Rippling and its affiliates do not provide tax, accounting or legal advice. This material has been prepared for informational purposes only, and is not intended to provide or be relied on for tax, accounting or legal advice. You should consult your own tax, accounting and legal advisors before engaging in any related activities or transactions.

The EU Pay Transparency Directive: what employers need to know before June 2026

In this article

The EU Pay Transparency Directive is one of the most significant pieces of European law to affect employers in recent years. Designed to strengthen pay equality and close the gender pay gap, it will require employers to change how they approach recruitment, pay reporting and internal communication. For HR leaders and compliance managers, the Directive brings both operational demands and strategic opportunities.

In this article, you’ll learn what the pay transparency law in Europe means in practice, the core obligations it introduces and how it will affect employers. We’ll also highlight practical steps to prepare your organisation for the upcoming changes, with a step-by-step checklist you can download and start using right away.

Why the EU Pay Transparency Directive matters

Although equal pay legislation has been in place across Europe since 1957, pay inequality remains a stubborn challenge today. According to the European Commission’s most recent figures, women in the EU earned 12% less than men in 2023. It’s a figure that has only reduced slightly in recent years – in 2021, the gap was 12.7%.

This persistent disparity has led to calls for stronger, enforceable measures across the EU. As a result, the EU Pay Transparency Directive was adopted by the EU Council in June 2023. Sometimes called “the gender pay gap directive”, it’s designed to place transparency and accountability at the centre of pay practices, it represents an increase in compliance responsibilities for employers and a marked cultural shift in how salaries are determined, communicated and scrutinised.

It’s no exaggeration to say the Directive will bring about a fundamental change to EU employment law in 2026, with all affected organisations required to adopt the new rules from June. For HR leaders and compliance managers, it means preparing for closer scrutiny of pay structures and formal reporting requirements. The Directive will also require many organisations to rethink their approach to recruitment, retention and employee relations, making it a critical issue for any organisation with a workforce in the EU.

Understanding the EU Pay Transparency Directive: who, what and when?

To prepare for the upcoming changes, it’s important to first understand who will be affected by the Directive, what the key obligations for employers are, and when organisations must adopt the rules.

Who is affected by the Directive?

All 27 EU countries with 100 or more employees must adopt the rules of the Directive. The rules affect all workers, including:

Public and private sector employees

Gig workers

Agency workers

The Directive applies to all companies headquartered in the EU and to non-EU companies with 100 employees or more within EU countries. This means that UK employers with more than 100 employees based in the EU will have to adopt the rules, even though the UK is no longer an EU country.

What obligations will employers have?

The Directive introduces several obligations for employers designed to make pay more transparent and equitable:

Pay transparency in recruitment: Employers must disclose salary ranges in job adverts or before interviews. Asking candidates about previous salaries is prohibited. This ensures applicants can make informed decisions and helps prevent pay inequalities from being perpetuated during hiring.

Employee access to information: Workers have the right to request details of their own pay level and the average pay of colleagues performing the same or equivalent work. Employers must also make transparent the criteria used to determine pay and career progression, ensuring these are objective and gender-neutral.

Mandatory gender pay gap reporting: Organisations must publish detailed data to regulators, including:

Median and mean gender pay gaps

Gender distribution across pay quartiles

Gender pay gaps in bonuses and other variable pay

Proportion of employees receiving performance-related pay

Differences in starting salaries for comparable roles

Joint pay assessments: If gender pay gaps of 5% or more are identified and cannot be justified by objective, gender-neutral reasons, employers must conduct a joint assessment with employee representatives. This process involves analysing pay structures, identifying discriminatory practices and developing corrective measures, highlighting the Directive’s focus on transparency and employee involvement.

The Directive also strengthens employee access to justice in pay disputes. Workers who experience pay discrimination will have access to compensation, which could include full back pay, while the burden of proof will shift away from employees. Instead, employers will have to prove they didn’t break the rules.

Each EU country will determine how to sanction employers found to be in breach of pay discrimination rules. The consequences may include financial penalties.

The Directive recognises that pay discrimination can occur across multiple factors such as gender, ethnicity, sexuality, or disability. The rules include provisions against this intersectional discrimination in pay disputes.

When do employers have to adopt the rules?

