An Employer of Record (EOR) is a third party that legally employs staff on your behalf in other countries, managing the localised onboarding experience. This might include handling things like payroll, benefits, and ensuring compliance with that country’s statutory obligations.

If we use Australia as an example, this means an EOR would take on responsibility for payroll, superannuation, and compliance with the Fair Work Act.

Many Australian companies choose an Employer of Record model to streamline global hiring and reduce the risk of non-compliance with complex international employment laws. Instead of managing different tax systems, leave entitlements, and contracts, an EOR allows you to hire talent in new markets quickly and confidently.

EOR providers vary in approach. Some are software-first platforms like Rippling, others use hybrid models that blend tech with services, and some are service-led firms focused on compliance, visas, and local expertise.

With so many options and varying models, it’s not always clear which provider will best suit your business. To help, I’ve reviewed and scored 30 EOR providers against six factors: compliance, features, support, pricing, scalability, and customer satisfaction — and Rippling earned the top spot as the best employer of record service in Australia.

Here's an overview of my findings. If you’d like to see the complete list and how I added up the scores, you can view the full research here.

|

1. Rippling | 4.85 | SMBs to enterprises | Everything managed in one system (HR, IT, payroll, compliance) | Software (SaaS) |

2. G-P (Globalization Partners) | 4.83 | Enterprises | A strong platform plus hands-on HR support | Hybrid (Tech + Service) |

3. Deel | 4.78 | SMBs to enterprises | Software with built-in compliance and fast contractor-to-employee workflows | Hybrid |

4. Papaya Global | 4.70 | Mid-sized to enterprises | Payroll plus local benefits packages across regions | Hybrid |

5. Employment Hero | 4.70 | SMBs to enterprises | Award interpretation with modern HR tools for AU teams | Hybrid |

6. Multiplier | 4.70 | Mid-sized to enterprises | Rapid hiring in APAC with simple onboarding | Hybrid |

7. Oyster | 4.70 | Mid-sized to enterprises | An easy UI for both employees and employers | Hybrid |

8. BIPO | 4.60 | Enterprises | Direct visa sponsorship support alongside EOR in Australia | Hybrid |

9. Asanify | 4.50 | SMBs | Budget-friendly setup for micro or small businesses | Software |

10. Borderless AI | 4.25 | SMBs | A light EOR with automation to cut down on manual admin | Software |

11. RemoFirst | 4.25 | SMBs to mid-sized | Cost-effective global hiring with clear pricing | Hybrid |

12. Safeguard Global | 4.25 | Enterprises | Enterprise-grade compliance with a direct AU presence | Hybrid |

13. Skuad | 4.25 | SMBs to enterprises | Flexible benefit options with scalable global coverage | Hybrid |

14. TopSource | 4.25 | Mid-sized | Consultative, people-driven support for mid-sized firms | Service-led |

15. Mercans | 4.15 | SMBs to mid-sized | Combined payroll and EOR | Hybrid |

16. Omnipresent | 4.15 | Enterprises | More benefits (like wellness or disability support) for competitive offers | Hybrid |

17. Pebl (previously Velocity Global) | 4.15 | Enterprises | Large enterprise growth that needs mature governance | Hybrid |

18. Remote | 4.10 | Mid-sized to enterprises | Strong self-serve platform, plus good benefit bundles | Hybrid |

19. GoGlobal | 4.00 | SMBs to mid-sized | A boutique, direct-entity approach with local guidance | Hybrid |

20. Horizons | 3.90 | Mid-sized | Wide reach that’s well-suited for mid-sized businesses | Hybrid |

21. Remote People | 3.85 | Mid-sized | Compliance support with a service-heavy, human touch | Service-led |

22. AYP Group | 3.80 | SMBs to mid-sized | Direct-entity EOR with visa sponsorship help | Hybrid |

23. Agile Hero | 3.75 | SMBs to mid-sized | Flexible benefits and a quick global setup | Hybrid |

24. Gloroots | 3.75 | SMBs to mid-sized | Simple compliance with operations | Hybrid |

25. CXC | 3.35 | SMBs to mid-sized | Recruitment paired with EOR compliance expertise | Service-led |

26. Remundo | 3.35 | SMBs to mid-sized | Hands-on, service-led delivery for multi-country hiring | Service-led |

27. Brunel | 3.20 | Enterprises | Compliance expertise in technical sectors | Service-led |

28. Links International | 3.20 | Mid-sized to enterprises

| Staffing-led provider with partner network in 20+ countries | Service-led |

29. Native Teams | 3.20 | SMBs | A contractor wallet for easy payouts | Software |

30. ABN Australia | 2.77 | SMBs | Australian specialists for EOR and immigration | Service-led |

Deep dive into the 12 Best EOR options in Australia

From the full list of 30 providers, a smaller group consistently came out on top. These 12 EOR services combine strong compliance, global reach, and local expertise, making them the most reliable choices for businesses hiring in or from Australia.

Now let’s take a closer look at the ones worth shortlisting:

1. Rippling

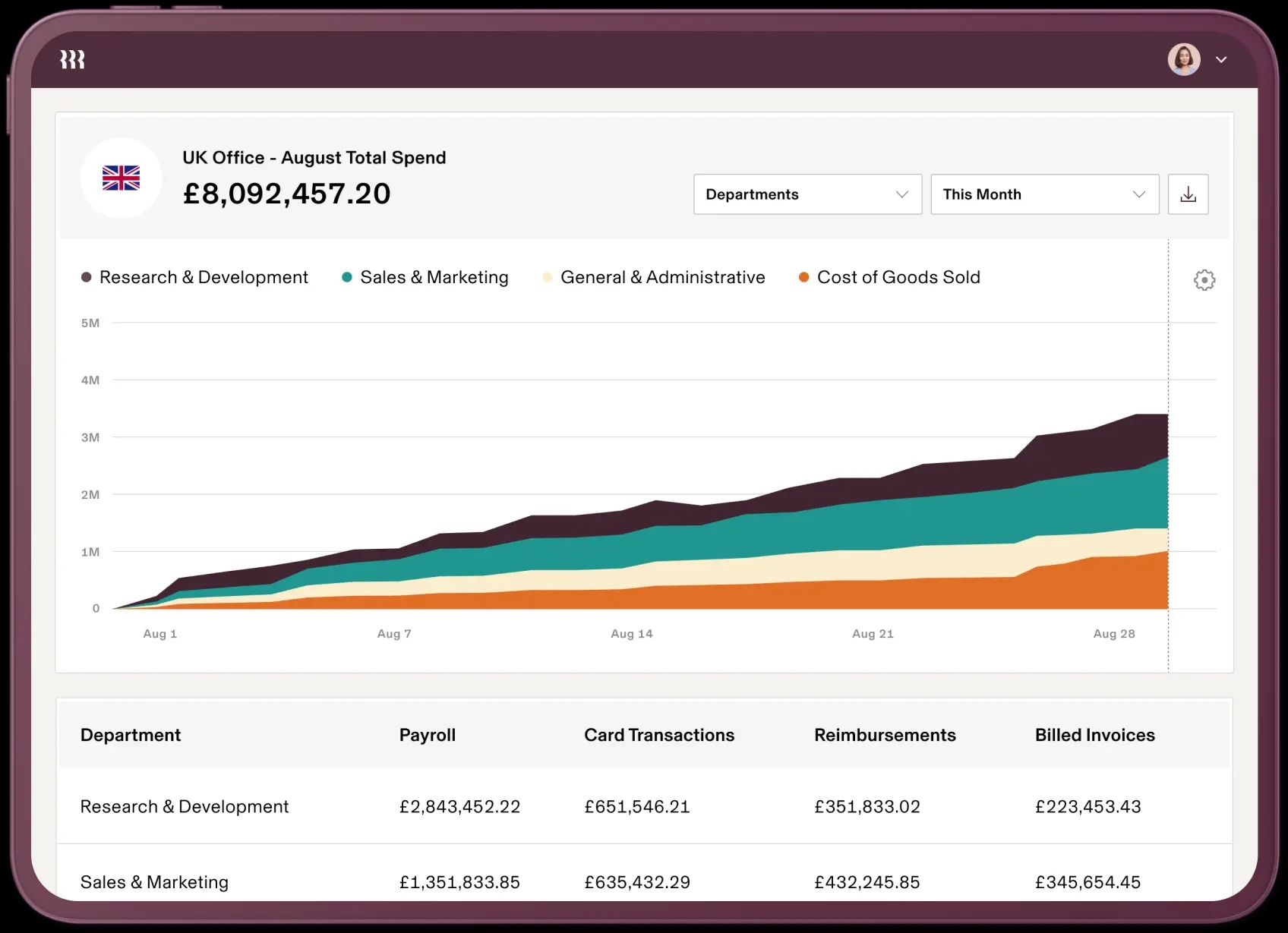

Rippling combines HR, IT, compliance, and global payroll in one platform, making it one of the most versatile EOR providers.

