Spot.jpg)

![[Blog - Hero Image] Finance Document](http://images.ctfassets.net/k0itp0ir7ty4/4QLqciNALVuIa3RyghYgyk/c3db1e55c2f5406caaca53dc1c41e511/Finance_Document_-_Spot.jpg)