Building the WGEA report in Rippling

Australia's push to close the gender pay gap has taken a concrete form with the updated requirements for the Workplace Gender Equality Agency (WGEA) report. Now, businesses with 100 or more employees are required to publicly share a broad range of workplace gender equality data.

Starting from the 2023 reporting season, the WGEA will also publish this data at the employer level. Additionally, from the 2024 reporting season, businesses must include specific details about their top leadership, even in the private sector. This move aims to enhance transparency and speed progress toward improving Australia’s gender equality in the workplace.

First time filing the annual report? Rippling is the go-to platform for simplifying this complex process. Our comprehensive human resources software streamlines your workforce management. For WGEA reporting, this means easy access to the necessary data, simplifying compliance, and beyond.

In this article, we explore the WGEA report essentials and discuss how Rippling's features streamline the entire process. Read on to see how you can reduce the burden of compliance and turn it into an opportunity for positive change at your company.

WGEA reporting overview

When it comes time to report on gender equality within your business—the submission period is between 1 April to 31 May 2024—the Workplace Gender Equality Agency requires a thorough submission. Here's an overview of what you'll need to do to comply with their reporting requirements:

- Confirm the details of your business and the contacts responsible for the submission.

- Fill out an online survey about your business’s gender equality policies, strategies, and actions.