What makes it stand out is the balance between Australian compliance and global reach. Having a direct entity in Australia, plus coverage in 160+ countries, allows businesses to get one system that can replace multiple tools without adding complexity to their workload.

Unlike its competitors, Rippling is built as a single SaaS platform. This means that payroll, employee data, devices, and even apps can all be managed in the same place. For companies expanding overseas, this cuts down time spent on admin work and keeps all your data in one place, lowering the risk of compliance mistakes.

Why do companies choose Rippling?

All-in-one platform that replaces multiple HR, IT, and payroll tools

Offers more than 600 integrations

Direct Australian entity for Fair Work Act and superannuation compliance

Global reach across 160+ countries with automated compliance built in

“The platform is intuitive and a great tool for consolidating all our HR information as we continue to grow and improve our organisation. One of the key reasons we chose Rippling over other options is its strong integration with contractor and international employee payroll.” - Rippling Capterra review.

User-flagged challenges

Visa and immigration support is advisory only

No live phone support during Australian business hours

The wide feature set can be a lot for smaller teams

Is Rippling right for your business?

Rippling is a smart option if you want HR, payroll, IT and compliance managed in one place. Everything sits within a single system, so you’re not juggling different providers or platforms. The platform works especially well for fast-growing businesses that need to stay compliant in Australia while building teams overseas.

Hire and pay global employees with Rippling's EOR services

2. Globalization Partners (G-P)

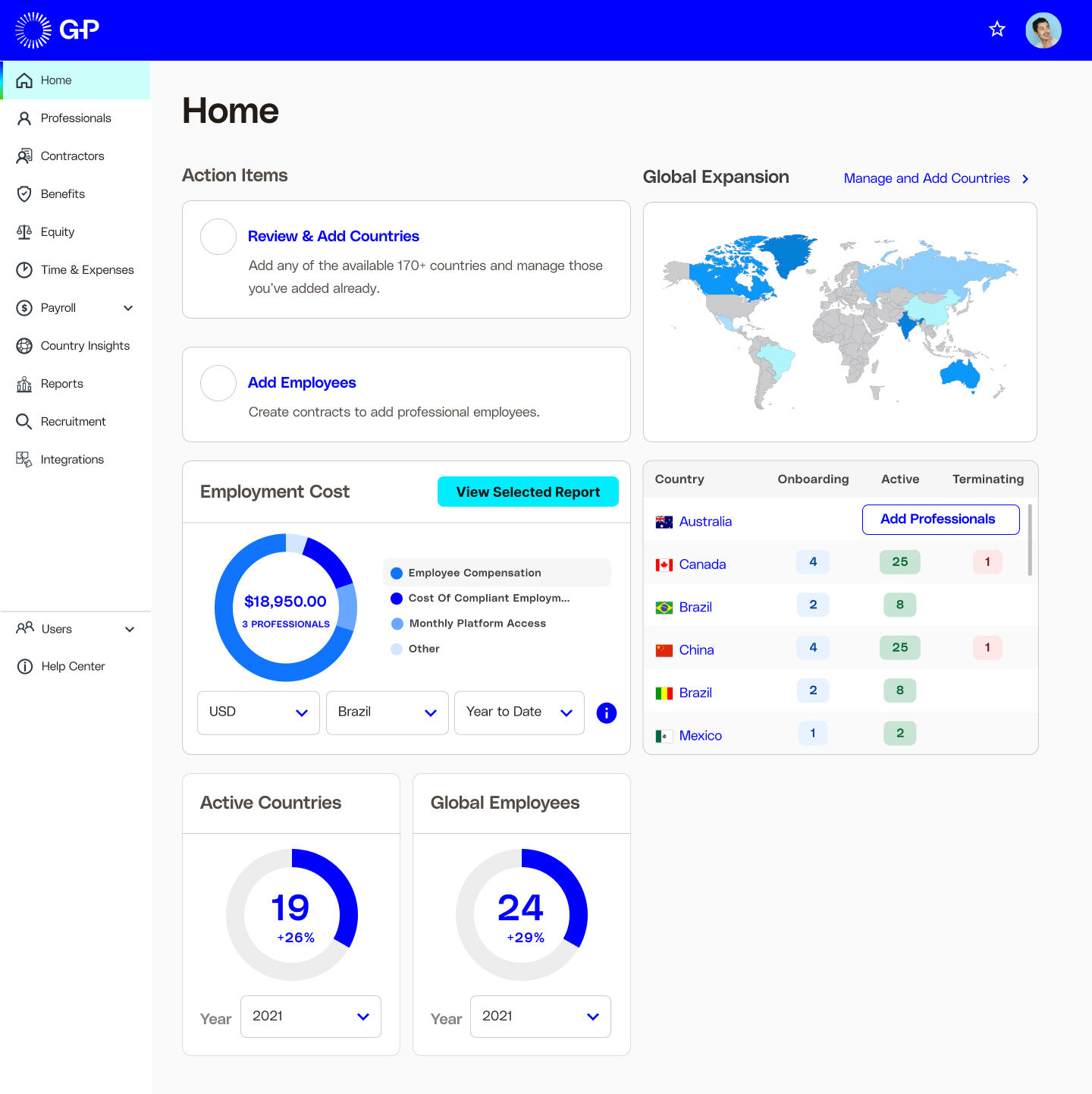

G-P combines software with hands-on support, giving businesses access to both a platform and a team of experts to help with local compliance. It has a direct entity in Australia and coverage in more than 180 countries, making it a good choice for large organisations hiring globally.

A standout feature is its ability to directly sponsor visas in Australia. Instead of employers taking on the legal responsibility and paperwork, G-P manages the process. This makes hiring and moving international staff a lot easier.

Why do companies choose G-P?

Mix of software and expert support

Direct Australian entity with full compliance for payroll, superannuation, and leave

Can directly sponsor visas in Australia, making it easier to hire global talent

One of the widest networks, covering 180+ countries

“What I like most about G-P is that it can handle payroll for many different countries, and the customer service is good.” - G-P Capterra review.

User-flagged challenges

Support can be slow, and many users say it’s hard to get a direct contact

Reviews call out poor communication, with emails bouncing back and forth for days

High hidden costs like FX fees

Is G-P right for your business?

G-P works best for large organisations that need both the technology and expert help to manage global teams. It’s especially useful if you’re hiring in many countries and want support that goes beyond software. However, keep in mind that many reviews note that it has high FX fees.

