We value your privacy. Learn more.

PEO software

Big-company benefits and expert support

Rippling PEO gives small businesses access to affordable benefits and expert HR and compliance support—all built on the #1 rated HR software.

Today’s leading businesses run on Rippling

Unmatched benefits and support powered by the #1 rated HR software

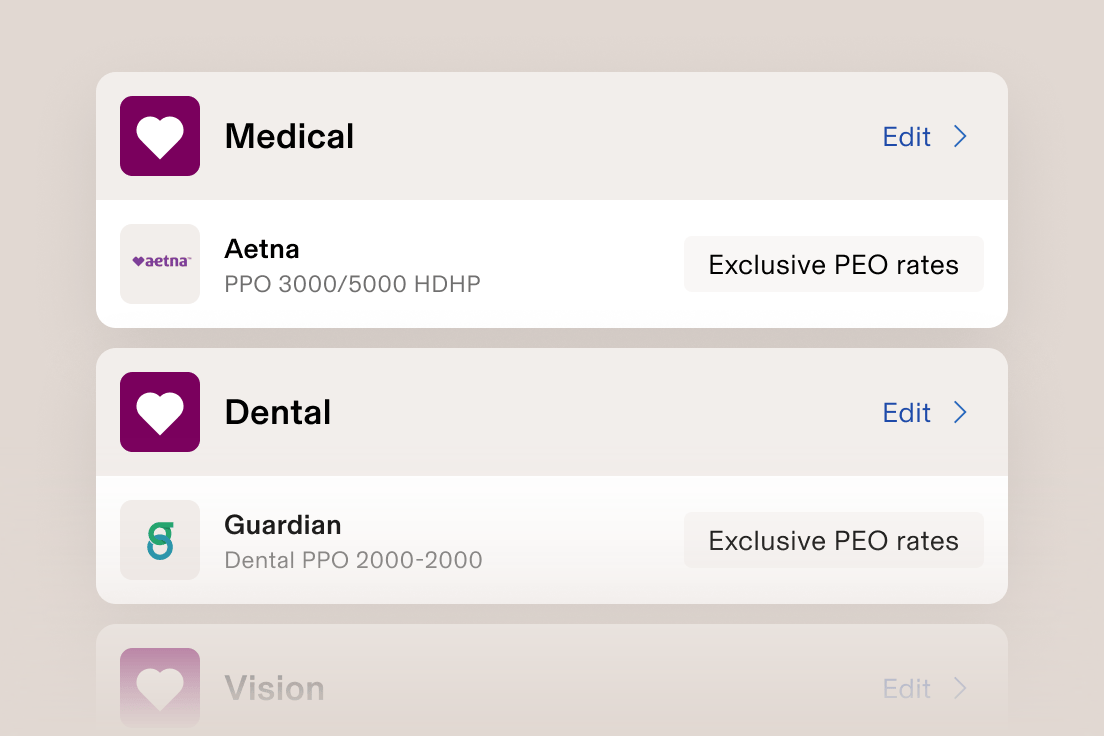

Competitive plans and pricing

Build plans that meet business and employee needs

Attract top talent with big company benefits packages at affordable and predictable rates—delivered through easy, online benefits enrollment.