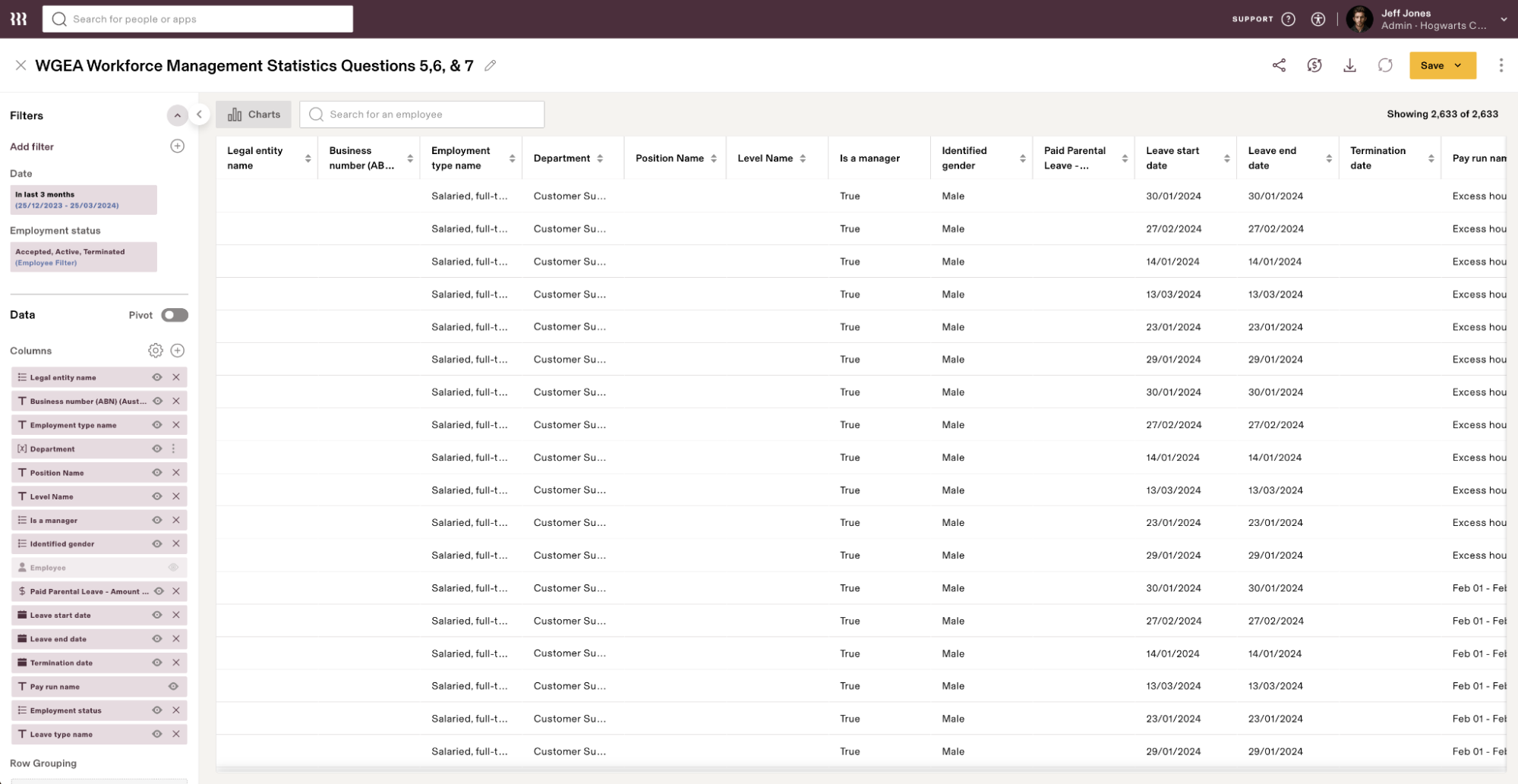

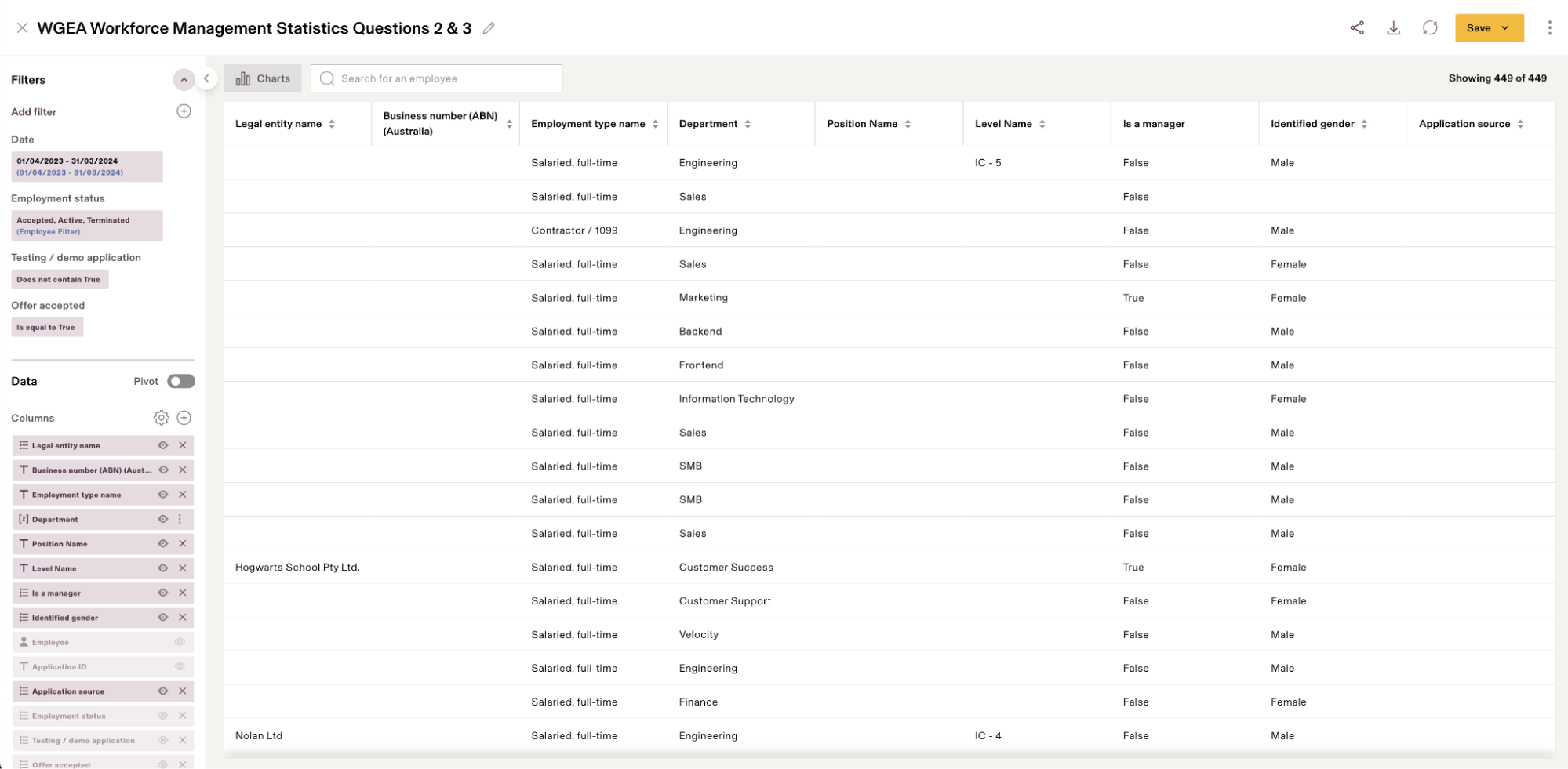

- Complete and upload a Workforce Management Statistics Sheet detailing employee movements, like appointments, promotions, resignations, and parental leave.