3. Deel

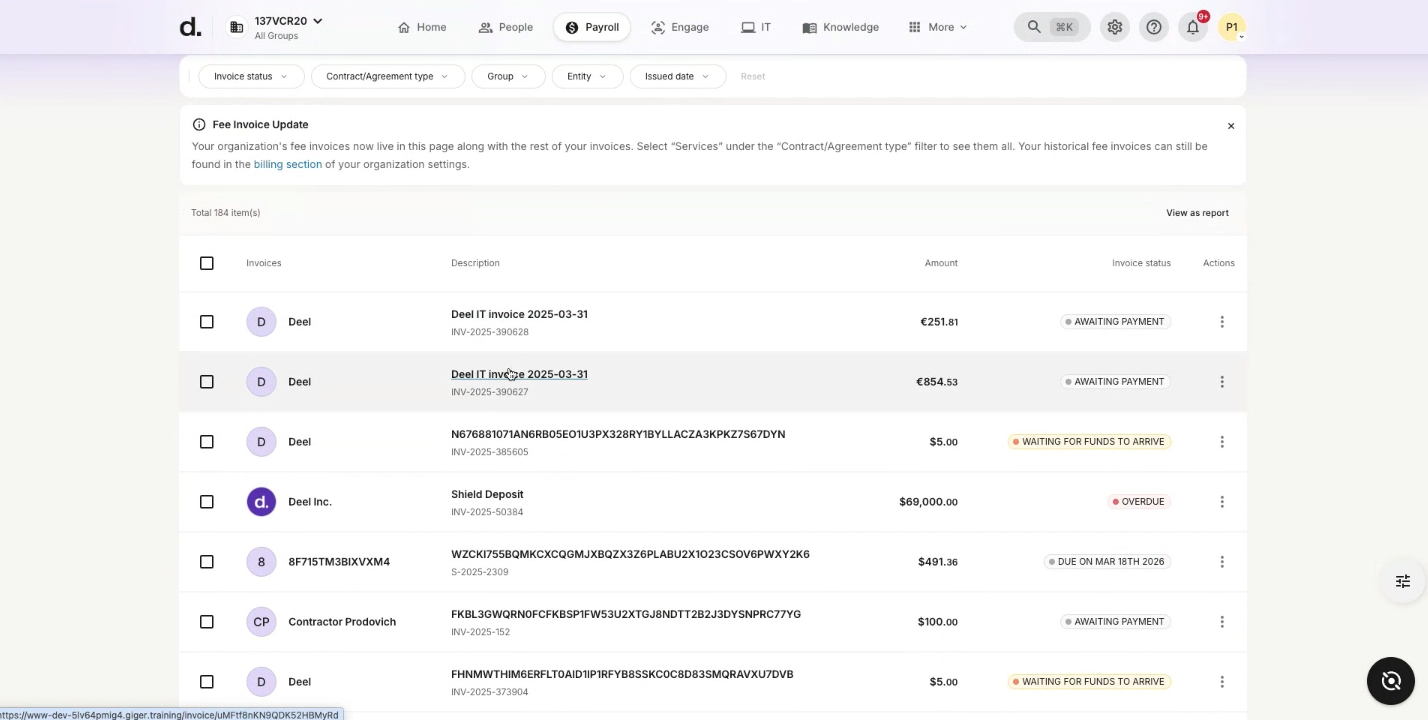

Deel is one of the most popular EOR providers globally, known for being fast, flexible, and easy to use.

It combines software with managed services, giving businesses both automation and hands-on support. Deel operates in 100+ countries, making it well-suited for companies that need reliable compliance at home and abroad.

One of its biggest strengths is how quickly companies can get started. Contractors and employees can be onboarded in days, with compliant contracts and payroll set up straight away.

Why do companies choose Deel?

New hires can start working almost immediately

Direct entity in Australia for Fair Work compliance and superannuation

Wide benefits coverage, including health insurance and allowances

“I really like how intuitive the platform is, especially for managing contracts and compliance in different countries. Payments are fast, automated, and transparent.” - Deel review on Capterra.

User-flagged challenges

Compliance can feel rigid, with little room for flexibility

Customer support is ticket-based, so issues may take days to resolve

Costs can be high for smaller businesses compared to simpler tools

Is Deel right for your business?

Deel is best for companies that want a balance of technology and support with a strong global presence. It’s especially good if you need to hire quickly in multiple countries and want to offer employees benefits. However, if you’re a small business or you want highly flexible compliance options, Deel might not work for your business.

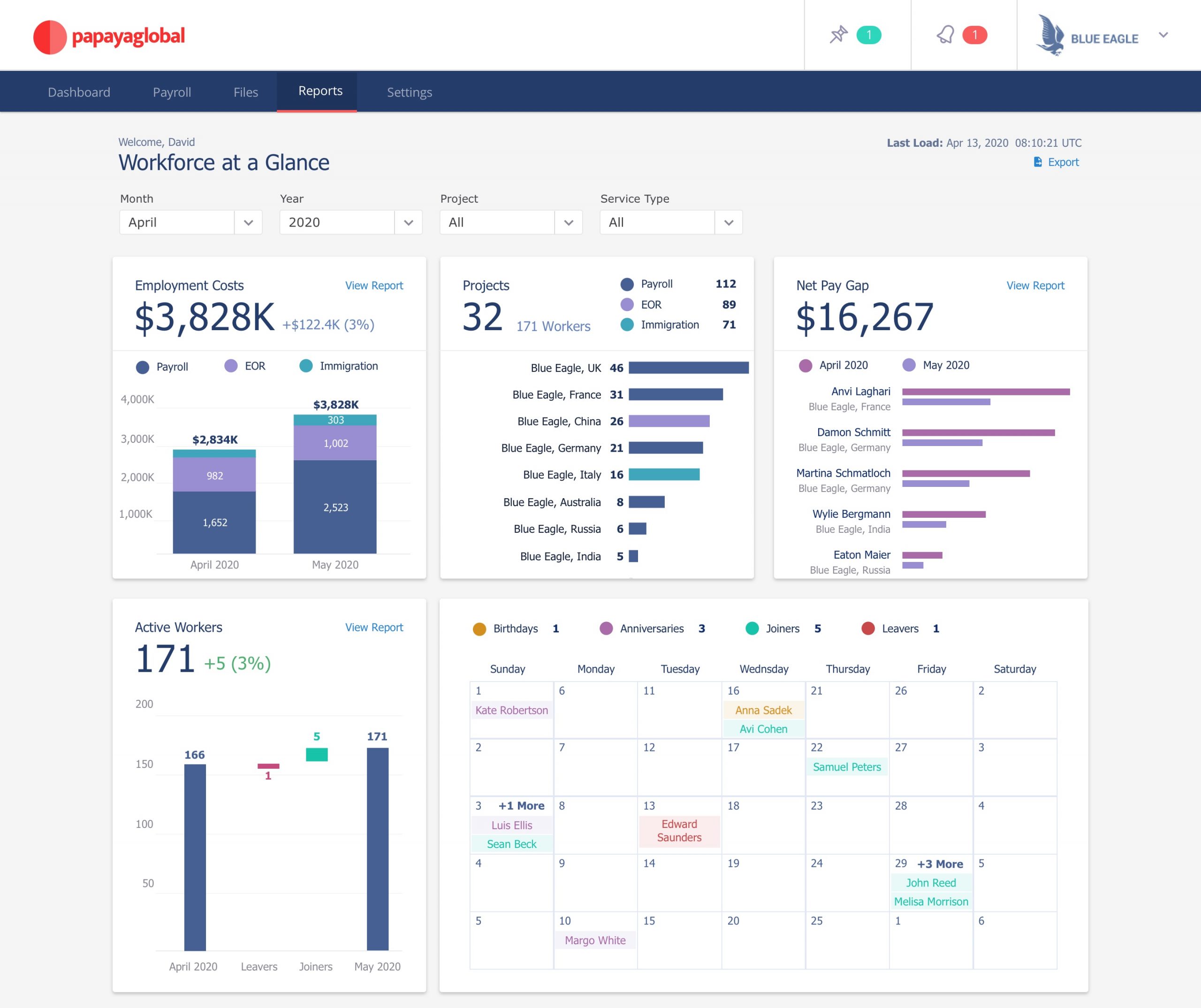

4. Papaya Global

Papaya takes an automation-first approach to managing global payroll and compliance. In Australia, it runs through a direct entity and stands out for offering more benefits than most EORs, including health insurance, equity, and stock options.