Organisations within the scope of the Directive must “transpose it into national law” by June 2026. Gender pay gap reporting will begin at different times – and with different reporting frequencies – based on the size of the organisation’s workforce:

Workforce size | When gender pay gap reporting starts | Frequency of reporting requirements |

|---|---|---|

150 employees or more | June 2027 (reporting on the 2026 calendar year) | - Annually if over 250 employees - Every three years if 100-249 employees |

100 to 150 employees | June 2031 (reporting on the 2030 calendar year) | Every three years |

Under 100 employees | Not required to report under the EU Pay Transparency Directive (although individual EU countries may choose to mandate it) | N/A |

Like all directives, the EU PAY Transparency Directive is a legislative act that sets out goals that EU countries must achieve. Each country must devise the laws to help them reach these goals and adopt (or “transpose”) the rules of the directive as it sees fit.

This means each country will interpret the Directive and adopt the rules in different ways. Here’s a breakdown of where each EU country stands in the process of transposing the Directive into law.

Employers who fail to comply with the rules could face serious consequences. Depending on the rules in each EU country, consequences could include financial penalties, litigation and reputational damage for employers.

How the EU Pay Transparency will affect employers

The Directive requires employers to adapt to new expectations around reporting, data management and employee rights. While these changes promote greater fairness, they also place new demands on HR and compliance teams.

Legal considerations

The Directive brings important legal responsibilities for employers. Employees who suspect discrimination will have greater access to remedies, including compensation. Importantly, the burden of proof will often shift to the employer to demonstrate that their pay practices are fair and non-discriminatory. Failure to comply could also result in financial penalties, with the level of fines determined by individual Member States.

Operational requirements

Beyond legal compliance, organisations may face operational pressures. Reporting obligations will increase demands on HR and payroll teams, particularly where systems are fragmented or where the business operates across multiple jurisdictions. Revealed pay gaps may prompt employee questions, media attention, or union engagement, all of which require clear communication and thoughtful management.

Demands on data management

For many organisations, one of the most immediate areas of focus will be data. Employers will need to consolidate information from different HR and payroll systems, often across several countries. Categorising employees consistently and ensuring accuracy will be essential for meeting reporting standards and avoiding misinterpretation of results.

Cross-border complexity

Employers with a presence in multiple Member States will need to navigate different national approaches. While the Directive sets a common framework, governments may add additional obligations when transposing it into law. HR and compliance leaders will need to track local developments closely and prepare for variations in enforcement across jurisdictions.

8 essential business areas to review for EU Pay Transparency Directive compliance

However each country chooses to adopt the rules of the Directive, HR and compliance managers will need to review their organization’s practices and policies in several areas in order to prepare:

1. Current pay structure and salary bands

Under the EU Pay Transparency Directive, employers will need to map out current pay levels across roles, departments and locations to identify any disparities. This process doesn’t just help ensure pay equity compliance. It also encourages transparency in how pay decisions are made, enabling organisations to articulate and justify compensation fairly across the workforce. Employers may wish to start the exercise by revisiting their compensation philosophy.

2. Recruitment and hiring processes

The Directive requires transparency in how roles are advertised and offers are made. Organisations will need to update job postings to include salary ranges and ensure hiring managers follow consistent, objective criteria. This encourages fairness and helps build trust with candidates, strengthening the employer brand in a competitive talent market.

3. Data preparation and technology

Accurate, consolidated data is essential for reporting. Organisations should review HR and payroll systems to ensure roles are categorised consistently and information is reliable across teams and locations. Upgrading or integrating systems may be necessary to meet reporting standards efficiently and to provide clear insights for decision-making.

4. Governance and ownership

Employee representatives, including unions and works councils, will play a more active role in reviewing pay practices. Joint pay assessments will formalise their involvement in addressing gaps. HR leaders should anticipate more structured dialogue around pay policies and prepare for collective bargaining pressures.

5. Training and communication

Conducting a pay audit is one of the most effective ways to prepare. This involves benchmarking current salaries, reviewing pay bands and identifying areas of risk. Addressing unjustified gaps ahead of mandatory reporting will reduce the risk of reputational damage later.

6. Union and work council engagement

Unions, works councils and other employee representatives will have a more active role under the Directive. Organisations should anticipate structured dialogue and joint pay assessments, using these conversations to align on fair practices. Early engagement supports collaboration, creates transparency and ensures processes are understood across the organisation.

7. Cultural readiness

For many organisations, the Directive represents a significant cultural shift. Previously, salary information was largely confidential. Now, transparency will become the norm. Employers should prepare teams for this change, helping employees understand how pay decisions are made and fostering a culture that values fairness and clarity.