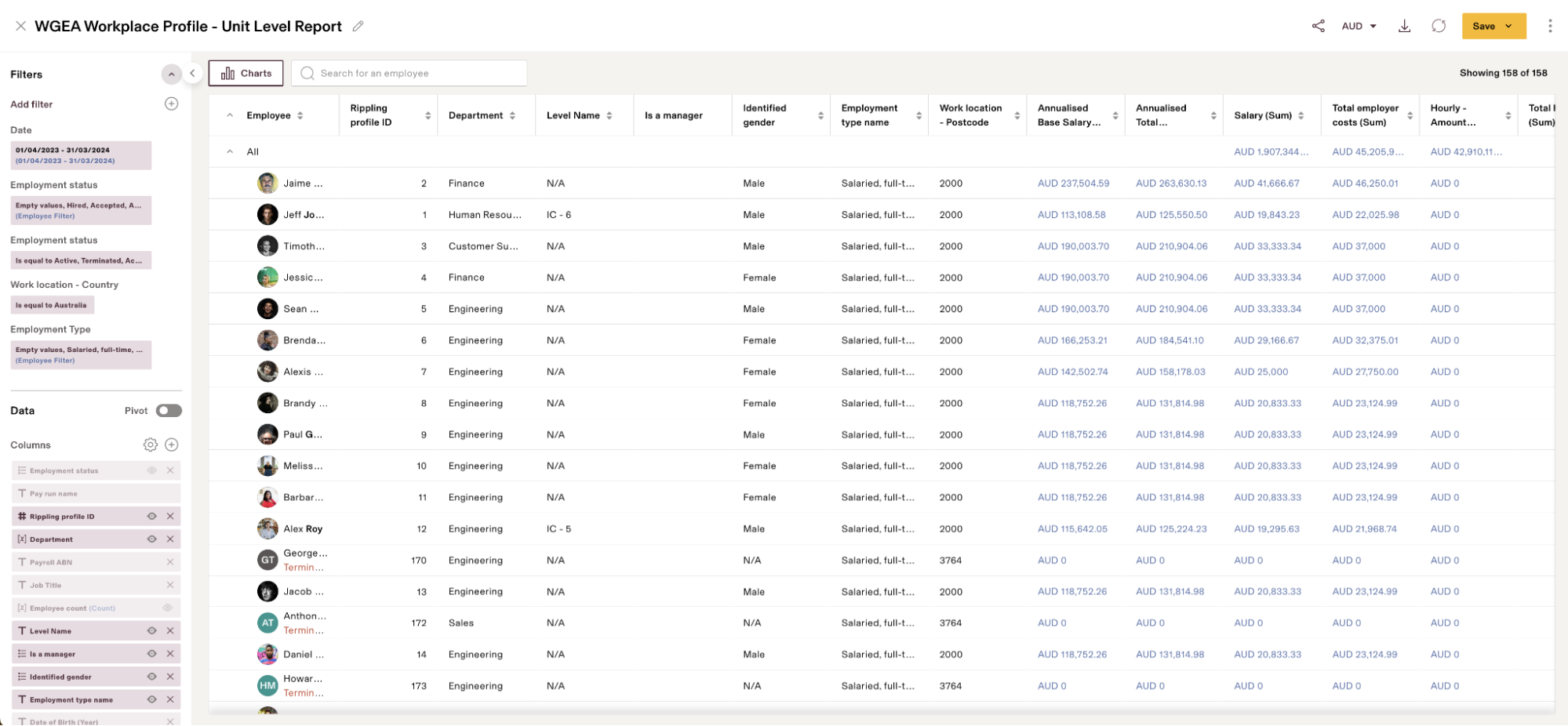

- Complete and upload a Workplace Profile that outlines workforce composition, base salaries, and total remuneration.

