Job Costing

See where employees’ time goes—and what it costs you

fully configurable system

Built for any type of business

Resolve employee hours with ease

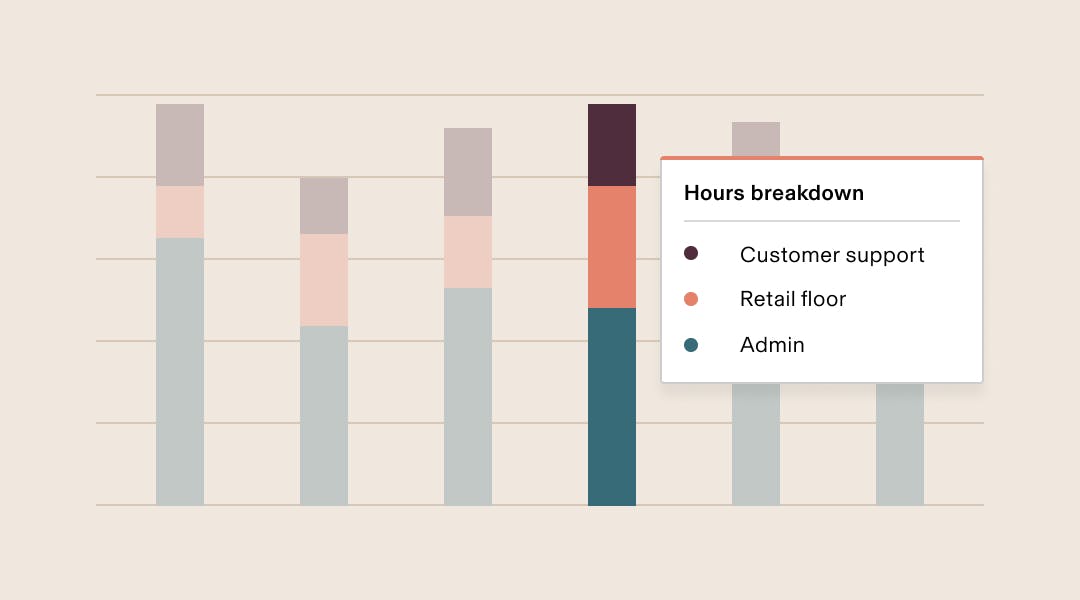

Track how your employees are spending their time, not just how many hours your employees are working. Almost every payroll system can tell you total hours worked at base pay or overtime. Most don't let you peer beneath the surface to see what employees were doing with different chunks of time.

Temporarily amend employee attributes

Employees might be paid different hourly rates depending on the broader circumstances and needs of your business. For instance, an employee might be temporarily reassigned to a different department or work at different locations—maybe even in different states. Job costing allows you to correctly record the employee’s wages and taxes accordingly.

features

Job costing, simplified

One integrated system

Rippling is the only provider to integrate job costing throughout the entire platform and can even integrate with your accounting system—all to give you extended functionality while automating much of the manual admin tasks that other, disjointed systems require.

Fully configurable dimensions

You can create unlimited dimensions to track jobs, locations, projects, clients, funding sources, and more. These dimensions can be assigned to everyone in the company or to specific people only. You can also allocate a certain percentage of an employee's pay to a specific dimension.

Embedded into time & attendance

Employees can track hours across different jobs or dimensions when they clock in or fill out a timesheet. You can create custom alerts and approvals for different job codes and report on hours across every dimension.

Automated split costing in payroll

Payroll turns the hours from time and attendance into dollar amounts, allowing you to track costs of wages as well as taxes and benefits. You can also track reports across any dimension.

Integrated with your accounting software

With Rippling’s pre-built accounting integrations, all of this split costing flows directly into your general ledger—no manual updates or data entry required.

USE CASES

Track employee hours based on almost any characteristic

Tasks

If your employees perform different tasks throughout the day—for example, working as a cashier, restocking inventory, and assisting customers—you can track your payroll costs split out by these different areas of work (and publish these costs properly to your general ledger system).

Multiple work locations

If individual employees split their time across multiple work locations, you can track costs by location using Jobs. You can also ensure that an employees’ payroll tax withholding is correct across multiple work locations—even if those work locations are in different tax jurisdictions or even different states.

Multiple pay rates and complex pay structure

If your employees get paid different rates based on the work they are performing, you can set up Jobs in Rippling and assign different hourly rates to each. Rippling will automatically pay employees the appropriate hourly rate for each Job.

Non-profit grant accounting

If you're a non-profit with multiple foundation grants, you may need to track payroll costs back to work performed under specific grants. You can set up each grant as a different Job in Rippling and track employee hours (and costs) according to grant.

Projects and project-based accounting

If your employees work on different projects, you may want to understand costs (and, eventually, profitability) across each of these projects. You can set up each of these projects as separate Jobs in Rippling and then record payroll costs by Job in your accounting system.

Client-based work

If your employees spend time working on different client projects, you can track their time back to specific clients and then record your payroll costs by client.

Workers’ compensation

If your workers' comp classification varies by Job, you can track payroll costs accordingly to report out to your insurance carrier. For example, if you run a roofing company, your employees might have one workers' comp classification for hours spent working on a roof and another for hours spent consulting with a client about a potential project.

Multiple entities

If you have multiple EINs in your Rippling instance and have employees who might work for both EINs during one pay period, Jobs can be used to allocate portions of an employee's time to different entities.

“Rippling is A+A+ for companies scalingscaling fastfast”

Authenticated Reviewer

Computer Software

“Rippling makes it easyeasy to manage my globalglobal teamteam”

Authenticated Reviewer

IT & Services Company

“Rippling saves time,time, moneymoney andand headachesheadaches”

Authenticated Reviewer

Staffing & Recruiting

“Rippling is a greatgreat choicechoice forfor remoteremote teamsteams”

Authenticated Reviewer

Marketing & Advertising

“AmazingAmazing productproduct for our small business”

Authenticated Reviewer

Venture Capital & Private Equity

See Rippling in action

Rippling is a single platform that can help your business manage all of its employee data and operations, no matter its size.