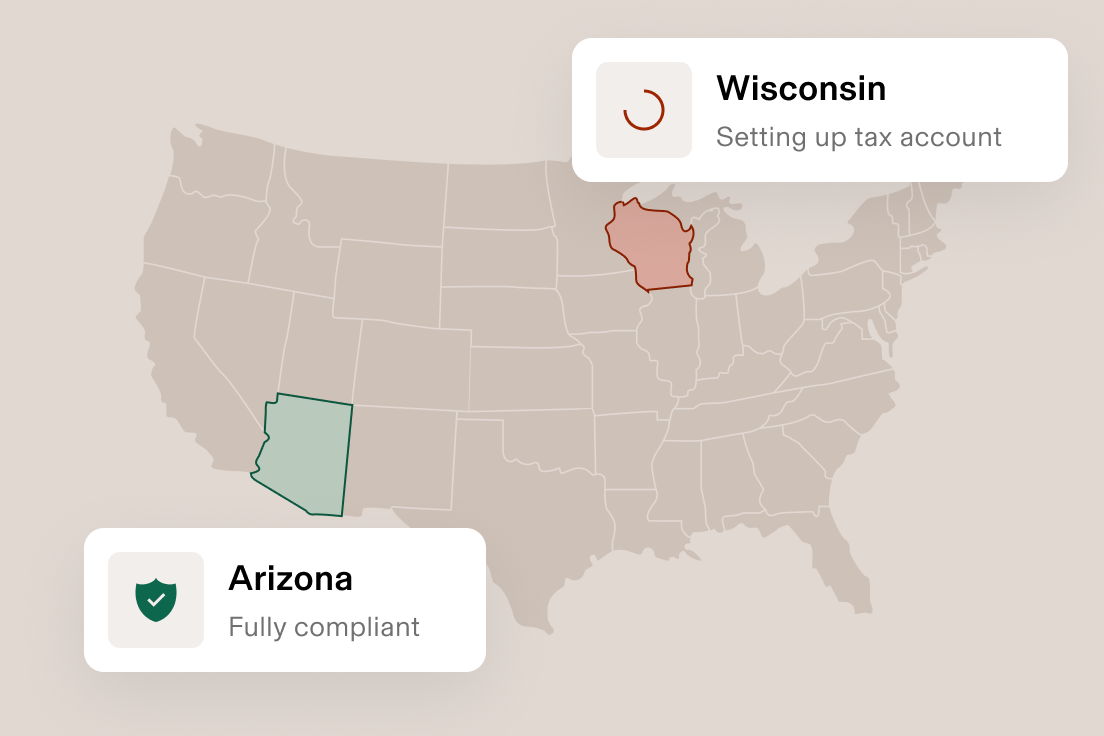

Comprehensive compliance

Minimize compliance gaps and penalties

Rippling automates dozens of filings other platforms can’t—including federal compliance requirements and state specific reporting. We’ll even keep you protected from claims with EPLI and workers’ comp coverage.

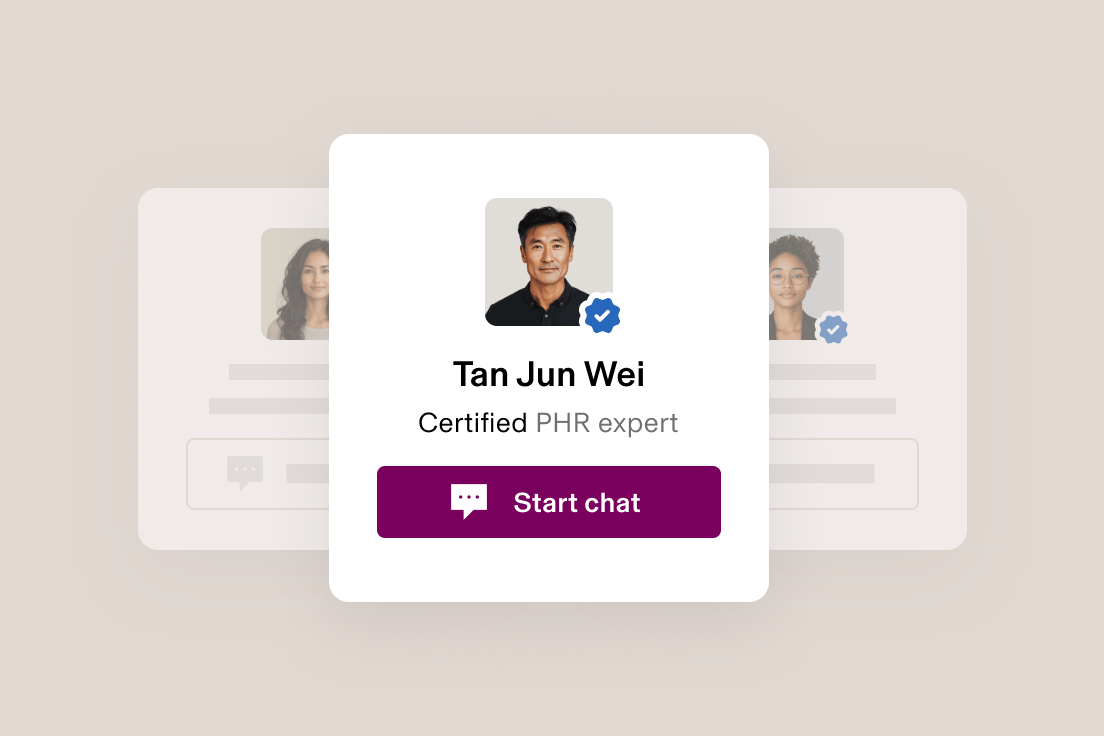

Expert guidance

Get on-demand HR support

Consult with Rippling’s PHR and SHRM certified experts for help navigating complex topics like performance management, leave policies, and more.