- Ensure your WGEA data passes quality checks, and have your CEO or equivalent review and sign off on the required reporting documents.

- Submit your WGEA report and make any necessary edits or updates within 28 days, provided you submit before the due date. (Note that late submissions might not get the full editing period, and you won’t be able to edit the report once the editing period ends or you receive a compliance certificate.)

Below, you can find some key details and prerequisites you’ll need to navigate the reporting process smoothly:

- You'll need access to the WGEA Portal which requires a Digital Identity (e.g., myGovID) that allows you to represent your employer for WGEA reporting.

- Your contact and business details must be current in the WGEA system before starting your submission.

- You'll require detailed information for each employee, including annualised Full-Time Equivalent (FTE) values, organised by various employee demographics and employment types.

- To prepare your submission data accurately, it's important to check the latest reporting templates and guidelines on the WGEA website.

Remember, staying ahead of these requirements not only ensures compliance, but also reflects your commitment to promoting gender equality in the workplace.

Rippling infrastructure and feature set

Rippling offers a fully customisable HR solution. Our underlying infrastructure and feature set support complex needs, such as Workplace Gender Equality Agency reporting, which you can explore below:

- Central employee database: Rippling consolidates all employee data into one accessible location. This centralisation facilitates everything from managing leave to running payroll and streamlining the retrieval of Workplace Gender Equality Act report information.