8. Governance and ownership

Responsibility for compliance should be clearly assigned across HR, legal, compliance and finance teams. Establishing internal controls, reporting timelines and escalation processes will help ensure smooth compliance once reporting becomes mandatory.

9. Employee engagement and retention

Employees and managers alike will need training. HR teams must be equipped to handle employee requests for pay data, while managers should be prepared to explain pay structures and progression criteria. Clear, proactive communication will be essential to maintaining trust as pay data becomes more widely available.

Priorities and next steps before June 2026 (with checklist)

No matter what stage each EU country is at in the process of transposing the Directive into national law, affected organisations should begin preparing well ahead of the June 2026 deadline. Key priorities for HR leaders include:

Understanding how the Directive applies to their organisation, based on size and jurisdiction.

Establishing systems and processes for data collection, analysis and reporting.

Engaging leadership and employee representatives to build alignment on compliance strategy.

Preparing for the cultural implications of greater transparency by integrating it into broader diversity, equity and inclusion initiatives.

For an actionable step-by-step guide to prepare for the June 2026 deadline,

[PLACEHOLDER; insert checklist link above]

How Rippling supports compliance with the EU Pay Transparency

Preparing for the EU Pay Transparency Directive requires employers to align legal, operational and cultural practices across multiple jurisdictions. For organisations managing fragmented systems, this can quickly become a major obstacle. Rippling simplifies the process by centralising HR, payroll and compliance on a single global platform, giving leaders full visibility and control as they adapt to new regulatory demands.

Rippling’s Global HRIS for centralised employee data

The Directive places significant emphasis on accurate and consistent workforce data. Rippling’s Global HRIS consolidates employee records from over 175 countries into a single source of truth. This ensures data consistency, simplifies pay categorisation and reduces the risk of errors when reporting or conducting pay assessments.

