How to hire employees in Ireland through an Employer of Record (EOR) [Updated 2024]

Thinking of hiring employees in the Emerald Isle? The Republic of Ireland has one of the most highly educated workforces in the world, which draws International companies to thriving cities like Dublin.

Many employers begin by hiring Irish contractors and sending international payments. However, if you’re ready to permanently expand and want to hire full-time employees, you’ll either need to establish a legal entity in Ireland or hire through an EOR.

Registering a legal entity can take months by the time you complete and send in the paperwork and fulfill the requirement of having at least one director who is a citizen of the European Economic Area (EEA). Once established, it also requires knowledge of both Irish and employment tax regulations so you remain compliant with the Revenue Commissioners (commonly known as “Revenue”).

Alternatively, you can use an “Employer of Record” (EOR), which handles Irish payroll, tax, and compliance considerations. Through Rippling EOR’s entities, you can start hiring and working with employees in Ireland quickly and compliantly—without needing to be an expert on Irish employment laws.

Here’s a step-by-step guide for hiring through an EOR in Ireland.

Step by step: How to hire through an Employer of Record in Ireland

Step #1: Decide between Irish Employer of Record services and a legal entity

First, you’ll need to decide if you’d like to hire your Irish employees through an EOR or set up your own legal entity in Ireland.

- Establishing a Legal entity in Ireland. Setting up a legal entity from scratch usually requires registration with local authorities, nominating an EEA Director, and consulting with local experts to ensure compliance with tax and employment laws.

- Irish EOR. An EOR is a third-party service that operates as an employer on a company’s behalf—meaning you don’t need to set up your own entity. As well as allowing you to hire full-time Irish employees, EORs handle all the legal requirements for complying with Irish laws for payroll, contracts, and benefits. EOR services also include calculating and withholding taxes, onboarding and managing employees, and running payroll.

Pros and cons of EORs vs. setting up a legal entity

EOR

Legal entity

Cost & Implementation

✔ Less time-consuming to set up.

✔ You can start hiring within days instead of months.

✘ Becomes costlier as your headcount increases.

✘ Takes time, paperwork, and money to set up—and requires nominating an EEA Director and having an Irish office address.

✔ More cost-effective once you’ve hired enough employees in a foreign country.

Hiring

✔ Quickly set up new hires, often within 1-14 days, depending on the provider.

✔ Supports large-scale expansion in a new market.

Compliance

✔ Manages all of your compliance work for you, takes on liability, and provides localised employment contracts.

✘ Can’t tailor certain policies, and other HR/legal processes, to the needs of your business.

✘ Requires expert knowledge of local laws and tax regulations and internal legal resources, as your company is liable for all legal and compliance infractions.

✔ Can tailor certain policies, and other HR/legal processes, to the needs of your business.

Payroll & Benefits

✔ Quickly pay and insure employees around the world.

✔ Taxes are filed for you.

✘ Must manually keep track of statutory deductions and employee entitlements for every hire.

Step #2: How to choose the best EOR for your business

Several EORs on the market—including Deel, Papaya Global, and Rippling—can help hire, pay, and manage Irish employees. Before you choose a platform, you should consider the services you will need, and how much you plan to grow your global hiring presence.

Here’s how Rippling EOR stacks up against Deel in Ireland:

Rippling

Deel

Global Payroll

✔

✔

Benefits Administration

✔

✘

Recruiting & Applicant Tracking

✔

✘

Learning Management

✔

✘

Time & Attendance

✔

✘

Experience the convenience and efficiency of hiring employees in Ireland within 90 seconds through Rippling EOR.