Papaya can also connect businesses with local experts, which helps when navigating complex tax or employment laws.

Why do companies choose Papaya Global?

Management of equity, stock options, and health insurance

Connections to local compliance experts

Automation reduces manual admin for large, multi-country teams

“The part I like about Papaya is that they have designated a payroll expert to support us who is available all the time, and all our queries and concerns get answered in no time.” - Papaya Global Capterra review.

Challenges users mention

Invoices and reporting can be disorganised and error-prone

Customer service is inconsistent, especially across time zones

Reviews say fees are high, with one saying they are as “high as an extra salary”

5. Employment Hero

Employment Hero is an Australian-founded EOR and HR platform with a strong focus on local compliance and employee experience. It operates through a direct entity in Australia and covers more than 180 countries, combining payroll, HR, and benefits in one system.

What makes Employment Hero stand out is its focus on employee engagement tools. Beyond payroll and compliance, it offers benefits like wellness support, mental health resources, learning and development, and even perks and allowances.

Why do companies choose Employment Hero?

Deep understanding of Fair Work and superannuation rules

Built-in employee engagement features like wellness, perks, learning and development

Combines HR, payroll, and compliance in a single platform

“Overall, our experience with EH has been an extremely positive one. It’s helped us streamline all our HR and payroll functions, we are now completely paperless.” - Employment Hero Capterra review.

User-flagged challenges

Customer support can be slow or difficult to reach

Some payroll and HR features overlap, causing confusion

Reporting features are limited and often require manual work in Excel

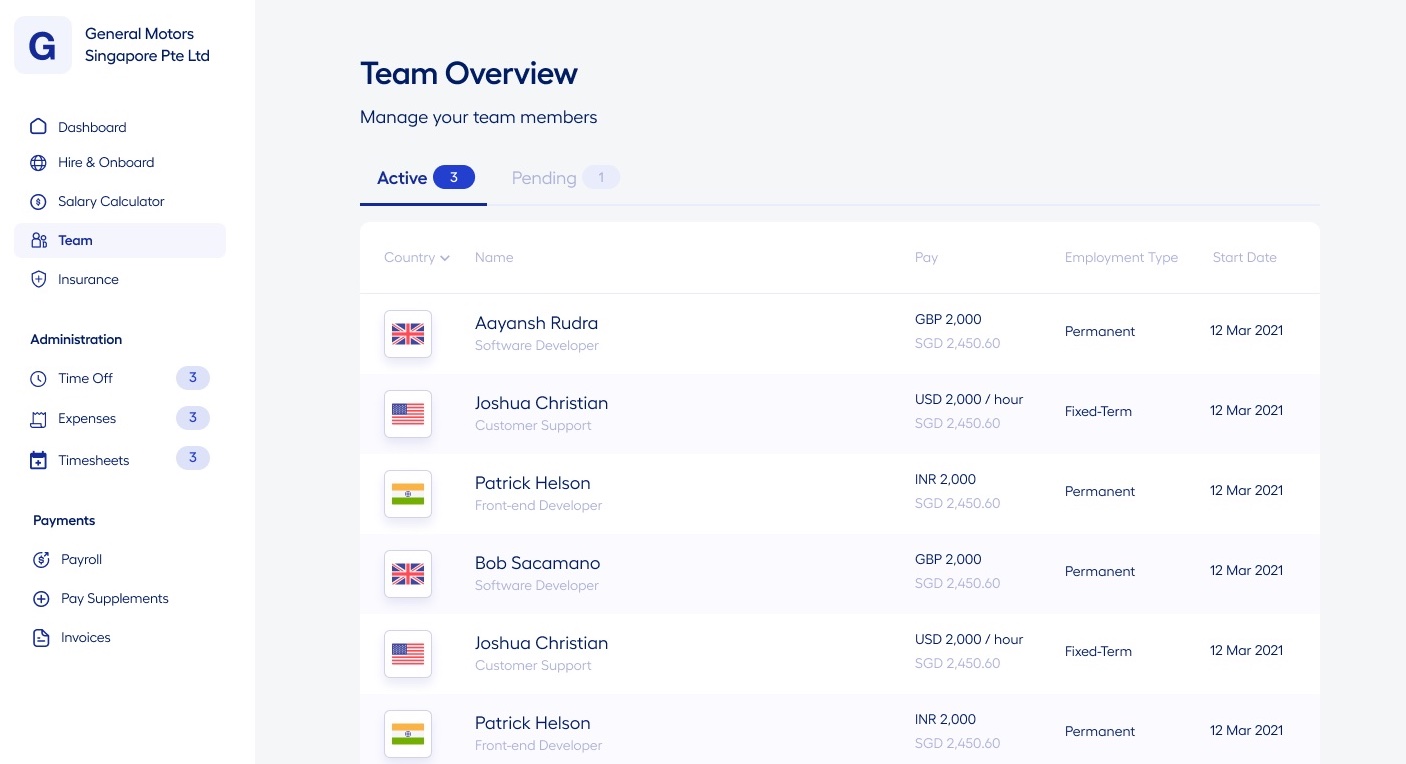

6. Multiplier

Multiplier has a focus on making global hiring and onboarding quick and simple. It operates through direct entities in 150+ countries, giving businesses confidence that payroll and compliance are handled locally.

What makes Multiplier stand out is its speed. Reviews often mention that onboarding can be done in minutes, which makes it appealing for startups and mid-sized companies that need to scale quickly without setting up entities.

Why do companies choose Multiplier?

Direct entity coverage across 150+ countries

Strong customer service praised for responsiveness

Competitive pricing compared to Deel and G-P

“It’s very easy to sign up a new employee, prompt action from the support team, and accurate invoicing and reporting.” - Multiplier Capterra review.