Smart payroll and compensation tools

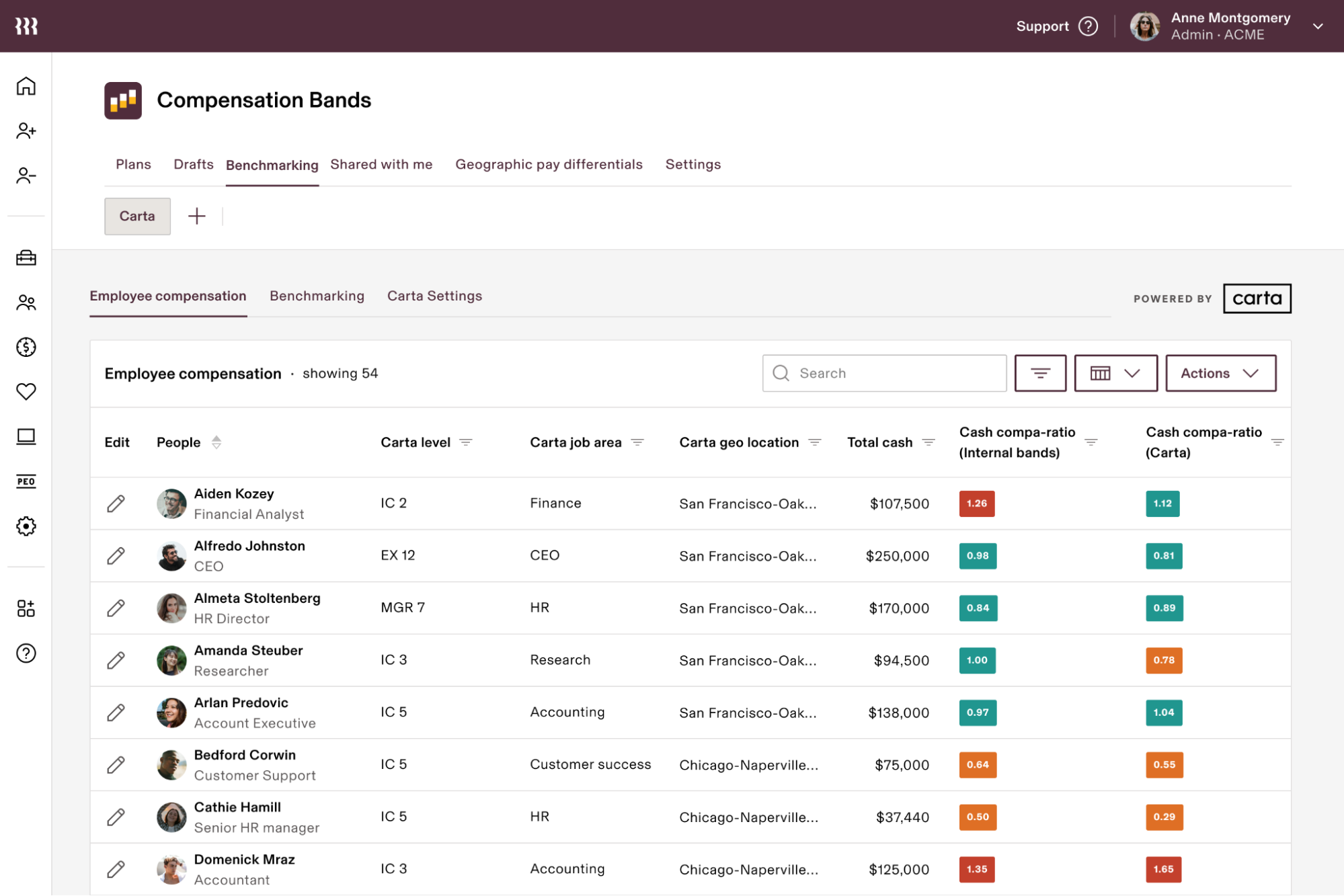

Complying with transparency requirements means being able to demonstrate how salaries are structured and justified. With Rippling’s payroll and compensation tools, organisations can define, manage and monitor pay ranges and salary bands in one place.

This makes it easier to communicate policies, address discrepancies and maintain equitable pay practices across regions.

Compliance dashboards for EU-specific reporting

Rippling’s compliance dashboards register compliance across virtually all countries in the EU, helping employers meet jurisdiction-specific obligations – including those set out by the EU Pay Transparency Directive..

HR and compliance leaders can track reporting deadlines, monitor required disclosures and identify gaps before they escalate into compliance issues — all from a single, intuitive interface.

By unifying HR, payroll and compliance functions, Rippling reduces complexity and enables organisations to meet regulatory requirements with confidence. Instead of patching together data from multiple systems, leaders can focus on strengthening fairness, transparency and trust across their workforce.

It’s time to prepare for a new era of pay transparency

The EU Pay Transparency Directive sets a new standard for how organisations approach pay, creating both responsibilities and opportunities for HR and compliance leaders. Meeting the requirements will demand careful planning across legal, operational and cultural dimensions, but it also provides a chance to take meaningful steps toward more consistent and transparent pay practices.

Organisations that act early – by auditing their data, reviewing policies and engaging employees openly – can build stronger foundations of trust and accountability. In doing so, they not only reduce compliance complexity but also enhance their reputation, strengthen retention and position themselves competitively in a labour market where fairness and openness are increasingly valued.

Disclaimer

Hubs

Author

The Rippling Team

Global HR, IT, and Finance know-how directly from the Rippling team.

Explore more

Statutory pay explained: UK employer guide

Discover everything you need to know about statutory pay, from rules and rates to employer duties, in this clear and practical UK guide.

Changes to DBS ID checking guidance: a compliance timeline for employers

Learn about the changes to DBS ID checking guidance and what employers need to do to comply by 1st November 2025.

Is redundancy pay taxable? A guide for UK employers

Learn what redundancy pay is, including what gets taxed and what doesn’t, and discover tips for running it through payroll correctly.

P45 vs P60 vs P11D: What UK employers need to know

Get clear on your legal duties with this guide to the P45 vs P60 vs P11D, including what they are, who gets them, when they’re due, and how to issue them properly.

What is a DBS check and do you need one to hire?

Discover when you need a DBS check to hire, the types available and how you can stay compliant during this phase of the recruitment process.

Securing HR’s seat at the leadership table: the ‘admin to advisor’ framework

Discover Rippling’s Admin to Advisor framework — a roadmap helping HR leaders across the UK elevate their influence, harness data, and secure a voice in business strategy.

Managing the employee lifecycle: HR workflows for small teams

Learn how to streamline HR workflows and manage every stage of the employee lifecycle smoothly with the right tools and automation.

UK Bank Holidays 2025: Key Dates and Business Implications

Plan ahead for bank holidays 2025: avoid rota chaos, late pay, and legal slip-ups with simple tips and smart tools.

See Rippling in action

Increase savings, automate busywork and make better decisions by managing HR, IT and Finance in one place.