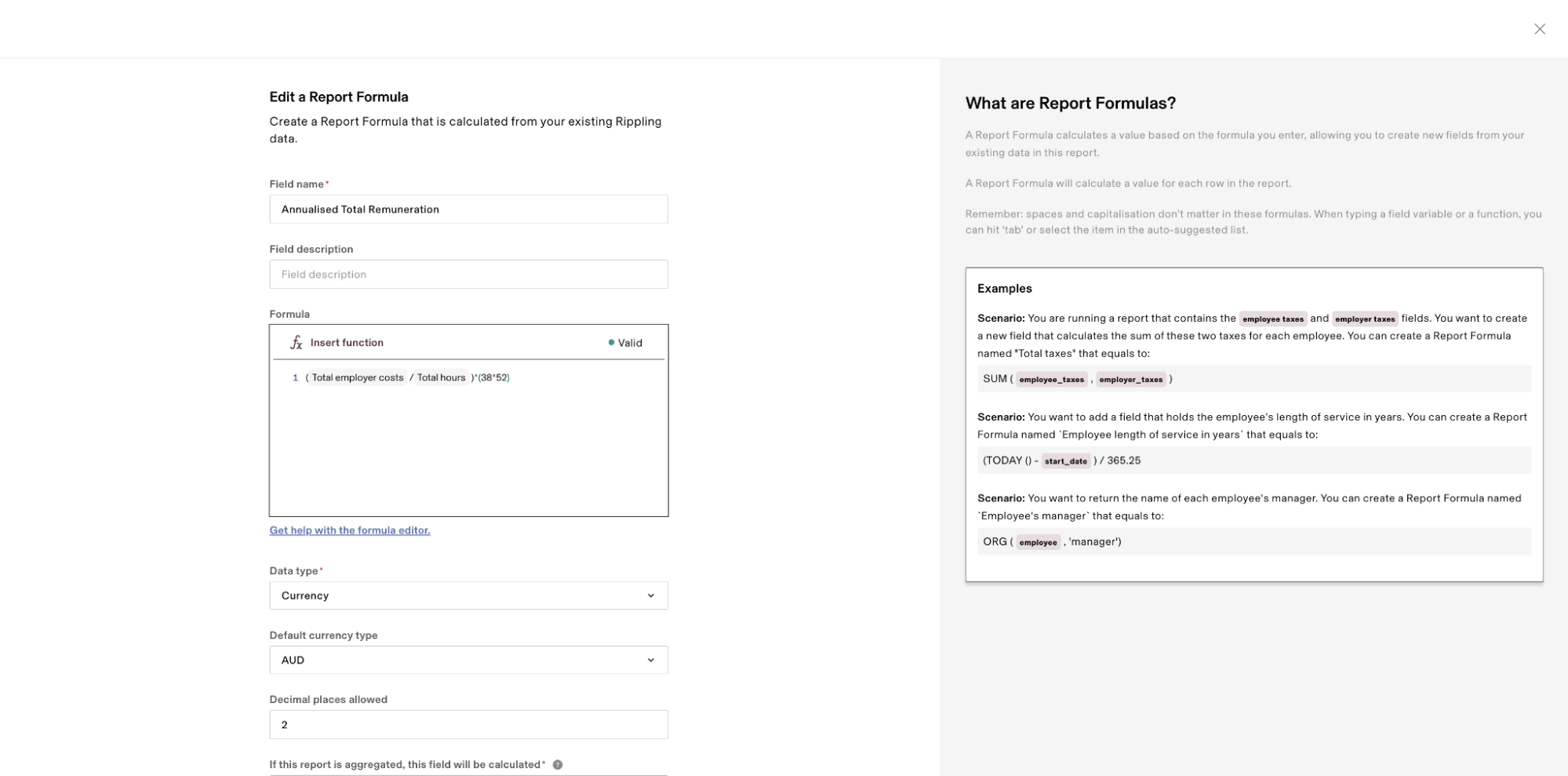

- Advanced formula fields for complex calculations: Rippling's advanced formula fields simplify the calculation of complex data, allowing for custom employee-level fields. You can run reports on any of these fields within Rippling, which is especially useful for calculations like annualised salaries.

- Localisation for Australian workplaces: Rippling has adapted its platform to meet Australian commonwealth employment standards, ensuring compliance. This adaptation guarantees that pay types and leave policies align with local requirements.

- Efficient data gathering: Rippling serves as a comprehensive repository for HR, salary, and other pertinent employee data. It also simplifies the data export process, making it dead simple to gather necessary information.

- Tailored reporting with Rippling Recipes: Rippling offers pre-built templates, which we refer to as recipes, including one specifically for WGEA. These recipes provide a foundation for reporting that you can customise to meet your business's unique needs.

How Rippling streamlines WGEA reporting

Rippling offers targeted solutions to streamline the Workplace Gender Equality Act reporting, focusing on key areas where businesses often face challenges. Below, you can explore the specific ways in which you can use Rippling to assist with your WGEA report submission:

Calculating precise annualised salaries

Rippling simplifies salary reporting by automatically annualising employee salaries, covering both base and annualised figures for the entire snapshot year. It provides options to customise wage types and adjust average weekly hours to ensure accuracy, catering to your business's unique payroll structure.

Generating reports for custom time periods flexibly

Acknowledging the Workplace Gender Equality Agency's requirement for reporting within specific time frames, Rippling offers flexible filters for data inclusion. Whether it's the April to March reporting period or any other custom range, Rippling ensures precision in selecting and reporting the exact data needed, thanks to its date-based filtering capabilities.

Integrating comprehensive data

Rippling's unified platform allows for the seamless selection and merging of various data fields necessary for gender equality reporting. This capability ensures that all relevant employee information can appear in one single report, creating a cohesive document that meets compliance standards without requiring manual data consolidation.

Using custom values for detailed reporting

With Rippling, you can introduce custom fields, pay types, and leave categories, enhancing the granularity of reports. This feature is particularly useful for including specific roles and classifications the Workplace Gender Equality Agency requires, like key personnel or department heads, ensuring you capture all necessary details accurately and efficiently.