User-flagged challenges

Invoicing and billing practices can feel rigid

Limited transparency around fees makes budgeting harder

Compliance depth isn’t as mature as older players

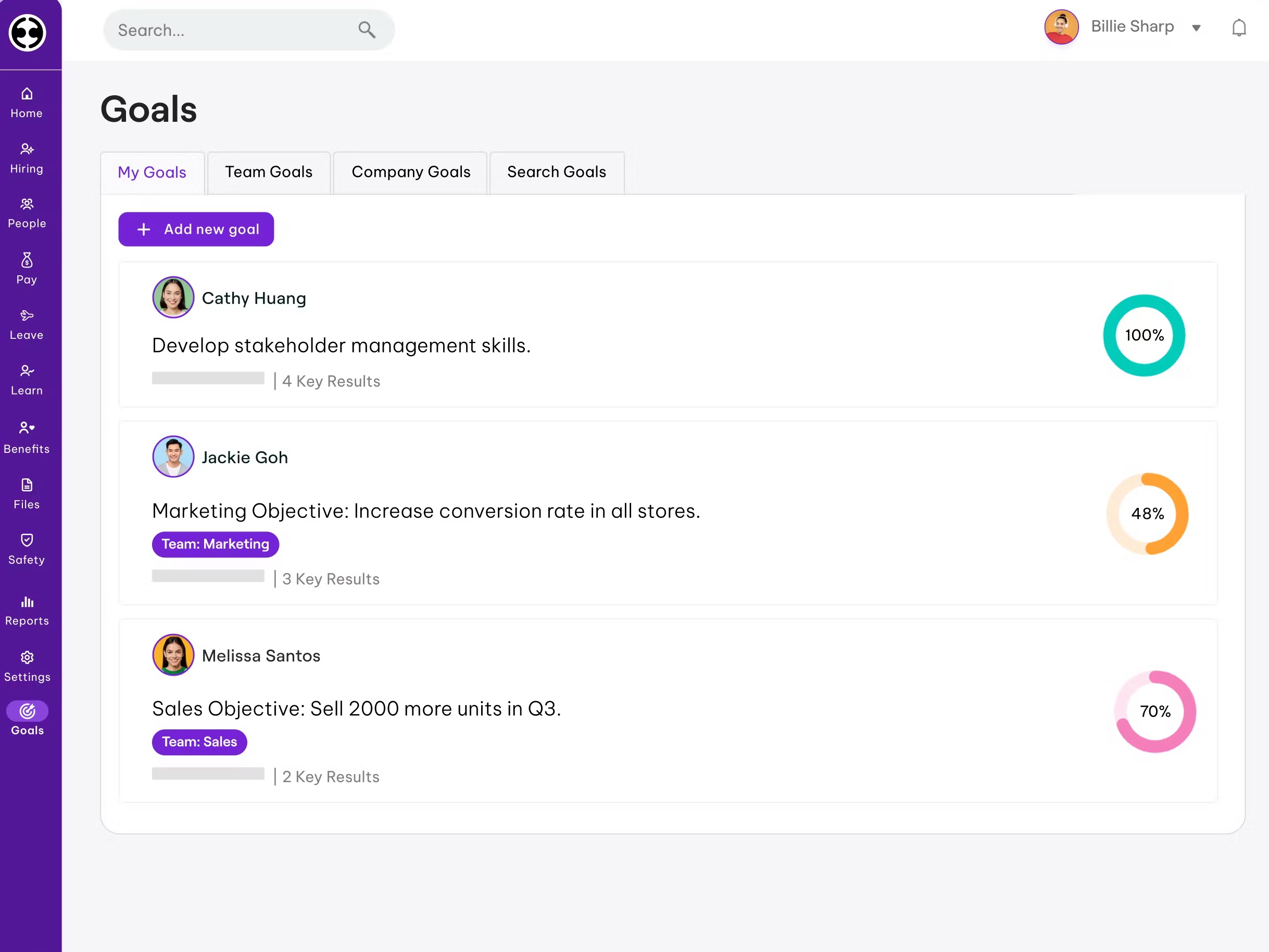

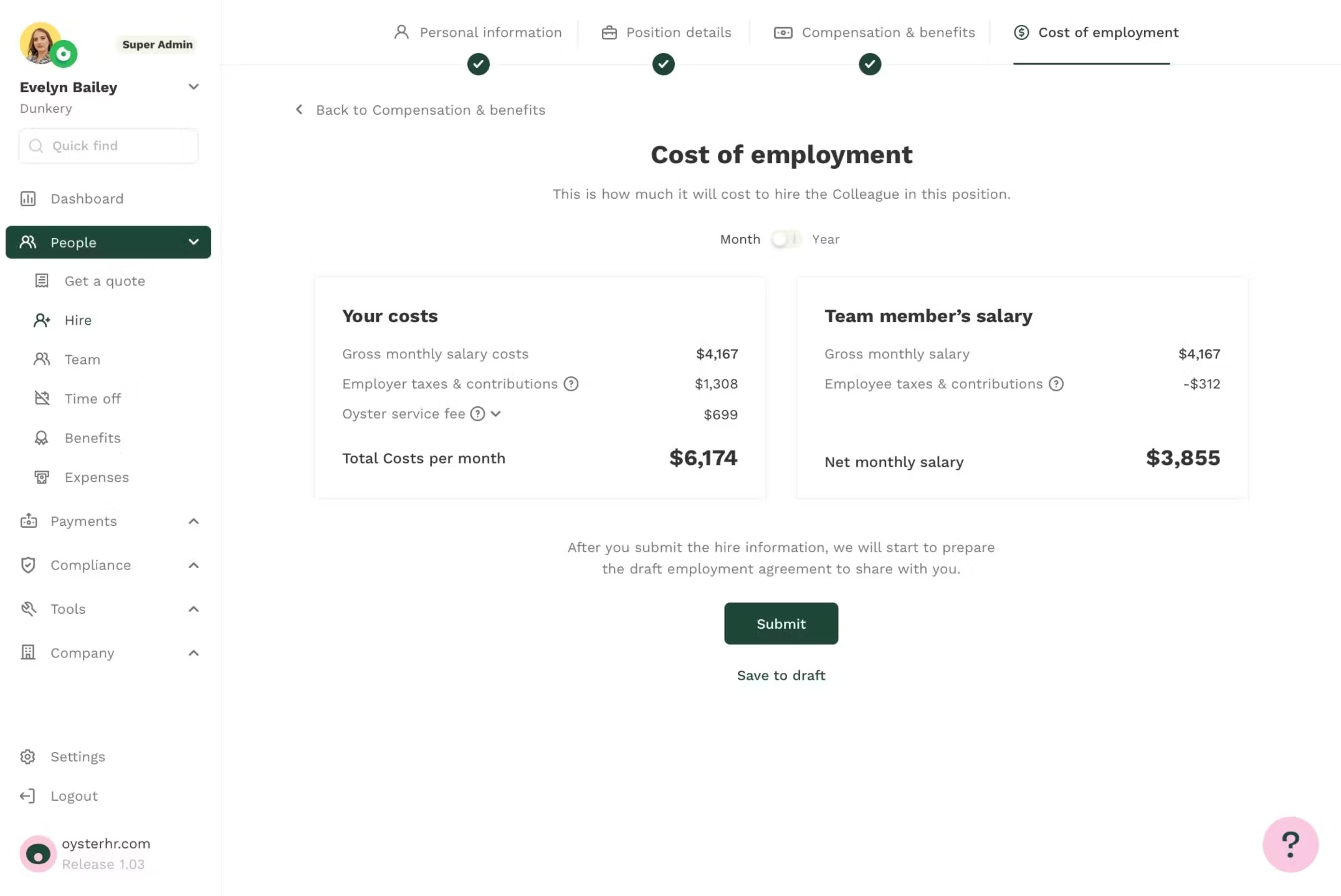

7. Oyster

Oyster is a hybrid EOR with a direct entity in Australia and reach in more than 180 countries. It's often described as easy to use, with a simple interface for both employers and employees. This makes it a good choice for small businesses that don’t need anything complex.

Many reviews also highlight the support team as responsive and helpful, particularly during onboarding and when questions arise.

Why do companies choose Oyster?

Compliance is covered locally through its Australian entity

The platform is straightforward and easy to use

Support staff are responsive and helpful during the onboarding process

“The expenses function is particularly simple and gives transparency on the amounts to be reimbursed very accurately in local currencies.” - Oyster Capterra review.

User-flagged challenges

Payroll cut-offs can be confusing, with delays for expense reimbursements

Some hiring is managed through local partners, which can slow down communication

Pricing runs higher than some competitors, especially for mid-sized businesses

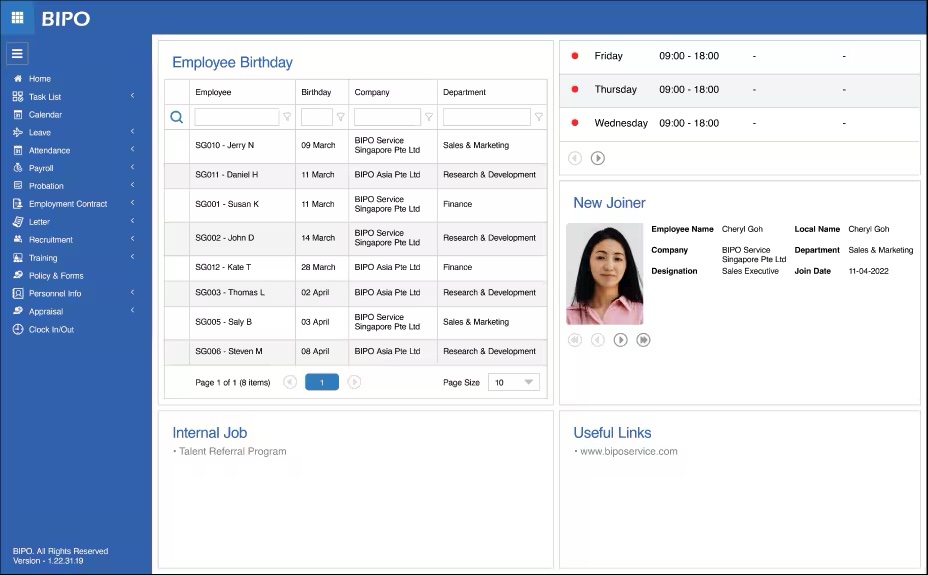

8. BIPO

BIPO stands out for its ease of use, especially for employees. Its mobile app is also frequently praised for making it simple to access payslips, submit leave, and manage timecards without needing to go through HR.