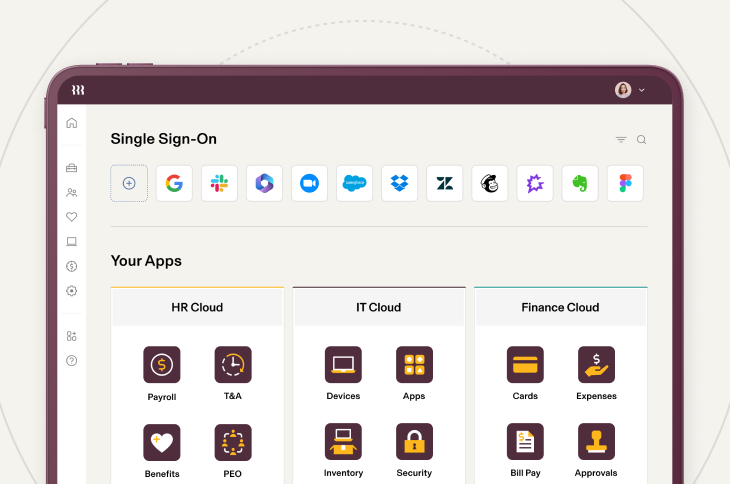

All-in-one global HR platforms, like Rippling, allow you to hire, pay, and manage employees and contractors worldwide. They are also “payroll processors,” which means they process your payroll, transmit funds, and calculate and file taxes in every country through their own software. This comprehensive approach lets you effortlessly handle the entire employee journey in one centralised place, regardless of your global operations.

Most EOR platforms are not HRISs (Human Resource Information Systems). They were built with the express purpose to hire and pay people internationally. They aggregate local payroll providers in every country and manually transmit your payroll files to them. This approach comes with many limitations.

All-in-One Global HR Platforms

Most EOR Platforms

Onboarding new hires

90 seconds

2-4 days

Payroll processing time

<5 days

2-4 weeks

Customized reporting

✔

✘

Integrated with every HR, IT, and Finance tool you need to run your business

✔

✘

Hire employees in Ireland in 90 seconds with Rippling

Normally, setting up a corporate entity abroad is a long, expensive process. But through Rippling EOR’s entities, you can reduce the hassle, and start hiring and working with people abroad quickly and compliantly. See Rippling.

Step #3: How to hire and onboard your Irish employees

The next step after choosing the right employer of record services is starting the onboarding process for your new employees. Full-time employees are automatically entered into Ireland’s Pay-as-You-Earn (PAYE) Scheme, which ensures the government is collecting the right amount of income tax, and paying related social insurance (PRSI) and the Universal Social Charge (USC) from each person’s paycheck.

Once you’ve picked an EOR that works in Ireland, you can begin the onboarding process by collecting the following information from your new employees:

- Name (matching the account where you’ll deposit their pay).

- Date of birth and date of hire.

- Personal Public Service Number (PPSN).

- Contact information, including their mailing address in Ireland.

- Bank account information.

- Amount to be paid in Euros (EUR).

Next, you need to send out employment contracts to your new employees. An EOR can automatically localise and distribute employment contracts. Every Irish hire will have a legally compliant contract offering statutory requirements for probationary periods, working hours, minimum wage, benefits, and termination policies like severance pay and notice periods.

Example: Let’s say you hire three Irish full-time employees. You’ll need to generate employment contracts for each one that includes the following information:

- Employee’s name and job description

- Their benefits and compensation

- Their commencement date and probationary period

- How much vacation time they get

- How much paid sick leave they’ll receive

- Parallel employment

- Termination policies

The majority of these sections will also require comprehensive understanding of Ireland’s stringent employment laws, some of which have changed recently, such as the Irish government’s policy on Statutory Sick Pay. Any errors in compliance could result in legal complications.

When you use an EOR in Ireland, however, it will generate employment contracts that are compliant with all the laws and benefits Irish employees are entitled to, ensuring you are protected from legal action.

Rippling EOR automatically flags non-compliant sick leave policies and tells you how to fix them. If you'd like to give your employees more leave to match policies in other countries, you have flexibility to do so. See Rippling.

Step #4: Run payroll

For the A-to-Z on global payroll, read our comprehensive guide to running international payroll for employees in Ireland.

Once you’ve collected a new hire’s information and both parties have signed employment agreements, an EOR will pay your Irish employees in EUR, while withholding legally required taxes from salaries. This includes contributions to:

- Federal income taxes

- Pay-related social insurance (PRSI)

- Universal Social Charge (USC)

Keep in mind many EOR companies are payroll aggregators, meaning they pay employees via third-party vendors. This makes for slower processing times and headaches when it comes to managing international employees under the same system.