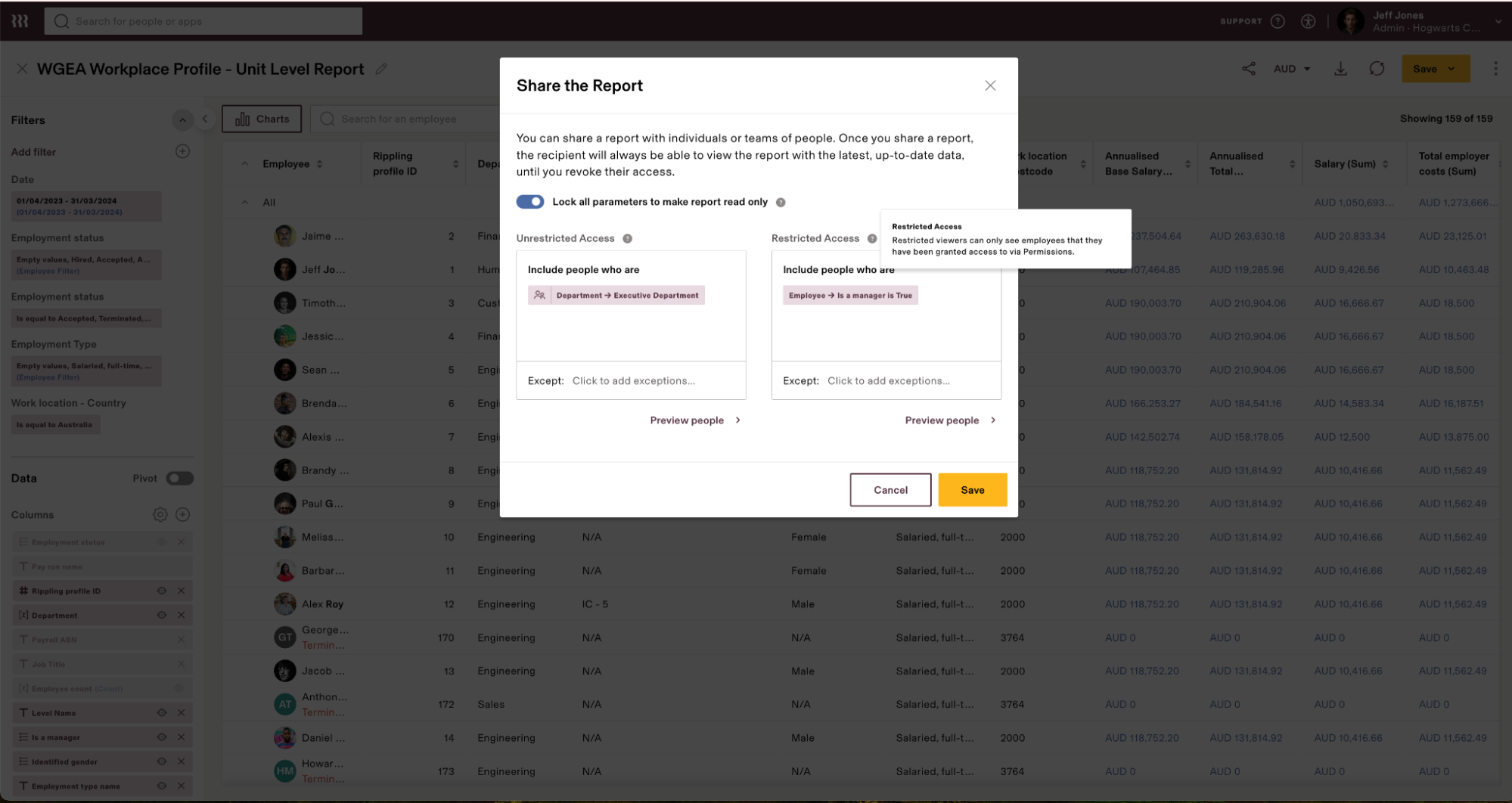

Facilitating streamlined data sharing

Rippling enhances collaboration and visibility by enabling single-click sharing of WGEA reporting data directly within the platform, eliminating the cumbersome process of exporting and circulating spreadsheets. This feature ensures that teams and departments can easily access and review pertinent information, creating a more unified approach to meeting Workplace Gender Equality Act requirements.

Challenges of WGEA Reporting without Rippling

The absence of an integrated system like Rippling increases the complexity and time needed to compile the Workplace Gender Equality Agency report, which burdens your businesses with additional administrative tasks.

Navigating WGEA reporting without Rippling means aggregating promotion, appointment, termination and parental leave data from your HR system or payroll. Additionally, you’ll need to convert all this data into the required formats for both the WGEA questionnaire and the Workplace Profile Report.

Make WGEA reporting a breeze

Rippling offers a powerful and flexible solution that significantly simplifies Workplace Gender Equality Agency reporting. It directly addresses the challenges of improving gender pay gap data and workplace gender equality. By automating data collection, streamlining report generation, and ensuring compliance through localisation and tailored reporting, Rippling empowers your business to focus on fostering gender equity.

With Rippling, Australian businesses can confidently navigate the complexities of WGEA compliance, turning a regulatory requirement into an opportunity for positive organisational change.

Disclaimer: Rippling and its affiliates do not provide tax, accounting, or legal advice. This material has been prepared for informational purposes only, and is not intended to provide or be relied on for tax, accounting, or legal advice. You should consult your own tax, accounting, and legal advisors before engaging in any related activities or transactions.