Why do companies choose BIPO?

Mobile app makes self-service simple for employees

Clean, user-friendly interface that works for less tech-savvy teams

Integrates with accounting and ERP systems to cut down on double-handling

“It helps the employees to access their payslips, apply for leave, and submit their time cards from their mobile devices.” - BIPO review on G2.

Challenges users mention

Reporting features are basic, with limited ability for deeper HR data analysis

Frequent password resets and the desktop interface frustrate some users

Customer support could be more responsive for real-time queries

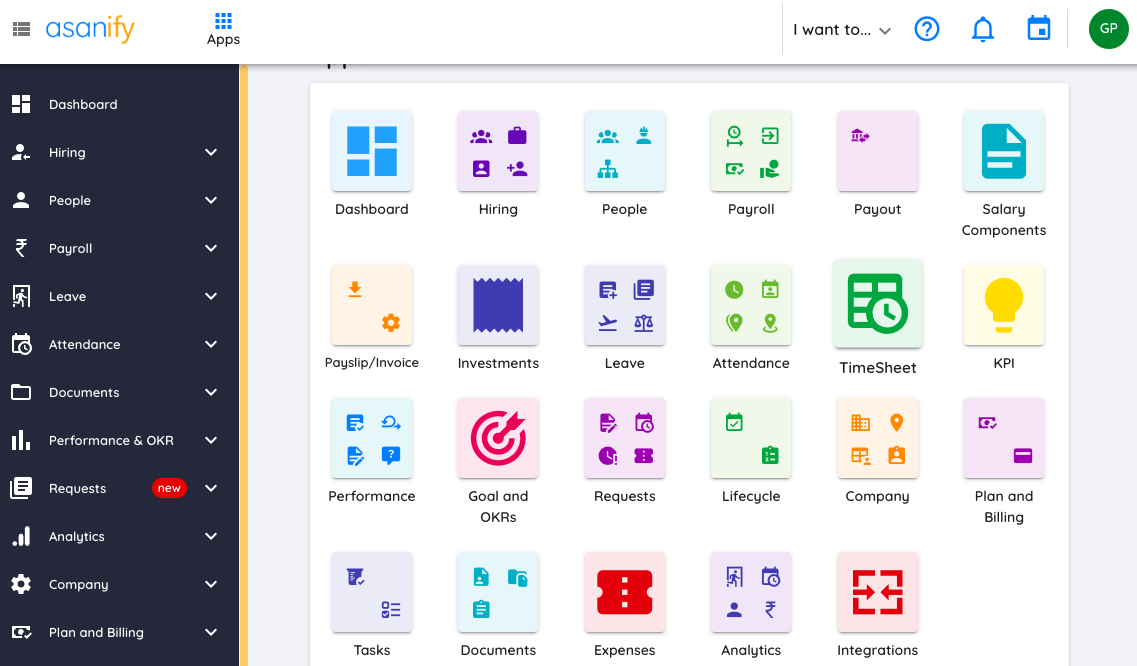

9. Asanify

Asanify is made for startups and small businesses that want payroll and HR handled with as little manual effort as possible. It’s a software-first platform, with automation at the core, covering payroll, leave, attendance, and compliance in Australia.

Its system is built to be quick to set up and easy for non-HR teams to use day-to-day.

Why do companies choose Asanify?

Simple, automated payroll and HR workflows

User-friendly interface that non-HR staff find easy to use

Quick chat support that helps small teams resolve issues fast

“It's become critical to my HR Operations in the company. I no longer have to worry about any people-related matters or payroll.” - Asanify review on Capterra.

User-flagged challenges

The initial setup can be technical and time-consuming

Reporting and data management features are limited

Customisation is limited, with many features fixed rather than optional

10. Borderless AI

Borderless AI is a software platform designed to simplify international hiring and payroll. It supports core entitlements in Australia, such as leave, superannuation, and parental benefits, while extending compliance to more than 170 countries.

What makes it different is its strong focus on payouts. Reviews often highlight its fast, low-cost transfers and payment tracking.

Why do companies choose Borderless AI?

Straightforward interface that makes payouts and payroll easy

Competitive fees compared to traditional banks and processors

Quick onboarding with responsive customer service

“Great, uncomplicated account setup. No long processes, after about a week of compliance, we were in.” - Borderless AI review on Capterra.