Rippling EOR, by contrast, simplifies global employment by using native payroll software to send funds and handle taxes, allowing you to pay Irish employees alongside your local workforce—all within a single pay run.

Below is a preview of how Rippling’s one-click global payroll system works:

Frequently asked questions about hiring through an EOR in Ireland

How much does an EOR cost?

If you call different EORs, you’ll likely get a range of varying quotes. However, you’ll generally find that employer of record services use one of two pricing structures:

- Fixed monthly fee per employee

- Percentage of payroll plus applicable taxes

In addition to these fees, you’ll also pay administrative costs, charges to onboard the employees, and, if you want any supplemental features, costs for those as well.

You don’t have to use an EOR for your entire global team if you don’t want to. You can use it for only some employees. And don’t worry: You’ll only be charged for those individuals.

What is the difference between an EOR and PEO?

When you work with a Professional Employer Organization (PEO), you and the PEO will become jointly responsible for your workforce. A PEO is a co-employer; they handle administrative tasks, like payroll, compliance, and filing taxes. A PEO does not, however, allow you to hire in other countries where you haven’t set up a local entity.

On the other hand an EOR will be the sole employer of the portion of your workforce you use it for. This means they’ll assume all the liabilities any employer would need to. And an EOR allows companies to work with employees in other countries without setting up a legal entity.

Does an EOR protect your sensitive and confidential information?

As always, you should be careful about sharing your data with companies that use third-party vendors. This could leave you exposed to data breaches from manual uploads.

For security purposes, seek out EORs that prioritize data protection, including:

- Compliance with industry-standard privacy regulations in different countries.

- Secure infrastructure with around-the-clock maintenance.

- Carefully vetted personnel.

A Data Processing Agreement (DPA) is an additional layer of security that can be established with a payroll service. The agreement mandates the service to adopt to top-tier privacy practices and protect you from potential legal issues.

Can an EOR help with Irish tax filings?

An EOR can automatically calculate and file your taxes in Ireland. Rippling, for instance, is an authorised payroll provider by Revenue. On your company’s behalf, it can distribute and submit the P35, which is the employer’s end-of-year return, as well as the P60, which is the employer’s end-of-year certificate. Both of these are required by the Irish government.

What are the mandatory benefits for Irish employees?

Through a series of Acts and Orders—many of which are still being amended and updated—Ireland has established the following statutory benefits for Irish employees:

- Pension plans/retirement contributions

- Statutory Sick Pay

- Workers’ compensation insurance

- Parental leave (maternity leave or paternity leave)

- Paid annual leave

- Public holidays (also called Bank Holidays; there are 11 each year, including New Year’s Day)

Private health insurance is not mandatory, but it is recommended, and many employers offer more than the minimum benefits in order to attract top talent.

Another note on healthcare: The laws around Statutory Sick Pay have recently changed. The number of paid sick days employees will now receive is as follows:

- 3 days in 2023

- 5 days in 2024

- 7 days in 2025

- 10 days in 2026

For more information on mandatory benefits in Ireland, read our complete guide.

What are the employer costs for full-time employees in Ireland?

Employers are responsible for deducting income taxes, PRSI, and the USC from their full-time employees’ paychecks.

First, let’s look at the income tax rates for 2024. They are 20% and 40%, depending on income.

Filing Status

20%

40%

Single

€42,000

Any amount above this

Married/civil partners with one income

€51,000

Any amount above this

Married/civil partners with two incomes

Up to €84,000

Any amount above this

Single-parent family

€46,000

Any amount above this

The amount of PRSI you and your employee will pay depends on which Class you both belong to (most employers and employees in Ireland belong to Class A).

Finally, the standard USC rates for 2023 are below:

Rate

Income Bracket

0.5%

Up to €12,012

2%

Between €12,012.01 and €22,920

4%

Between €22,920.01 to €70,044

8%

Above €70,044.01

11%

Must be paid on any self-employment income that exceeds €100,000

Rippling and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for tax, legal, or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any related activities or transactions.