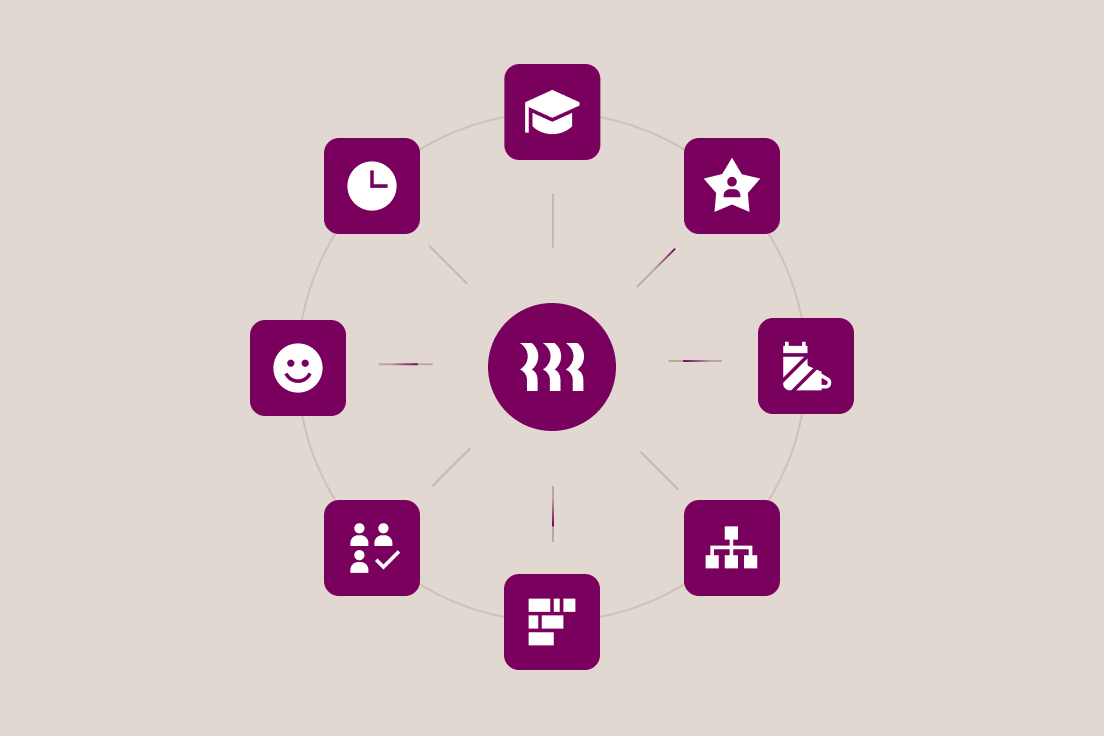

All-in-one platform

Run on the #1 rated HCM

Running on Rippling unlocks built-in provisioning, powerful reporting, and time saving workflows—like simplified employee benefits enrollment and auto-syncing deductions with payroll.

Get more from your PEO with Rippling

Employee handbook builder

Quickly set up a compliant handbook and get alerts on new regulations and labor laws with Mineral.

Built-in employee training

Automatically enroll employees in state and federal compliance training no matter where they work.

Real-time benefits support

Direct employees to Rightway's dedicated clinical experts for high-quality, cost-effective care.

The only PEO software built to meet your changing needs

Rippling is the only provider to let you move off PEO without replacing your underlying system. We give you total flexibility over whether to stick with PEO, shift to HR services, or stay on the Rippling platform as your business evolves.

Explore more HR products from Rippling

Built different

Learn more about the Rippling platformMeet the platform powering your PEO

Most "all-in-one" software consists of acquired systems. These modules are disconnected, so your business data is, too. Rippling takes a platform approach, building products on a single source of truth for all the business data related to employees. This rich, flexible data source unlocks a powerful set of capabilities.

650+ integrations with your favorite apps

Small businesses scale faster on Rippling

See how Rippling PEO can support your benefits program

FAQs

What does PEO stand for?

PEO stands for professional employer organization.

What is a PEO services company?

A PEO (professional employer organization) is a technology and service offering that takes payroll services, benefits, HR tasks, and compliance work off your plate, so you can focus on growing your business.

What is an example of a PEO?

A PEO (professional employer organization) is a company that partners with businesses to manage payroll processing, benefits administration, HR, and compliance. An example of a PEO is Rippling PEO, one of the largest PEOs in the United States. Rippling PEO provides comprehensive services and technology solutions including payroll automation, employee benefits, HR expertise, and compliance support. By partnering with Rippling PEO, businesses can leverage expertise and technology to streamline their business operations, often leading to cost savings and improved efficiency.

Is Rippling a PEO?

Yes, Rippling is a PEO and so much more. Rippling is a unified workforce management platform that offloads your HR, IT, and Finance busy work with powerful automation and services. We'll handle your benefits, payroll, HR, compliance, spend management, IT, device management, and more.

What is the difference between PEO and HRIS?

A PEO is not just a software, but a combination of services and technology. Entering a PEO also means entering a co-employment with a provider and sharing employer responsibilities. Your PEO manages benefits administration, workers' compensation, and compliance. An HRIS is primarily a software system for managing HR processes and employee data, like role transitions, compensation bands, headcount planning, and HR documents.

How do I choose the best PEO for my company?

Choosing the best PEO for your company is a significant decision that can streamline your HR management and free you up to focus on your core business needs. When evaluating service providers, consider several key factors to ensure you find the right fit:

Scope of HR functionality:

Evaluate the range of HR functions covered. Does the PEO offer comprehensive compliance solutions, including assistance with tax filings and navigating employment laws? Are their employee benefits packages competitive to aid in retention?

Pricing and affordability:

For everyone from small businesses to enterprises, understand the pricing structure and ensure it aligns with your budget.

Scalability and all-in-one fit:

Check if the PEO can scale with your business needs as you grow, potentially supporting mid-sized businesses and even global payroll in the future. Look for a modern, unified technology platform, like Rippling's, that automates time-consuming administrative tasks such as payroll processing and benefits administration.