User-flagged challenges

Reporting and integrations are limited compared to larger platforms

Compliance processes (like approvals) take longer than expected

Some reviewers want more role-based permissions and flexibility

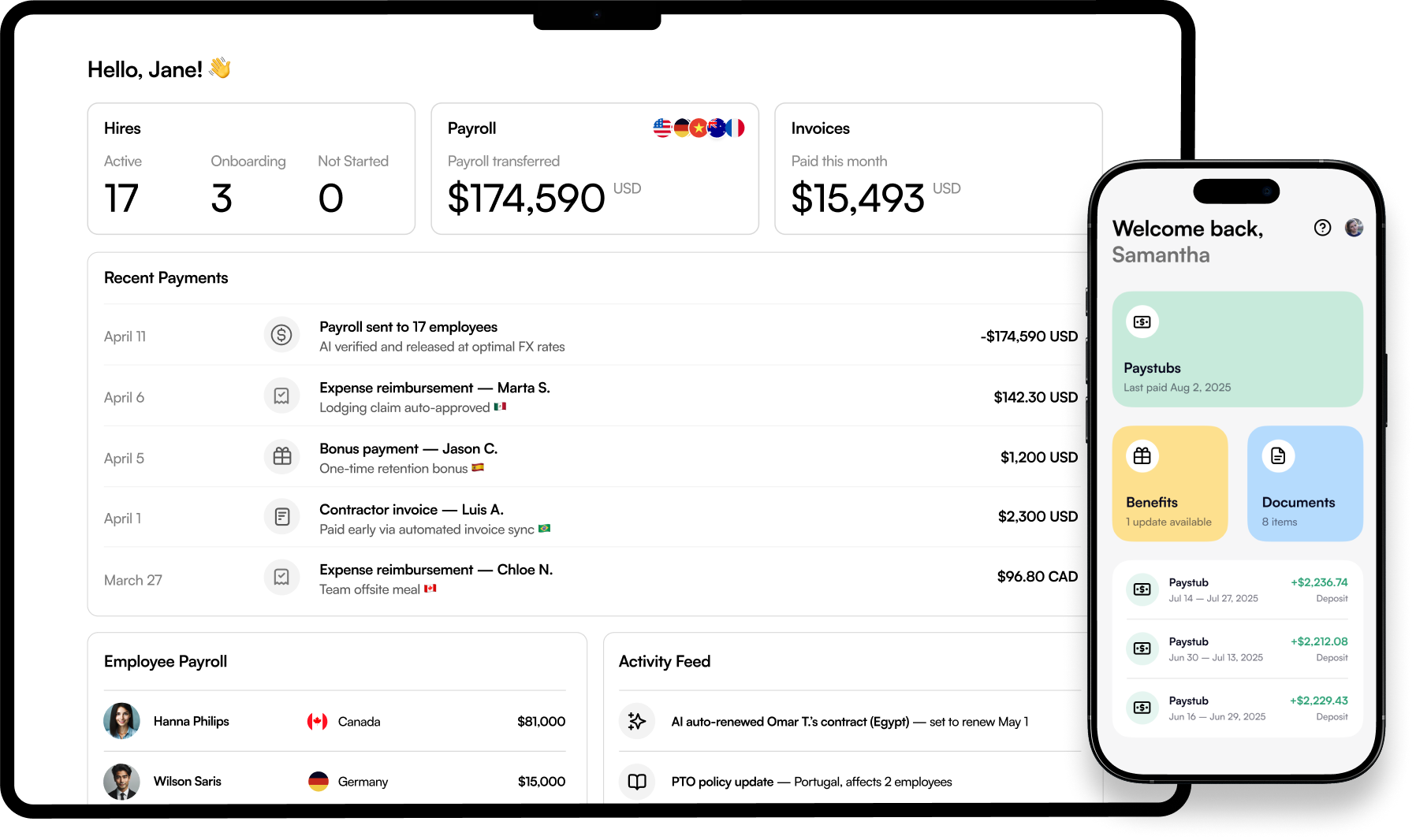

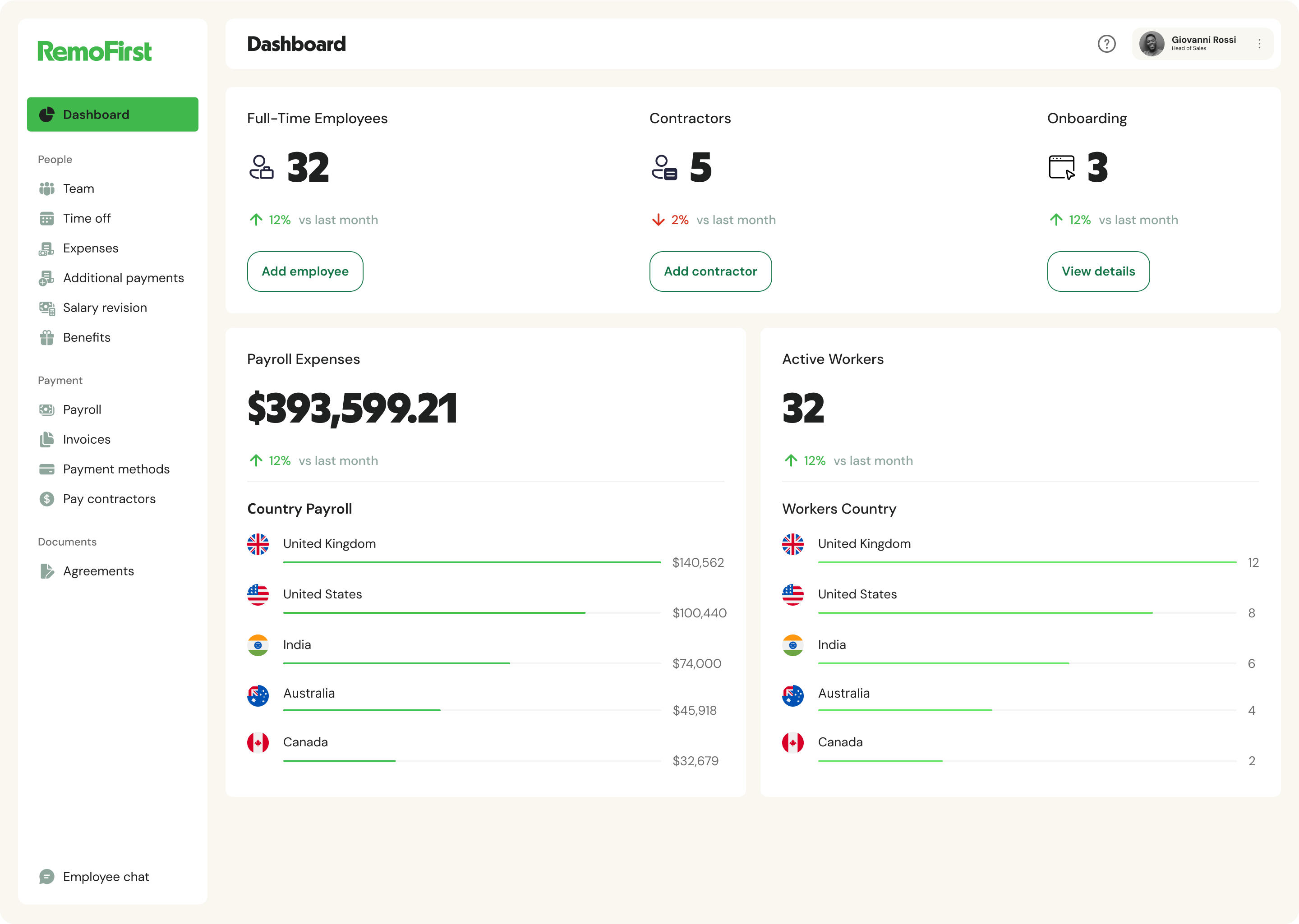

11. RemoFirst

RemoFirst is one of the newer EOR providers, but it has quickly built a reputation for affordability and straightforward service. It supports Australian entitlements like leave, superannuation, and parental benefits, and covers more than 185 countries through its network.

Many reviews note that RemoFirst is cheaper than other providers, while still covering their core payroll and compliance needs.

Why do companies choose RemoFirst?

Competitive pricing compared to larger EORs

Simple platform for payroll, contracts, and bonuses

Great support team that’s responsive and easy to work with

“With RemoFirst we've been able to hire full-time employees in 7 countries with the best pricing across other EORs that we got quotes from.” - RemoFirst Capterra review.

User-flagged challenges

Feature set is still developing compared to older providers

Some contractor tools feel limited or buggy

Reporting and dashboard options are basic

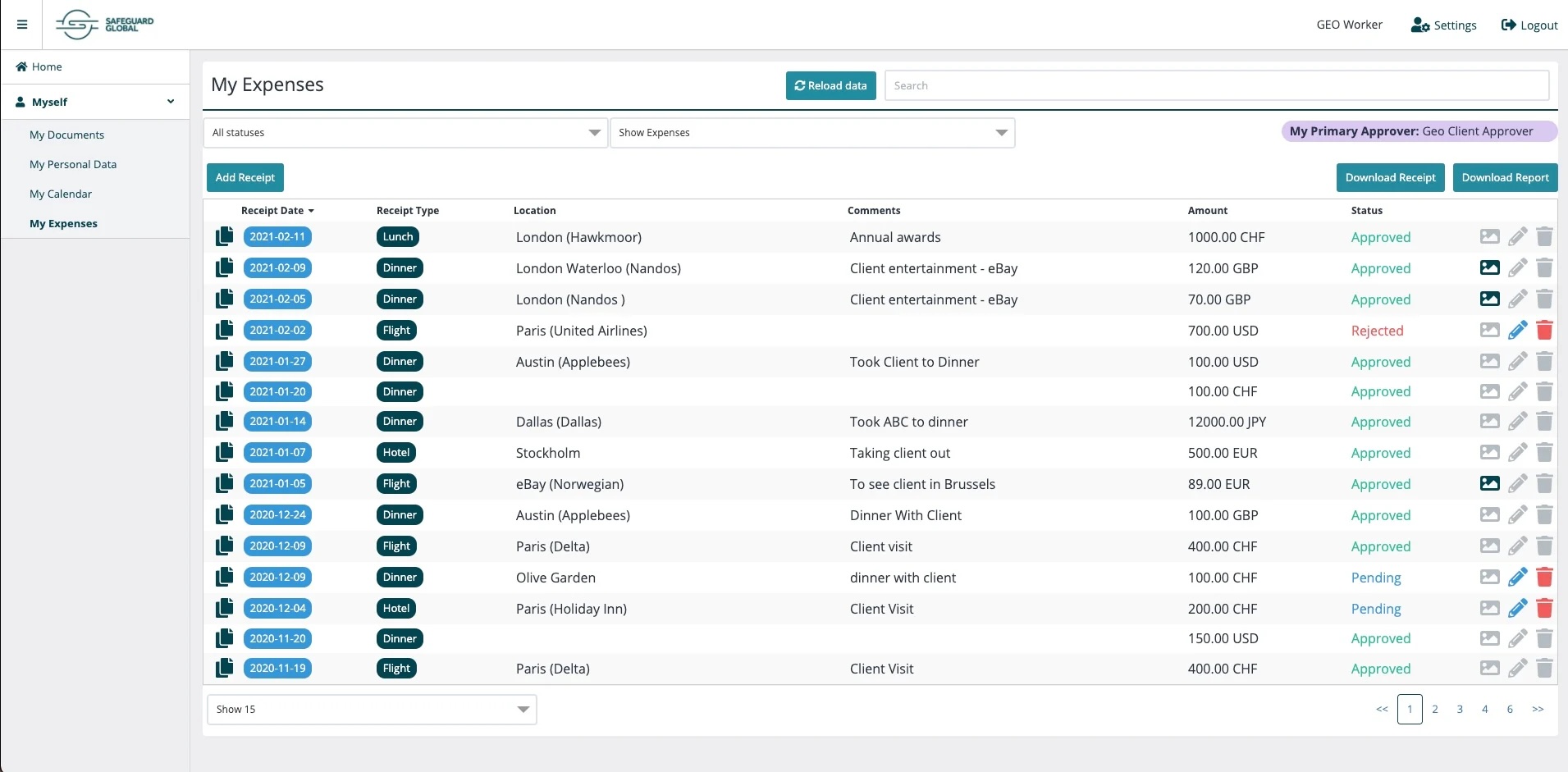

12. Safeguard Global

Safeguard Global is one of the oldest EOR providers, with coverage in 187 countries and deep compliance expertise. It offers a mix of payroll, HR, and advisory services, making it well-suited to large enterprises managing complex, multi-country teams.

Reviews consistently highlight account managers and support staff as helpful, proactive, and focused on long-term relationships rather than just transactions. For big companies that need a strategic partner as much as a service provider, this can make a big difference.

Why do companies choose Safeguard Global?

Large in-country expert network with compliance depth

Works seamlessly with existing HRIS and HCM systems

Account managers are often described as proactive and supportive

“It’s good to have oversight of our people overseas and the cost all in one place. Safeguard has the most advanced platform we have seen for this service.” - Safeguard Global review on G2.

User-flagged challenges

Local HR reps can be unavailable during some time zones

Platform integrations and features are less advanced than newer SaaS competitors

Some services rely on local partners, which can add extra communication layers

What to weigh up when selecting an EOR

Choosing an EOR comes down to what will be the best fit for your business. The right provider should align with how you hire, your budget, and the level of support you expect.

When comparing options, these four questions can help you narrow down which option might be best for your business.

Are you hiring in AUS or internationally?

Think about whether you’re planning to bring employees into Australia or hire internationally. If you’re hiring in Australia, you’ll need strong compliance with Fair Work, superannuation, and leave entitlements. If you’re hiring overseas, you’ll need broad country coverage, reliable payroll, and local benefits that meet market standards.

Being clear on this will help you decide whether to focus on local compliance or international reach.

Do you need software or a consulting service?

Some platforms are software-first, designed around automation, integrations, and self-service dashboards. Others are service-led, where you get more hands-on help from local experts around the world.

If you already have an HR team and want control of the process through technology, a software-first option makes sense. If you don’t have any internal resources and have large hiring plans, service-led support can save you time and reduce the risk of mistakes.

Most EORs present their pricing as a simple per-employee, per-month fee. However, keep in mind that extra costs like foreign exchange margins, onboarding fees, payroll cut-off charges, or premium support can add to this base price.

Before you commit, think about what matters most for your business. For example, do you need strict cost control, or are you comfortable paying more for speed and flexibility? The right choice isn’t always the cheapest option; it’s the one that fits your budget.

Do you need a direct entity or a partner network?

A direct entity means the provider owns its own local company in the country where you are hiring. This gives you more control, faster onboarding, and stronger compliance since everything is handled in-house.

A partner network means the provider works with third-party companies in each country to employ staff. This often gives you wider global coverage at a lower cost, but communication can be slower, and compliance may feel less consistent.

If you want reliability and long-term stability, look for direct entities. If your priority is reaching many countries quickly and cost-effectively, a partner network can be a great choice.

What to expect from an EOR in Australia

Hiring in Australia means strict rules around leave, termination, superannuation, and contracts. A good EOR, like Rippling, takes on these responsibilities so you stay compliant while focusing on growing your team.

1. Employee benefits and paid leave

The NES sets the minimum for paid leave and benefits. Your EOR must correctly put these into contracts and payroll.

2. Termination and redundancy

Notice depends on service length, with extra protections for older employees. A compliant EOR manages this process, including redundancy pay.

|

Up to 1 year | 1 week | 0 weeks |

1–3 years | 2 weeks | 4 weeks |

3–5 years | 3 weeks | 7 weeks |

5+ years | 4 weeks | 12 weeks |

3. Superannuation and taxation

Payroll compliance covers the following main areas.

Obligation | Requirement |

|---|

Superannuation Guarantee | 12% of earnings |

PAYG Withholding | Tax withheld from wages |

Payroll Tax | State-based, applies above thresholds |

4. State/Territory payroll tax rates

Below is a snapshot of payroll tax rates and thresholds by state/territory in Australia. Please note that these are current as of 2025. Always check the relevant state revenue office for the latest numbers.

|

New South Wales (NSW) | 5.45% | $1,200,000 |

Victoria (VIC) | 4.85% | $1,000,000 |

Queensland (QLD) | 4.75% | $1,300,000 |

South Australia (SA) | 4.95% | $1,500,000 |

Tasmania (TAS) | 4.0% - 6.1% | $1,250,000 |

Western Australia (WA) | 0% - 5.5% | $1,000,000 |

Australian Capital Territory (ACT) | 6.85% | $2,000,000 |

Northern Territory (NT) | 5.5% | $2,500,000 (varies) |

*The annual tax-free threshold is the payroll amount under which no payroll tax is paid.

5. Employment contracts and work permits

All your contracts must comply with the NES and modern awards.

For overseas hires, your EOR will also need to manage visa sponsorship and ongoing right-to-work compliance.

Choosing the best EOR for your business

Every provider on this list can handle payroll, contracts, and compliance. The difference is in how they deliver, the support you’ll receive, and whether their model fits the way your business operates.

A software-first platform is best if you want control and automation. A service-led option is better if you don’t have internal HR resources and need more hands-on support.

Rippling ranked first in my review because it’s the strongest provider that combines HR, payroll, IT, and compliance in one system, while also running through a direct entity in Australia.

If you want confidence in Fair Work compliance and the ability to scale globally, book a demo to learn more about Rippling’s Employer of Record service.

FAQs

What does an employer of record mean in Australia?

An employer of record in Australia is a third party that takes on payroll, contracts, and compliance with local labour laws. This setup enables companies to hire staff without setting up a local legal entity.

How do EOR platforms work?

EOR platforms use tech and sometimes add-on services to manage payroll, contracts, and compliance risk. Some, like Oyster HR, focus on simple self-service, while others blend automation with hands-on support.

What are the key benefits of using an EOR company?

The key benefits include faster international expansion, access to a broader talent pool and simplified payroll processing. An EOR also helps with benefits administration and ensuring compliance with local employment regulations.

How do payroll and tax withholding work under an EOR?

The EOR acts as the legal employer, running the payroll system, managing payroll benefits, and handling tax withholding in line with local law.

Disclaimer

Rippling and its affiliates do not provide tax, accounting, or legal advice. This material has been prepared for informational purposes only, and is not intended to provide or be relied on for tax, accounting, or legal advice. You should consult your own tax, accounting and legal advisers before engaging in any related activities or transactions.